Define Offshore: The term “offshore” conjures images of exotic locales and complex financial transactions, but its meaning in the business world is far more nuanced. This guide delves into the multifaceted world of offshore operations, exploring everything from the legal and regulatory frameworks governing offshore businesses to the economic and social impacts of offshore outsourcing. We’ll examine the key geographic regions involved, analyze the advantages and disadvantages of various offshore activities, and provide illustrative examples across different industries, from manufacturing and software development to finance and renewable energy.

We will dissect the core concept of “offshore,” differentiating it from onshore operations and highlighting the diverse types of offshore business activities. This includes a detailed exploration of offshore outsourcing, its benefits and drawbacks, and the ethical considerations involved. We’ll also investigate the crucial role of offshore financial centers in the global economy and the legal and regulatory landscapes that shape offshore operations worldwide.

Defining “Offshore” in Business

In the business world, “offshore” refers to the practice of contracting a third-party company or individual located in a different country to perform specific business functions or tasks. This contrasts with “onshore,” where these operations are handled domestically. Offshore activities leverage geographical and economic differences to achieve cost savings, access specialized skills, or expand operational capabilities.Offshore business activities encompass a wide range of functions.

Companies commonly outsource tasks such as customer service, software development, data entry, manufacturing, accounting, and human resources to offshore locations. The choice of activity depends on the company’s specific needs and the capabilities of the offshore provider.

Types of Offshore Business Activities

Offshore outsourcing involves a diverse set of activities. These range from relatively simple tasks like data entry and transcription to highly complex operations such as software development and research and development. For instance, a US-based technology company might outsource its software testing to an offshore team in India, while a European retailer might outsource its customer service operations to a call center in the Philippines.

The decision to offshore specific functions often hinges on factors such as cost, expertise, and time zone differences.

Onshore versus Offshore Business Operations

Onshore and offshore business operations differ significantly in several key aspects. Onshore operations offer greater control and direct oversight, facilitating easier communication and collaboration. However, they typically involve higher labor costs and may limit access to specialized skills. In contrast, offshore operations often provide cost advantages and access to a wider talent pool, but can present challenges related to communication, time zone differences, and potential quality control issues.

Effective management of these challenges is crucial for the success of offshore operations.

Advantages and Disadvantages of Offshore Outsourcing

The decision to offshore requires a careful weighing of the potential benefits and drawbacks. The following table summarizes these considerations:

| Advantage | Disadvantage | Advantage | Disadvantage |

|---|---|---|---|

| Reduced labor costs | Communication barriers | Access to specialized skills | Potential quality control issues |

| Increased operational efficiency | Time zone differences | 24/7 operations | Security and data privacy concerns |

| Focus on core competencies | Cultural differences | Faster time to market | Increased management complexity |

Geographic Aspects of “Offshore”

The geographical distribution of offshore operations is significantly influenced by a complex interplay of economic, political, and infrastructural factors. Understanding these geographical aspects is crucial for businesses seeking to leverage the benefits of offshore outsourcing and for policymakers navigating the implications of these global operations. The choice of location isn’t arbitrary; it’s a strategic decision based on a careful assessment of various contributing elements.The selection of offshore locations is a multifaceted process.

Businesses consider a range of factors, including cost of labor, availability of skilled workforce, technological infrastructure, time zone differences, regulatory environment, and political stability. These factors often interact in complex ways, shaping the geographic landscape of offshore activities. For example, a country with a low cost of labor might be less attractive if it lacks the necessary technological infrastructure or suffers from political instability.

Key Offshore Regions, Define Offshore

Several regions have emerged as prominent hubs for offshore operations. Asia, particularly India, the Philippines, and China, has long been a dominant player, offering a large pool of skilled labor at competitive prices. Eastern Europe, including countries like Ukraine, Poland, and Romania, has also gained traction, attracting businesses seeking cost-effective solutions and access to a workforce proficient in European languages.

Latin America, particularly in countries like Mexico and Costa Rica, is also emerging as a significant offshore destination, leveraging its proximity to North America and growing technological capabilities. Finally, Africa, while still developing its offshore capabilities, is gradually attracting attention due to its potential for growth and cost advantages.

Factors Influencing Location Choice

The choice of an offshore location hinges on a careful evaluation of numerous factors. Cost-effectiveness, encompassing labor costs, infrastructure expenses, and operational overheads, is a primary driver. The availability of a skilled workforce, particularly in specific sectors like IT, engineering, or finance, is equally crucial. Time zone differences can impact communication and collaboration, with businesses often preferring locations with a time zone that allows for overlapping working hours.

