Offshore Account Interest Rates: Navigating the world of offshore banking can feel like charting uncharted waters. Understanding the intricacies of interest rates across various jurisdictions is crucial for making informed decisions. This guide delves into the factors influencing these rates, from global economic conditions and central bank policies to the specific types of offshore accounts available. We’ll compare offshore rates to domestic options, highlighting the advantages, disadvantages, and crucial tax implications.

Prepare to uncover the complexities and potential rewards of this often-misunderstood financial landscape.

We’ll explore different account types, including savings accounts, term deposits, and money market accounts, examining the typical interest rate ranges offered in various offshore locations. A detailed comparison table will illustrate the nuances between jurisdictions, including currency, minimum deposit requirements, and the potential returns. We’ll also analyze the risks associated with offshore accounts, including currency fluctuations and political instability, and provide a framework for assessing your risk tolerance and making informed choices.

Introduction to Offshore Account Interest Rates

Offshore banking, the practice of holding financial accounts in jurisdictions outside one’s country of residence, presents a complex global landscape. This landscape is characterized by a diverse range of jurisdictions, each with its own regulatory framework, economic conditions, and consequently, interest rate environments. Understanding these nuances is crucial for individuals and businesses considering offshore banking options. The appeal often lies in factors like asset protection, tax optimization, and potentially higher interest rates compared to domestic options, although the latter is subject to significant variation and should not be assumed.Factors influencing interest rates in offshore jurisdictions are multifaceted.

Central bank policies, prevailing global interest rate trends, the specific economic conditions of the jurisdiction (inflation, growth rates), and the level of risk associated with the jurisdiction all play significant roles. For example, a jurisdiction with a stable political environment and strong regulatory framework might offer lower interest rates reflecting lower risk, while a jurisdiction with higher perceived risk may offer higher rates as an incentive to attract deposits.

Furthermore, the demand for deposits within a particular offshore jurisdiction will influence the rates offered; high demand may lead to lower rates, while low demand may push rates higher.

Historical Overview of Offshore Account Interest Rate Trends

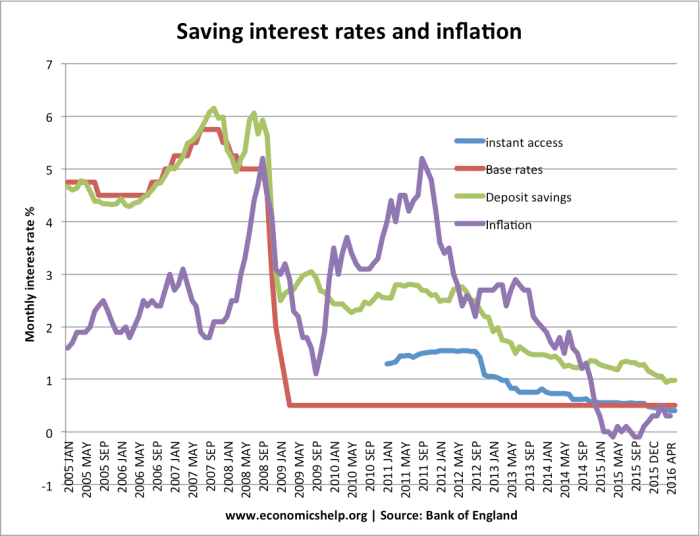

Offshore account interest rates have historically mirrored, albeit with some lag, global interest rate trends. Periods of low global interest rates, such as those seen following the 2008 financial crisis, generally resulted in lower interest rates offered on offshore accounts. Conversely, periods of higher global interest rates often led to increases in offshore account interest rates. However, it’s important to note that this correlation isn’t always perfect.

Jurisdictional-specific factors can cause deviations from the global trend. For instance, a particular offshore center might experience a surge in deposits due to specific regulatory changes or economic developments, leading to lower rates even during a period of rising global interest rates. Conversely, political instability or regulatory uncertainty in a given jurisdiction could drive rates higher, even if global trends suggest otherwise.

Analyzing historical data from reputable financial institutions and research firms specializing in offshore banking provides a more comprehensive understanding of these trends and their influencing factors. Such analysis reveals that while general trends exist, the specifics vary greatly depending on the jurisdiction and the prevailing economic and political landscape.

Types of Offshore Accounts and Their Interest Rates

Offshore accounts offer a range of options for investors seeking higher returns or greater privacy. Understanding the different account types and their associated interest rates is crucial for making informed decisions. The interest rates offered vary significantly depending on factors such as the account type, the jurisdiction, the currency, and the deposit amount.Interest rates on offshore accounts are generally higher than those offered in many onshore jurisdictions, reflecting a combination of factors including higher risk, varying regulatory environments, and competitive market dynamics.

However, it’s vital to remember that higher interest rates often come with increased risk.

Savings Accounts, Offshore Account Interest Rates

Offshore savings accounts typically offer higher interest rates than comparable onshore accounts. These accounts provide easy access to funds, making them suitable for short-term savings goals. However, the interest earned is often subject to taxation in the investor’s home country. Typical interest rate ranges for offshore savings accounts vary greatly depending on the jurisdiction and the financial institution, but can range from 2% to 6% annually, though higher rates may be available in certain circumstances.

