Open Offshore Account Online: Navigating the world of offshore banking can feel daunting, but understanding the process, regulations, and potential benefits is key. This comprehensive guide demystifies offshore accounts, walking you through the online application process, choosing a reputable bank, and navigating the legal and tax implications. We’ll explore the various types of offshore accounts, their advantages and disadvantages, and provide crucial insights into security and risk management.

Prepare to gain a clear understanding of this often misunderstood financial tool.

From understanding the different account types and comparing jurisdictions to mastering the online application and securing your financial future, this guide serves as your roadmap to successfully opening and managing an offshore account. We’ll cover everything from required documentation and security measures to the legal and tax considerations involved, equipping you with the knowledge you need to make informed decisions.

Understanding Offshore Accounts: Open Offshore Account Online

Offshore accounts, held in banks or financial institutions outside an individual’s or company’s country of residence, offer a range of possibilities for managing finances internationally. Understanding their complexities, benefits, and drawbacks is crucial before considering opening one. This section delves into the various types of offshore accounts, their associated advantages and disadvantages, regulatory differences across jurisdictions, and a comparison of fees and minimum deposit requirements.

Types of Offshore Accounts

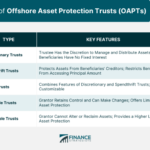

Several types of offshore accounts cater to different financial needs. These include traditional savings accounts offering interest, checking accounts for transactional purposes, investment accounts for stocks and bonds, and corporate accounts for business operations. More specialized accounts might include trust accounts for asset protection or retirement accounts designed for long-term savings. The choice depends heavily on individual circumstances and financial goals.

Benefits and Drawbacks of Offshore Accounts

Opening an offshore account presents several potential advantages. These can include asset protection from legal actions in the home country, diversification of investments in different currencies and markets, lower tax burdens in some jurisdictions (though careful consideration of tax laws is paramount), and increased privacy concerning financial transactions. However, drawbacks also exist. These include higher account maintenance fees, potentially complex regulatory compliance requirements, and the risk of stricter scrutiny from financial institutions regarding the source of funds (Know Your Customer or KYC regulations).

Furthermore, accessing funds might be more challenging depending on the location of the account and the prevailing banking regulations.

Offshore Account Regulations Across Jurisdictions

Offshore banking regulations vary significantly depending on the jurisdiction. Some jurisdictions, such as those in the Caribbean, are known for their relaxed regulations and banking secrecy, while others, like those in Europe, have stricter rules and greater transparency. The Cayman Islands, for instance, are popular for their established offshore banking sector but are increasingly subject to international pressure for greater transparency.

Switzerland, while historically known for bank secrecy, now operates under stricter regulations and information-sharing agreements with other countries. The specific regulations impact factors like reporting requirements, anti-money laundering (AML) compliance, and the level of due diligence required by banks. Thorough research into the regulatory landscape of the chosen jurisdiction is essential before opening an account.

Comparison of Fees and Minimum Deposit Requirements

The fees and minimum deposit requirements for offshore accounts vary considerably across different banks and jurisdictions. It is crucial to compare options carefully before making a decision. The following table provides a sample comparison, but it is important to note that these figures are subject to change and may not represent all available options. Always verify the current fees and requirements directly with the relevant financial institution.

| Bank | Jurisdiction | Minimum Deposit (USD) | Annual Fee (USD) |

|---|---|---|---|

| Example Bank A | Cayman Islands | 50,000 | 500 |

| Example Bank B | Switzerland | 100,000 | 1000 |

| Example Bank C | Singapore | 25,000 | 250 |

| Example Bank D | British Virgin Islands | 75,000 | 750 |

The Online Application Process

Opening an offshore account online offers convenience and accessibility, but understanding the process is crucial. This section details the typical steps, required documentation, and security measures involved in applying for an offshore account online. The process, while generally straightforward, varies slightly depending on the financial institution and the jurisdiction involved.Applying for an offshore account online typically involves several key steps, each designed to verify your identity and financial standing.

These steps ensure compliance with international regulations and protect both the institution and the applicant from fraud.

Required Documentation for Online Offshore Account Applications

Financial institutions require robust verification to prevent money laundering and other illicit activities. Therefore, applicants should anticipate providing comprehensive documentation. This typically includes a valid passport or national identity card, proof of address (recent utility bill or bank statement), and evidence of the source of funds. Depending on the account type and the institution’s policies, additional documentation, such as business registration documents (for corporate accounts) or employment verification, may be requested.