The regulatory environment, including tax laws, intellectual property protection, and data privacy regulations, significantly influences location decisions. Political and economic stability is paramount, as instability can disrupt operations and pose significant risks. Finally, the quality of infrastructure, including reliable internet connectivity, power supply, and transportation networks, is essential for efficient offshore operations.

Political and Economic Implications

Offshore activities have profound political and economic implications for both the sending and receiving countries. Sending countries often benefit from reduced operational costs and increased efficiency. However, they may also face criticism regarding job displacement and potential exploitation of labor in offshore locations. Receiving countries, on the other hand, can experience economic growth, job creation, and technological advancement.

However, they may also face challenges related to dependency on foreign investment, potential for exploitation of their workforce, and pressure to adapt to international regulations. The political implications can be significant, particularly concerning issues such as data security, intellectual property rights, and the potential for geopolitical tensions. For instance, the concentration of certain types of offshore activities in specific regions can create economic dependencies and vulnerabilities.

Countries Known for Specific Offshore Services

The following list highlights countries recognized for their expertise in particular offshore service sectors:

- India: IT services, software development, customer support, back-office processing.

- Philippines: Business process outsourcing (BPO), customer service, data entry.

- China: Manufacturing, supply chain management, engineering.

- Ukraine: Software development, IT services, engineering.

- Romania: IT services, software development, customer support.

- Mexico: Manufacturing, customer service, back-office processing.

- Costa Rica: Customer service, data entry, medical transcription.

Offshore Outsourcing and its Impacts: Define Offshore

Offshore outsourcing, the practice of hiring a third-party company in a different country to perform specific business functions, has become a defining characteristic of the globalized economy. This practice presents a complex interplay of economic benefits, social implications, and inherent risks, impacting both the countries outsourcing work and those receiving it. Understanding these multifaceted effects is crucial for businesses and policymakers alike.

Industries Utilizing Offshore Outsourcing

Many industries leverage offshore outsourcing to gain cost advantages and access specialized skills. The Information Technology (IT) sector, encompassing software development, data entry, and customer support, is a prime example. Manufacturing, particularly in sectors like textiles and electronics, also extensively utilizes offshore outsourcing for production. Other sectors, including finance (back-office processing), healthcare (medical billing and transcription), and business process outsourcing (BPO) for tasks like human resources and accounting, increasingly rely on offshore partners.

The decision to offshore often hinges on factors such as labor costs, skill availability, and regulatory environments.

Economic Effects of Offshore Outsourcing

Offshore outsourcing generates significant economic effects in both sending and receiving countries. Sending countries, those outsourcing work, may experience job displacement in certain sectors, potentially leading to increased unemployment and wage stagnation in those areas. However, they often benefit from lower operational costs, increased competitiveness, and the ability to focus on higher-value activities. Receiving countries, on the other hand, typically experience economic growth through job creation, increased foreign investment, and the development of new industries.

However, this growth can be unevenly distributed, potentially exacerbating existing inequalities if benefits are not shared broadly. For example, India’s IT sector has flourished due to offshore outsourcing, creating numerous high-skilled jobs. Conversely, some manufacturing sectors in developed nations have faced job losses due to outsourcing to countries with lower labor costs.

Social and Ethical Considerations of Offshore Outsourcing

The social and ethical implications of offshore outsourcing are significant and multifaceted. Concerns exist regarding labor standards and working conditions in receiving countries. Issues such as low wages, long working hours, inadequate safety measures, and the lack of worker protections are often raised. Furthermore, the potential for cultural clashes and communication barriers can impact project outcomes and employee morale.

Ethical considerations also include data security and intellectual property protection, requiring robust contractual agreements and oversight. The impact on local communities in sending countries, particularly in terms of job displacement and social disruption, also demands careful consideration. Responsible outsourcing practices necessitate adherence to ethical codes of conduct and transparent supply chain management.

Risks and Challenges of Offshore Outsourcing

Despite its potential benefits, offshore outsourcing presents several risks and challenges. Communication barriers, differing time zones, and cultural differences can hinder effective collaboration and project management. Quality control can be a major concern, requiring rigorous monitoring and testing processes. Data security and intellectual property protection are critical issues, demanding robust security protocols and contractual safeguards. Political instability, economic fluctuations, and natural disasters in the receiving country can disrupt operations and cause delays.