Term Deposits

Term deposits, also known as fixed deposits or certificates of deposit (CDs), offer higher interest rates than savings accounts in exchange for locking up funds for a predetermined period. The longer the term, the higher the interest rate typically offered. These accounts are ideal for individuals with medium-to-long-term savings goals who are willing to forgo immediate access to their funds.

Interest rates on term deposits can range from 3% to 8% annually, or even higher, depending on the term length, the amount deposited, and the jurisdiction.

Money Market Accounts

Money market accounts (MMAs) offer a balance between liquidity and interest rates. They generally offer higher interest rates than savings accounts but may have limitations on withdrawals or transactions. The interest rates offered on MMAs fluctuate based on market conditions. Expect interest rate ranges from 1.5% to 5% annually, though again this is subject to market conditions and the specific financial institution.

Comparison of Interest Rates Across Jurisdictions

The following table provides a comparison of typical interest rates across various offshore jurisdictions. Note that these are approximate ranges and actual rates can vary significantly depending on the financial institution, the specific account type, the deposit amount, and prevailing market conditions. It is crucial to conduct thorough research before opening any offshore account.

| Jurisdiction | Account Type | Currency | Interest Rate Range (%) | Minimum Deposit |

|---|---|---|---|---|

| Cayman Islands | Savings Account | USD | 2-4 | $10,000 |

| Switzerland | Term Deposit (1 year) | CHF | 1-3 | CHF 50,000 |

| Singapore | Money Market Account | SGD | 1.5-3.5 | SGD 20,000 |

| Panama | Term Deposit (3 years) | USD | 4-6 | $25,000 |

Factors Affecting Offshore Account Interest Rates

Offshore account interest rates, while seemingly independent, are intricately linked to a complex web of global and local economic forces. Understanding these influences is crucial for individuals and businesses considering offshore banking to make informed decisions about their financial strategies. Several key factors significantly shape the interest rates offered on these accounts.Global Economic Conditions Impact on Offshore Interest RatesGlobal economic conditions exert a powerful influence on offshore interest rates.

Periods of robust global growth often lead to increased demand for capital, driving up interest rates across the board, including those offered on offshore accounts. Conversely, during economic downturns or recessions, demand for capital falls, resulting in lower interest rates. The interconnectedness of global financial markets means that shifts in major economies, such as the US or the Eurozone, directly impact the interest rate environment in offshore banking centers.

For instance, a rise in US interest rates, often driven by Federal Reserve policy, typically leads to higher rates in other jurisdictions, as investors seek higher returns.

Central Bank Policies and Offshore Interest Rates

Central bank policies play a pivotal role in shaping offshore interest rates. Central banks, through monetary policy tools such as adjusting benchmark interest rates (like the federal funds rate in the US or the base rate in the UK), influence borrowing costs within their respective economies. These policies have a ripple effect globally. A central bank raising its benchmark rate tends to attract international capital, potentially increasing the demand for deposits in offshore accounts and thus influencing the interest rates offered.

Conversely, a lowering of rates can lead to capital outflows and potentially lower rates in offshore banking centers. The actions of the US Federal Reserve, for example, often serve as a bellwether for global interest rate movements.

Political Stability and Regulatory Environments

Political stability and the regulatory environment within a jurisdiction significantly impact the attractiveness of its offshore banking sector. Countries with stable political systems and transparent regulatory frameworks tend to attract more foreign investment, boosting demand for offshore accounts and potentially leading to higher interest rates. Conversely, political instability, regulatory uncertainty, or concerns about corruption can deter investment and result in lower interest rates as investors seek safer havens.

For instance, a country experiencing political turmoil might see a decline in foreign investment, impacting the interest rates offered on offshore accounts. Similarly, jurisdictions with strict anti-money laundering (AML) and know-your-customer (KYC) regulations might attract investors seeking transparency, potentially increasing the demand and influencing interest rates positively, albeit potentially limiting access for some.

Regulations and Compliance in Offshore Banking

Offshore banking, while offering various financial advantages, operates within a complex web of international regulations designed to maintain financial stability and prevent illicit activities. Strict adherence to these rules is paramount for both offshore banks and their clients, ensuring the integrity and longevity of the offshore banking system. Understanding these regulations is crucial for anyone considering engaging in offshore banking practices.Offshore banking is subject to a multifaceted regulatory framework aimed at combating financial crime and ensuring transparency.

These regulations are implemented and enforced by a network of international organizations and individual jurisdictions, each with its own specific rules and procedures. Failure to comply with these regulations can result in severe penalties, including hefty fines, legal action, and reputational damage.

Anti-Money Laundering (AML) and Know-Your-Customer (KYC) Regulations

AML and KYC regulations are cornerstones of the fight against money laundering and terrorist financing within the offshore banking sector. These regulations require offshore banks to identify and verify the identities of their clients, monitor their transactions for suspicious activity, and report any potentially illegal activities to the relevant authorities. This rigorous process helps prevent the use of offshore accounts for illicit purposes.