Failure to provide the necessary documentation will delay or prevent account opening.

Security Measures Used to Protect Online Applications

Protecting applicant data is paramount. Reputable offshore financial institutions utilize advanced security protocols to safeguard sensitive information during the online application process. This typically involves encryption technologies (such as SSL/TLS) to protect data transmitted between the applicant’s device and the institution’s servers. Multi-factor authentication (MFA) is frequently employed, requiring verification beyond a simple password, adding an extra layer of security.

Regular security audits and penetration testing are also vital in maintaining a secure online application environment. These measures aim to prevent unauthorized access and protect applicant data from breaches.

Flowchart Illustrating the Online Application Process

The following describes a typical flowchart for the online application process. Imagine a flowchart with distinct boxes connected by arrows.Box 1: Start: The process begins when the applicant initiates the online application.Arrow 1: Points from Box 1 to Box 2.Box 2: Account Selection: The applicant selects the desired account type (e.g., personal, corporate, savings, investment).Arrow 2: Points from Box 2 to Box 3.Box 3: Personal Information Entry: The applicant provides personal details (name, address, date of birth, etc.).Arrow 3: Points from Box 3 to Box 4.Box 4: Document Upload: The applicant uploads the required documentation (passport, proof of address, etc.).Arrow 4: Points from Box 4 to Box 5.Box 5: Application Review: The institution reviews the application and uploaded documents.Arrow 5: Points from Box 5 to Box 6 (Success) and Box 7 (Failure).Box 6: Account Approval: The application is approved, and the account is opened.Arrow 6: Points from Box 6 to Box 8.Box 7: Application Rejection: The application is rejected; reasons for rejection are communicated to the applicant.Arrow 7: Points from Box 7 to Box 8.Box 8: End: The process concludes with either account approval or rejection.

Legal and Tax Implications

Opening and maintaining an offshore account involves navigating a complex web of legal and tax regulations. Understanding these implications is crucial to ensure compliance and avoid potential penalties. This section details the legal requirements for account establishment and maintenance, explores the tax ramifications for various nationalities, and provides illustrative examples of potential tax liabilities.

Legal Requirements for Offshore Account Opening and Maintenance

Establishing and maintaining an offshore account necessitates adherence to specific legal stipulations, varying considerably based on the jurisdiction chosen. These requirements often include providing comprehensive identification documentation, demonstrating the source of funds, and adhering to anti-money laundering (AML) and know-your-customer (KYC) regulations. Failure to comply can lead to account closure, financial penalties, and even legal prosecution. Jurisdictions typically require meticulous record-keeping, necessitating detailed documentation of all transactions.

Furthermore, specific reporting requirements might apply, demanding regular updates on account activity to the relevant financial authorities. The specific regulations will vary depending on the country where the account is held and the account holder’s nationality and tax residency.

Tax Implications of Holding Assets in Offshore Accounts

The tax implications of holding assets in offshore accounts are significantly influenced by an individual’s nationality, tax residency, and the type of assets held. Many countries impose taxes on worldwide income, meaning that income generated from assets held in offshore accounts is taxable regardless of where the account is located. However, some countries have tax treaties with other jurisdictions, which may mitigate or eliminate double taxation.

For instance, an individual who is a tax resident of the United States will likely be subject to US taxation on income earned from an offshore account, even if the account is held in a tax haven. The specific tax treatment will depend on the applicable tax laws and any relevant tax treaties. Failure to declare offshore income can result in substantial penalties and legal repercussions.

Examples of Potential Tax Liabilities Associated with Offshore Accounts

Consider a US citizen holding investments in an offshore account in the Cayman Islands. Any capital gains realized from the sale of these investments will be subject to US capital gains tax, even though the investments were held in an offshore account. Similarly, interest earned on deposits in an offshore account held by a UK resident will be subject to UK income tax.

Undeclared income from an offshore account can lead to significant tax penalties, including interest and potentially criminal charges. In addition, if funds are transferred from an offshore account to a domestic account without proper reporting, it can trigger tax audits and penalties. The specific tax liabilities will depend on the jurisdiction of the account, the nationality and tax residency of the account holder, and the type of assets held.