Managing legal and regulatory compliance in different jurisdictions adds another layer of complexity. Furthermore, the potential for reputational damage due to unethical practices or human rights violations within the offshore partner’s operations is a significant risk. Companies must carefully assess and mitigate these risks through due diligence, robust contracts, and ongoing monitoring.

Offshore in Finance and Banking

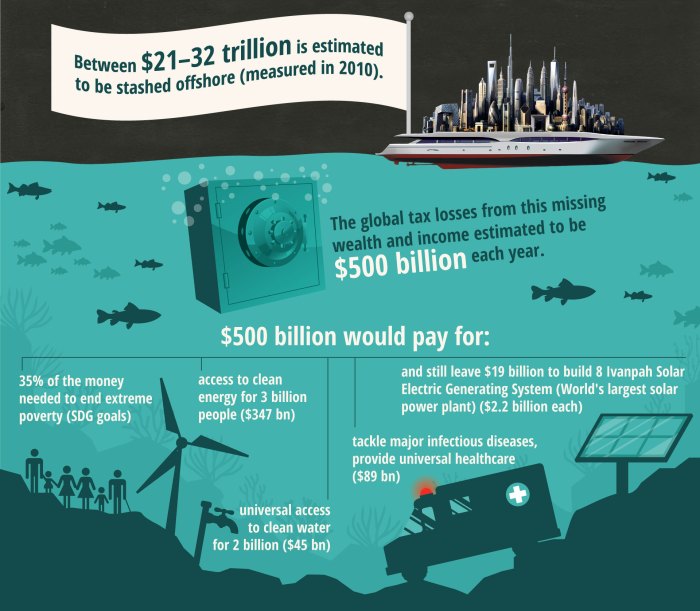

Offshore banking refers to financial services provided by banks and other financial institutions located in jurisdictions with more lenient regulatory environments than those typically found in a company’s home country. These jurisdictions, often known as offshore financial centers (OFCs), are attractive to individuals and businesses seeking to minimize taxes, protect assets, or access specific financial products and services not readily available domestically.

This practice, while legal in most cases, is subject to significant scrutiny due to its potential for misuse in illicit activities.Offshore banking plays a significant role in the global financial system. OFCs act as conduits for international capital flows, facilitating cross-border investments, trade finance, and wealth management. Their presence can contribute to economic growth in the host jurisdiction through job creation and increased tax revenue (though this is often debated).

However, their role also raises concerns about financial stability, regulatory arbitrage, and the potential for money laundering and tax evasion.

Offshore Banking Characteristics

Offshore banking is characterized by several key features. These include relaxed regulatory frameworks compared to onshore jurisdictions, often resulting in lower capital requirements, less stringent reporting requirements, and greater privacy for account holders. The availability of specialized financial products and services, such as international trusts and investment vehicles, further distinguishes offshore banking from its onshore counterpart. Finally, the relative anonymity offered by some OFCs attracts individuals and businesses seeking to shield their financial activities from public scrutiny.

It’s crucial to note that while secrecy is often associated with offshore banking, the increasing global effort towards transparency and information sharing is significantly reducing this aspect.

The Role of Offshore Financial Centers in Global Finance

Offshore financial centers (OFCs) serve as crucial hubs within the global financial network. They provide a range of services including wealth management, asset protection, international trade finance, and investment banking. Their lower regulatory burdens and specialized financial products attract international businesses and high-net-worth individuals, contributing to the flow of capital across borders. This can stimulate economic activity in both the OFC and the countries whose entities utilize its services.

However, this role also presents challenges related to the potential for illicit financial flows and the need for international cooperation to ensure financial stability and prevent misuse. Examples of prominent OFCs include the Cayman Islands, Luxembourg, and Hong Kong. These centers handle vast sums of money, impacting global markets and investment flows.

Offshore Banking versus Onshore Banking: A Comparison

Offshore and onshore banking differ significantly in their regulatory environments, the services offered, and the level of transparency involved. Onshore banking, conducted within a country’s domestic regulatory framework, is subject to stringent regulations designed to protect depositors, prevent financial crimes, and maintain the stability of the financial system. This includes robust reporting requirements, strict anti-money laundering (AML) and know-your-customer (KYC) procedures, and higher capital adequacy standards.

