Open International Bank Account Online: Managing finances across borders is simpler than ever before. This guide navigates the process of opening an international bank account online, covering eligibility, step-by-step procedures, account types, security measures, and international money transfer options. We’ll demystify the process, highlighting key considerations to help you choose the right bank and confidently manage your global finances.

From understanding residency requirements and necessary documentation to navigating the online application and verification processes, we’ll provide a comprehensive overview. We’ll also compare different account types, explore security protocols, and examine various international money transfer methods, empowering you to make informed decisions about your international banking needs.

Types of International Bank Accounts Available Online: Open International Bank Account Online

Opening an international bank account online offers numerous benefits, from convenient access to global financial markets to streamlined international transactions. However, understanding the different account types and their associated features is crucial for selecting the best option for your individual or business needs. This section Artikels the key differences between common international account types, including their features, benefits, and associated fees.

Current Accounts (Checking Accounts)

Current accounts, also known as checking accounts, are designed for day-to-day transactions. They offer easy access to funds through debit cards, online banking, and ATM withdrawals. These accounts typically do not accrue interest, but they provide the flexibility needed for frequent transactions.

- Features: Debit card access, online banking, ATM withdrawals, checkbook (sometimes), low or no minimum balance requirements.

- Benefits: Convenient access to funds, ease of making payments, suitable for regular transactions.

- Fees: Monthly maintenance fees (may vary depending on the bank and account balance), ATM fees (for withdrawals outside the bank’s network), international transaction fees.

Savings Accounts

Savings accounts are designed for accumulating funds and earning interest. They typically offer lower transaction limits compared to current accounts and may have higher minimum balance requirements. The interest earned is a significant benefit, though the rate varies depending on the bank and prevailing interest rates.

- Features: Interest accrual, online banking, limited transaction limits, potentially higher minimum balance requirements.

- Benefits: Earning interest on deposits, safe storage of funds, suitable for long-term savings goals.

- Fees: Monthly maintenance fees (if minimum balance not met), potential penalties for exceeding transaction limits.

Business Accounts

Business accounts are specifically designed for businesses and offer features tailored to commercial needs. These accounts often provide tools for managing business finances, including accounting software integration, higher transaction limits, and corporate credit cards.

- Features: Higher transaction limits, corporate credit cards, accounting software integration, online banking with enhanced business reporting tools.

- Benefits: Streamlined business financial management, separation of personal and business finances, enhanced reporting capabilities.

- Fees: Monthly maintenance fees (often higher than personal accounts), transaction fees, potential charges for exceeding overdraft limits.

Customer Support and Accessibility

Opening an international bank account online offers convenience, but reliable customer support is crucial for a positive experience. Access to efficient and responsive assistance is paramount, especially when dealing with cross-border transactions and potential complexities inherent in international finance. The accessibility of support channels for users with disabilities is also a critical factor in evaluating the overall quality of service.The availability and responsiveness of customer support vary significantly across different international online banks.

While some prioritize multiple channels and rapid response times, others may rely primarily on email communication, potentially leading to slower resolution times. Understanding these differences is key to choosing a bank that meets individual needs and expectations.

Customer Support Channels

International online banks typically offer a range of customer support channels designed to cater to diverse user preferences and technological capabilities. The specific channels available, however, can differ considerably from one institution to another.

- Phone Support: Many banks offer telephone support, allowing customers to speak directly with a representative. Response times and wait times can vary depending on the bank and the time of day. Some banks may offer dedicated phone lines for specific customer segments or inquiries, leading to potentially faster resolution times for certain issues.

- Email Support: Email support is a common feature, allowing customers to submit detailed inquiries and receive written responses. Response times can be longer than phone support, but email provides a documented record of the interaction. Banks may categorize email inquiries to route them to the appropriate specialist for efficient handling.

- Live Chat Support: Live chat offers immediate interaction with a support agent through a website or mobile app. This is often the fastest method for resolving simple issues, but the availability of live chat may be limited to certain hours or days. Some banks use AI-powered chatbots for initial inquiries, escalating to human agents when necessary.

- Online Help Center/FAQ: Most international online banks provide comprehensive online help centers or frequently asked questions (FAQ) sections. These resources can often answer common questions without requiring direct contact with customer support, providing a self-service option for many users. Well-designed help centers can significantly reduce the volume of support requests.

Accessibility Features for Users with Disabilities

Accessibility is a crucial aspect of inclusive banking. Leading international online banks are increasingly incorporating features to support users with disabilities, ensuring equal access to their services. These features may include:

- Screen Reader Compatibility: Websites and mobile apps should be compatible with screen readers, allowing visually impaired users to navigate and access information effectively. This requires careful adherence to web accessibility guidelines, such as WCAG (Web Content Accessibility Guidelines).

- Keyboard Navigation: All functionalities should be accessible via keyboard navigation, allowing users with motor impairments to interact with the banking platform without relying solely on a mouse.

- Alternative Text for Images: Images should include descriptive alternative text, providing context for users who cannot see the images. This enhances accessibility for visually impaired users and also improves search engine optimization.