Tax Treaties and Their Impact on Offshore Accounts

Tax treaties aim to prevent double taxation by establishing rules for how income and capital gains are taxed by different countries. The impact of these treaties on offshore accounts can be significant, as they can reduce or eliminate the tax burden on individuals who hold assets in multiple jurisdictions.

| Country A | Country B | Tax Treaty | Impact on Offshore Accounts |

|---|---|---|---|

| United States | United Kingdom | Yes | Reduces double taxation on certain types of income |

| Canada | Switzerland | Yes | Provides clarity on tax residency and the taxation of investment income |

| Germany | Luxembourg | Yes | Specifies rules for the avoidance of double taxation on dividends and interest |

| France | Singapore | Yes | Addresses the taxation of capital gains from the sale of assets |

Security and Risk Management

Opening and utilizing offshore online accounts presents a unique set of security challenges. While offering potential financial benefits, these accounts are susceptible to various risks, demanding a proactive and informed approach to risk mitigation. Understanding these risks and implementing robust security measures is crucial for safeguarding your assets and maintaining financial privacy.The importance of selecting a secure and reputable online banking platform cannot be overstated.

A platform’s security infrastructure directly impacts the safety of your funds and personal information. Factors such as encryption protocols, multi-factor authentication, and regulatory compliance should be carefully considered before selecting a provider. Compromised platforms can lead to account breaches, financial losses, and identity theft.

Choosing a Secure Online Banking Platform

Selecting a reputable offshore online banking platform requires diligent research. Look for platforms with robust security features, including advanced encryption (like 256-bit AES), multi-factor authentication (MFA) requiring more than just a password, and a strong track record of security. Check for certifications such as ISO 27001 (information security management) and adherence to relevant financial regulations. Independent reviews and ratings from reputable financial news sources can provide valuable insights into a platform’s security practices and customer experiences.

Consider platforms that offer regular security updates and transparent communication about any security incidents. Transparency builds trust and shows commitment to customer protection.

Protecting Your Offshore Account from Fraud and Cyber Threats

Several best practices can significantly reduce the risk of fraud and cyber threats. These include using strong, unique passwords for your offshore account and employing a password manager to securely store them. Regularly review your account statements for any unauthorized transactions. Be wary of phishing emails or suspicious links claiming to be from your bank; legitimate institutions will never request sensitive information via email.

Enable email notifications for account activity to receive prompt alerts about login attempts and transactions. Furthermore, keeping your antivirus software updated and regularly scanning your devices for malware is essential. Consider using a virtual private network (VPN) to encrypt your internet connection, especially when accessing your offshore account from public Wi-Fi networks. Finally, educating yourself about common online scams and fraudulent activities can help you avoid becoming a victim.

Protecting Your Online Offshore Banking Information

A comprehensive guide to protecting your online offshore banking information involves multiple layers of security. Firstly, never share your login credentials, account numbers, or any other sensitive information via email, phone, or unsecured websites. Use strong, unique passwords for each online account and regularly update them. Consider using a password manager to generate and securely store these passwords.

Always log into your offshore account directly through the official website, and avoid clicking on links from suspicious emails or messages. Enable multi-factor authentication (MFA) whenever available; this adds an extra layer of security by requiring a second verification method, such as a code sent to your mobile phone. Regularly review your account statements for any unusual activity and report any suspicious transactions immediately to your bank.

Be mindful of your surroundings when accessing your account on public devices, and always log out securely after each session. Regularly update your operating system and antivirus software to protect your devices from malware.

Illustrative Examples of Offshore Account Use Cases

Offshore accounts, while often shrouded in mystery, serve a variety of legitimate purposes for both individuals and businesses. Understanding these use cases requires a nuanced perspective, acknowledging both the benefits and potential drawbacks associated with each. The following examples illustrate the diverse applications of offshore accounts, emphasizing transparency and responsible financial management.

Offshore Account Use Cases for Individuals

Individuals utilize offshore accounts for various reasons, often related to asset protection, tax optimization (within legal frameworks), and diversification of investments. These choices should always align with local and international regulations.

| User Type | Purpose | Benefits | Drawbacks |

|---|---|---|---|

| High-Net-Worth Individual | Asset Protection and Diversification | Protection from creditors in a different jurisdiction; diversification of investment portfolio across different markets, reducing overall risk. | Complexity of managing assets across borders; potential compliance challenges with reporting requirements in multiple jurisdictions; higher administrative costs. |

| Expatriate | Managing Finances Across Borders | Simplified management of finances in multiple countries; easier access to funds in their country of residence. | Potential for currency exchange fluctuations impacting returns; need to comply with tax regulations in both home and host countries. |

| International Business Owner | International Transaction Management | Facilitates international transactions and payments; streamlines business operations across borders. | Increased regulatory scrutiny; potential for increased compliance costs; risks associated with currency exchange rate fluctuations. |

