Offshore Savings Rates offer a compelling avenue for wealth preservation and growth, but navigating this landscape requires careful consideration. Understanding the nuances of offshore banking, from interest rate fluctuations and currency exchange impacts to the diverse account types and inherent risks, is crucial for making informed decisions. This exploration delves into the intricacies of offshore savings, empowering you to assess the potential benefits and pitfalls before embarking on this financial journey.

This guide unpacks the key factors influencing offshore savings rates, including global economic conditions and specific regulatory environments. We’ll examine various account types, comparing their features and suitability for different investor profiles. Furthermore, we’ll discuss the crucial aspects of risk management, regulatory compliance, and secure access to your funds. Ultimately, the goal is to equip you with the knowledge needed to confidently navigate the world of offshore savings.

Factors Influencing Offshore Savings Rates

Offshore savings rates, while offering potential benefits like higher returns and diversification, are influenced by a complex interplay of economic factors. Understanding these factors is crucial for investors seeking to maximize their returns and manage risk effectively. This section will delve into the key drivers shaping offshore savings account interest rates.

Global Interest Rate Environment

Global interest rates significantly impact offshore savings rates. Central banks worldwide influence their domestic interest rates through monetary policy tools, such as adjusting reserve requirements or implementing quantitative easing. These actions ripple outwards, affecting the borrowing costs and lending rates in various countries, including those offering offshore banking services. For instance, a global rise in interest rates generally leads to increased rates offered on offshore savings accounts, while a decrease in global rates typically results in lower offshore rates.

The degree of impact, however, can vary depending on the specific jurisdiction and the bank’s individual risk assessment. A strong correlation often exists between the benchmark interest rates set by major economies (like the US Federal Reserve rate or the European Central Bank’s rate) and the rates offered by offshore banks.

Currency Exchange Rate Fluctuations, Offshore Savings Rates

Currency exchange rates play a pivotal role in determining the overall return on offshore savings accounts. The initial deposit is converted into the local currency of the offshore jurisdiction, and the interest earned is calculated based on that currency. Upon withdrawal, the funds are converted back into the investor’s home currency. Fluctuations in exchange rates can significantly impact the final return.

For example, if the home currency appreciates against the offshore currency during the savings period, the investor will receive less in their home currency after conversion, despite earning a potentially high interest rate in the offshore currency. Conversely, a depreciation of the home currency would enhance the overall return. Investors need to carefully consider the potential impact of currency exchange rate volatility when making investment decisions in offshore savings accounts.

Jurisdictional Differences in Interest Rate Policies

Interest rate policies and regulatory environments differ significantly across various offshore banking jurisdictions. These differences can lead to substantial variations in the savings rates offered. For example, let’s compare the Cayman Islands and Switzerland. The Cayman Islands, known for its robust financial sector, often offers competitive rates driven by its role as an international financial center. However, regulatory changes or economic shifts in the global economy could impact these rates.

Switzerland, with its reputation for stability and banking secrecy, might offer slightly lower rates, but potentially with greater emphasis on capital preservation and security. This highlights the importance of researching specific jurisdictions and understanding their respective economic climates before choosing an offshore savings account. The investor should compare not only the advertised interest rates but also the associated risks and regulatory environment of each jurisdiction.

Types of Offshore Savings Accounts

Offshore savings accounts offer a range of options catering to diverse financial goals and risk tolerances. Understanding the nuances of each type is crucial for making informed decisions that align with individual circumstances. The choice depends on factors such as investment horizon, risk appetite, and desired liquidity.

High-Yield Savings Accounts

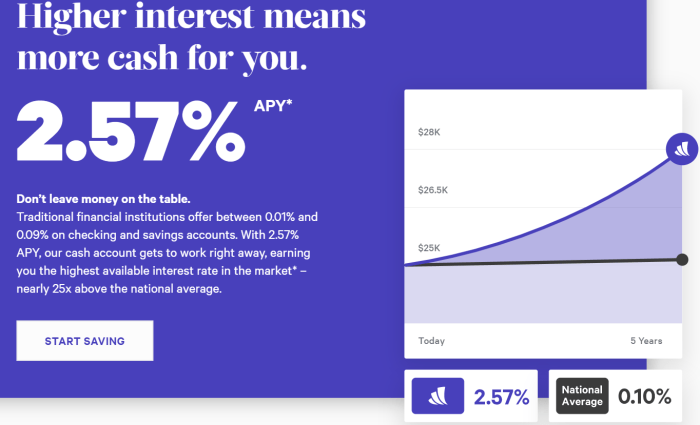

High-yield offshore savings accounts prioritize maximizing returns. These accounts typically offer interest rates significantly higher than those found in domestic markets, driven by factors such as international interest rate differentials and the competitive landscape of offshore banking. However, these higher yields often come with specific terms and conditions.

- Key Feature: Higher interest rates compared to domestic options.

- Advantage: Potential for significant returns on savings.

- Disadvantage: Interest rates can fluctuate, potentially impacting returns; may have higher minimum balance requirements.

Fixed-Term Deposit Accounts

Fixed-term deposit accounts, also known as term deposits, lock in your funds for a predetermined period, typically ranging from several months to several years. In exchange for the commitment, these accounts often offer a fixed interest rate, providing predictable returns and mitigating the risk of fluctuating interest rates.

- Key Feature: Fixed interest rate for a specified term.

- Advantage: Predictable returns, reduced interest rate risk.

- Disadvantage: Limited liquidity; early withdrawal penalties may apply; returns may be lower than high-yield accounts in periods of rising interest rates.

Offshore Money Market Accounts

Offshore money market accounts offer a blend of liquidity and relatively higher returns compared to traditional savings accounts. These accounts invest in short-term, low-risk securities, providing access to funds while still generating interest income. However, the returns may be subject to market fluctuations, albeit generally less volatile than other investment options.

- Key Feature: Combination of liquidity and relatively higher returns.

- Advantage: Easy access to funds; higher interest rates than standard savings accounts.

- Disadvantage: Interest rates are not fixed and can fluctuate based on market conditions; returns may be modest compared to higher-risk investments.

Comparative Chart of Offshore Savings Account Types

| Account Type | Interest Rate | Liquidity | Risk |

|---|---|---|---|

| High-Yield Savings | Variable, generally high | High | Moderate (interest rate risk) |

| Fixed-Term Deposit | Fixed | Low (penalties for early withdrawal) | Low |

| Offshore Money Market | Variable, moderate | High | Low to Moderate (market fluctuations) |

Successfully leveraging offshore savings rates hinges on a thorough understanding of the economic forces at play, the regulatory landscape, and the inherent risks involved. By carefully weighing the potential benefits against the potential drawbacks, and by diligently conducting due diligence, individuals can strategically utilize offshore accounts to achieve their financial objectives. Remember, seeking professional financial advice tailored to your specific circumstances is paramount before making any investment decisions in this complex arena.