KYC procedures typically involve collecting documentation such as passports, utility bills, and proof of address to verify a client’s identity. AML compliance often necessitates implementing robust transaction monitoring systems to detect unusual patterns that might indicate money laundering. These systems use algorithms and data analysis to flag suspicious transactions for further investigation.

Key Regulatory Bodies in Offshore Banking

Several key regulatory bodies play a significant role in overseeing offshore banking activities globally. These organizations work collaboratively to establish international standards and ensure consistent enforcement of regulations across different jurisdictions. The effectiveness of these bodies in preventing financial crime and maintaining the stability of the global financial system is crucial.

- The Financial Action Task Force (FATF): An intergovernmental organization that develops and promotes policies to combat money laundering and terrorist financing. The FATF sets international standards and assesses countries’ effectiveness in implementing these standards. Its recommendations influence the AML/KYC regulations adopted by many jurisdictions, including those with offshore banking centers.

- The Organisation for Economic Co-operation and Development (OECD): A global forum working to promote policies that will improve the economic and social well-being of people around the world. The OECD plays a role in addressing tax evasion and harmful tax practices related to offshore banking, promoting transparency and information exchange between countries.

- National Regulatory Authorities: Each jurisdiction with offshore banking centers has its own regulatory authority responsible for overseeing banks and financial institutions operating within its borders. These authorities implement and enforce local regulations, often in conjunction with international standards set by organizations like the FATF and OECD. Examples include the Cayman Islands Monetary Authority (CIMA) and the Bermuda Monetary Authority (BMA).

Illustrative Examples of Offshore Account Interest Rates

Understanding offshore account interest rates requires examining real-world scenarios. The following examples illustrate potential returns, highlighting the interplay between interest rates, deposit amounts, and investment terms. Remember that these are hypothetical examples and actual returns can vary significantly based on market conditions and the specific financial institution.

Example 1: High-Yield Savings Account in USD

This example features a high-yield savings account in US Dollars (USD) held in a reputable offshore bank in Singapore. Let’s assume a deposit of $100,000 with an annual interest rate of 3.5%, compounded annually.

| Year | Beginning Balance (USD) | Interest Earned (USD) | Ending Balance (USD) |

|---|---|---|---|

| 1 | 100,000 | 3,500 | 103,500 |

| 2 | 103,500 | 3,622.50 | 107,122.50 |

| 3 | 107,122.50 | 3,749.30 | 110,871.80 |

| 5 | 110,871.80 | 3,880.51 | 114,752.31 |

Projected returns after 5 years are approximately $14,752.31. The risk is relatively low as this is a savings account, but the return is modest compared to higher-risk investments. Potential rewards include a stable, albeit low, return on investment and the diversification benefits of holding assets outside of one’s home country.

Example 2: Fixed Deposit in EUR

This example involves a fixed deposit in Euros (EUR) at an offshore bank in the Cayman Islands. The deposit amount is €50,000, with a fixed interest rate of 4.0% per annum for a 3-year term. Interest is paid annually.

| Year | Beginning Balance (EUR) | Interest Earned (EUR) | Ending Balance (EUR) |

|---|---|---|---|

| 1 | 50,000 | 2,000 | 52,000 |

| 2 | 52,000 | 2,080 | 54,080 |

| 3 | 54,080 | 2,163.20 | 56,243.20 |

The projected return after 3 years is €6,243.20. The risk is considered moderate; the return is higher than the savings account, but the funds are locked for three years. Early withdrawal may incur penalties. Rewards include a higher return compared to savings accounts and potential capital preservation.

Example 3: Offshore Bond Investment in GBP

This example demonstrates an investment in offshore bonds denominated in British Pounds (GBP). Let’s assume an investment of £25,000 in a diversified bond portfolio with a projected annual return of 5.5% over 10 years. This assumes annual compounding. Calculating the exact return requires a more complex formula considering the fluctuating nature of bond yields. However, we can use a simplified approach for illustrative purposes.

The approximate compound interest formula is: A = P (1 + r/n)^(nt) , where: A = the future value of the investment/loan, including interest; P = the principal investment amount (the initial deposit or loan amount); r = the annual interest rate (decimal); n = the number of times that interest is compounded per year; t = the number of years the money is invested or borrowed for.

Using this formula with the provided values, we can approximate the return. The risk associated with bond investments is moderate to high, depending on the specific bonds held within the portfolio. Credit risk, interest rate risk, and inflation risk are all potential factors. Rewards include potentially higher returns than savings accounts and fixed deposits, as well as diversification benefits.

However, the investment is subject to market fluctuations and potential capital loss.

Successfully navigating the world of offshore account interest rates requires a thorough understanding of global economic trends, regulatory landscapes, and inherent risks. By carefully weighing the potential rewards against the inherent complexities, you can make informed decisions aligned with your financial goals. Remember, due diligence and a clear understanding of the regulations are paramount to ensuring a secure and compliant offshore banking experience.

This guide serves as a starting point; further research tailored to your specific circumstances is always recommended.