Offshore Account Use Cases for Businesses

Businesses leverage offshore accounts for various strategic reasons, primarily focused on international trade, tax efficiency, and operational streamlining. These strategies must adhere to international and local laws.

| User Type | Purpose | Benefits | Drawbacks |

|---|---|---|---|

| Multinational Corporation | International Trade and Investment | Facilitates international transactions; simplifies global operations; potential for tax optimization within legal frameworks. | Increased complexity in accounting and compliance; potential for regulatory scrutiny; exposure to currency risks. |

| Small and Medium-Sized Enterprise (SME) | International Expansion and Market Access | Access to international markets; improved efficiency in managing foreign currency transactions. | Increased administrative burden; potential for higher compliance costs; risks associated with international transactions. |

| E-commerce Business | Payment Processing and Currency Management | Simplified processing of international payments; efficient management of multiple currencies. | Potential for fraud; exposure to currency exchange rate fluctuations; compliance with international payment regulations. |

Common Misconceptions about Offshore Accounts

Offshore accounts often attract misconceptions due to their association with secrecy and high-net-worth individuals. However, many misunderstandings surround their legitimate uses and legal implications. Understanding the realities of offshore banking is crucial for anyone considering this financial option. This section will clarify common myths and address the ethical considerations involved.

Offshore Accounts are Only for Tax Evasion

This is perhaps the most pervasive misconception. While some individuals may misuse offshore accounts for illegal tax avoidance, the vast majority of legitimate uses are for asset protection, diversification, and managing finances across borders. Many businesses utilize offshore accounts for international trade and investment, simplifying complex cross-border transactions. Legitimate use often involves complete transparency and compliance with all relevant tax laws in both the account holder’s home country and the jurisdiction where the account is held.

Failure to comply with these laws can lead to severe legal consequences.

Offshore Accounts are Automatically Anonymous and Untraceable, Open Offshore Account Online

Contrary to popular belief, offshore accounts are not inherently anonymous. Most reputable offshore banks adhere to strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. These regulations require banks to verify the identity of account holders and monitor transactions for suspicious activity. Information sharing agreements between countries further limit the potential for anonymity. While some jurisdictions might offer greater privacy than others, complete anonymity is virtually impossible in the modern financial landscape.

Opening an Offshore Account is Difficult and Expensive

The process of opening an offshore account can vary significantly depending on the jurisdiction and the bank. While some banks may have more stringent requirements, many offer online application processes that are relatively straightforward. The costs associated with opening and maintaining an offshore account also vary, but they are not necessarily prohibitive for individuals with significant assets or businesses operating internationally.

Many banks offer competitive fee structures, making offshore banking accessible to a wider range of clients than often perceived.

Ethical Considerations of Offshore Accounts

The ethical implications of offshore accounts hinge on transparency and compliance with all applicable laws. Using an offshore account to evade taxes or engage in illegal activities is unethical and carries significant legal risks. However, utilizing offshore accounts for legitimate purposes, such as asset protection or international business operations, is not inherently unethical, provided full transparency and legal compliance are maintained.

The key is to ensure that all financial activities are conducted legally and ethically, with complete disclosure to relevant tax authorities.

Common Myths and Facts

The following table summarizes common misconceptions about offshore accounts and provides factual clarifications:

| Myth | Fact |

|---|---|

| Offshore accounts are only for the wealthy. | While high-net-worth individuals frequently use offshore accounts, they are accessible to a broader range of clients, including businesses and individuals with international financial needs. |

| All offshore accounts are tax havens. | Many jurisdictions offer offshore banking services, and not all are considered tax havens. The tax implications depend heavily on the specific jurisdiction and the individual’s tax residency. |

| Offshore accounts are inherently risky. | The risk associated with an offshore account depends on factors such as the jurisdiction, the bank’s reputation, and the account holder’s compliance with regulations. Reputable banks and careful management can mitigate risks. |

| Opening an offshore account is a simple process. | The complexity of opening an offshore account varies significantly depending on the jurisdiction and the bank. Some processes are straightforward, while others involve more stringent requirements and documentation. |

Opening an offshore account online offers significant opportunities for individuals and businesses alike, but it’s crucial to approach it with careful planning and a thorough understanding of the associated risks and regulations. By carefully considering the factors discussed—from choosing a reputable bank to implementing robust security measures—you can mitigate potential challenges and maximize the benefits. This guide has provided a solid foundation; remember to consult with financial and legal professionals to tailor your strategy to your specific circumstances.