In contrast, offshore banking often operates under less stringent regulations, leading to greater flexibility but also increased risks. The choice between offshore and onshore banking depends on an individual’s or business’s specific needs and risk tolerance. Factors such as tax implications, asset protection requirements, and the level of regulatory scrutiny desired will influence this decision.

Benefits and Risks of Offshore Banking

| Benefit | Risk | Benefit | Risk |

|---|---|---|---|

| Lower taxes | Increased risk of regulatory non-compliance | Greater asset protection | Potential for involvement in illicit activities |

| Access to specialized financial products | Difficulty in resolving disputes | Enhanced privacy | Reputational damage |

| Easier access to international markets | Higher transaction costs | Simplified investment structures | Lack of depositor protection |

Illustrative Examples of Offshore Activities

Offshore activities encompass a broad range of business operations conducted in a different country than the company’s headquarters. These activities offer various benefits, including cost reduction, access to specialized skills, and expansion into new markets. However, they also present unique challenges related to communication, cultural differences, and regulatory compliance. The following examples illustrate the diverse nature of offshore operations across different sectors.

Offshore Manufacturing: Electronics Production in Vietnam

A US-based electronics company, “TechCorp,” decides to offshore its manufacturing operations to Vietnam. TechCorp leverages Vietnam’s lower labor costs and readily available skilled workforce in electronics assembly. The process involves several stages: first, TechCorp designs the product and develops the manufacturing specifications. These specifications, including detailed blueprints and quality control standards, are then sent to a Vietnamese contract manufacturer, “VietManufactory.” VietManufactory sources components from various suppliers, both domestically and internationally.

The actual assembly takes place in VietManufactory’s facilities, adhering to TechCorp’s specifications. Quality control checks are performed at multiple stages, and the finished products are shipped back to TechCorp in the US for distribution. Key parties involved include TechCorp (the client), VietManufactory (the contract manufacturer), component suppliers, and logistics providers responsible for shipping. This arrangement allows TechCorp to reduce manufacturing costs significantly, improve production efficiency by utilizing a large pool of skilled workers, and focus its internal resources on product development and marketing.

Offshore Software Development: Mobile App Development in India

A UK-based fintech startup, “FinLeap,” decides to outsource the development of its mobile banking application to an Indian software development firm, “CodeCraft.” The project follows a phased approach: Phase 1 involves requirement gathering and system design, where FinLeap and CodeCraft collaboratively define the app’s functionality and user interface. Phase 2 focuses on development, with CodeCraft’s developers writing the code and conducting regular testing.

Phase 3 involves quality assurance and testing, ensuring the app meets FinLeap’s standards and is free of bugs. Finally, Phase 4 is deployment and maintenance, with CodeCraft providing ongoing support and updates. Potential challenges include managing communication across time zones, ensuring consistent code quality, and navigating cultural differences in project management styles. Despite these challenges, FinLeap benefits from access to CodeCraft’s experienced developers at a lower cost compared to hiring in-house.

The phased approach allows for incremental progress and iterative feedback, mitigating some of the risks associated with large-scale offshore projects.

Offshore Investment in Renewable Energy: Solar Farm in Chile

A European investment firm, “GreenInvest,” invests in the construction of a large-scale solar farm in Chile. Chile offers abundant solar energy resources and supportive government policies for renewable energy projects. However, GreenInvest faces regulatory hurdles, including obtaining environmental permits, navigating complex land acquisition processes, and complying with Chilean energy regulations. The benefits include access to a stable and growing renewable energy market, diversification of the investment portfolio, and the potential for significant returns.

The project involves multiple stakeholders, including GreenInvest (the investor), a Chilean construction company, local landowners, and the Chilean government’s energy regulatory body. Successful completion of the project requires careful planning, effective communication with local authorities, and adherence to all relevant environmental and safety regulations. This example highlights the complexities and potential rewards of offshore investments in emerging markets, particularly in sectors such as renewable energy that require significant capital investment and long-term commitment.

Understanding “offshore” requires a multifaceted perspective, encompassing geographical, legal, economic, and ethical considerations. From the strategic advantages of offshore outsourcing to the complexities of offshore banking and the regulatory hurdles in different jurisdictions, this guide has provided a comprehensive overview. By weighing the benefits and risks associated with offshore operations across various sectors, businesses can make informed decisions that align with their strategic goals and ethical responsibilities.

The future of offshore activity will undoubtedly be shaped by evolving global dynamics, and staying informed about these changes is crucial for success.