- Adjustable Font Sizes and Colors: The ability to adjust font sizes and colors allows users with visual impairments to customize the display to their needs, improving readability and comfort.

- Closed Captioning for Videos: Videos should include closed captioning or transcripts, making them accessible to deaf or hard-of-hearing users.

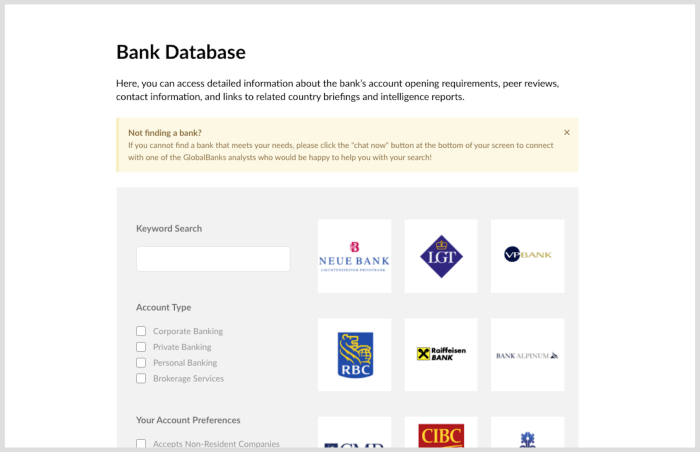

Choosing the Right International Bank

Opening an international bank account online offers significant advantages, but selecting the right institution is crucial. The ideal bank will depend on your specific needs and circumstances, encompassing factors beyond just the convenience of online access. Careful consideration of several key aspects will ensure a seamless and beneficial banking experience.

Factors to Consider When Selecting an International Bank

Several critical factors influence the selection of an international bank for online account opening. These range from the purely financial, such as fees and exchange rates, to the more qualitative, such as security and customer service responsiveness. A comprehensive assessment across these areas is essential.

- Fees and Charges: Account maintenance fees, transaction fees (wire transfers, ATM withdrawals), and foreign exchange fees can significantly impact your overall costs. Compare fee structures meticulously across different banks.

- Features and Services: Consider the range of services offered, such as debit/credit cards, online bill payment, international money transfers, and access to ATMs. Ensure the bank provides the features you require for your international transactions.

- Security Measures: Robust security protocols are paramount. Look for banks with multi-factor authentication, encryption, and fraud prevention measures to protect your funds and personal information. Investigate the bank’s history of security breaches and data protection policies.

- Customer Support: Reliable and accessible customer support is vital, especially when dealing with international transactions. Check the availability of multilingual support, multiple contact channels (phone, email, chat), and the responsiveness of the customer service team.

- Regulatory Compliance and Reputation: Choose a bank that is regulated by a reputable financial authority and maintains a strong reputation for ethical and transparent practices. Research the bank’s history and financial stability.

- Accessibility and User Experience: The online banking platform should be user-friendly, intuitive, and accessible across different devices (desktop, mobile). Consider the language options available and the overall ease of navigation.

Comparison of Services Offered by Prominent International Online Banks

Direct comparison across several leading international online banks highlights the variations in services and features. This comparison is not exhaustive and should be supplemented with your own research. Specific offerings and fees are subject to change.

| Bank | Account Fees | Transaction Fees | Currency Exchange Rates | Customer Support | Security Features |

|---|---|---|---|---|---|

| Example Bank A | $5/month | Variable, depending on transfer method | Competitive, but check specifics | Email, phone, online chat | Multi-factor authentication, encryption |

| Example Bank B | $0 (with minimum balance) | Higher than average for wire transfers | Mid-range | Email, phone | Two-factor authentication |

| Example Bank C | $10/month | Lower than average for online transfers | Very competitive | Email, phone, 24/7 chat | Multi-factor authentication, fraud monitoring |

Decision-Making Matrix for Choosing an International Bank, Open International Bank Account Online

To facilitate your decision, consider using a decision matrix. Assign weights to each factor based on its importance to your needs. Then, rate each bank on a scale (e.g., 1-5) for each factor. Multiply the weight by the rating for each factor and sum the scores to obtain a final score for each bank. The bank with the highest score best aligns with your priorities.

| Factor | Weight | Example Bank A (Rating) | Example Bank B (Rating) | Example Bank C (Rating) |

|---|---|---|---|---|

| Fees | 3 | 4 | 2 | 1 |

| Features | 2 | 3 | 4 | 5 |

| Security | 4 | 5 | 3 | 4 |

| Customer Support | 2 | 4 | 2 | 5 |

| Total Weighted Score | 38 | 22 | 39 |

Opening an international bank account online offers unprecedented convenience and accessibility for managing global finances. By understanding eligibility criteria, account types, security protocols, and money transfer options, you can confidently navigate this process. Remember to carefully compare different banks, considering factors like fees, features, and customer support, to find the best fit for your specific needs. Empower your international financial journey with informed decision-making.