Switzerland Bank Account: This exploration delves into the intricacies of Swiss banking, a system renowned for its discretion and robust financial infrastructure. We’ll navigate the historical context of Swiss banking secrecy, examining its evolution under current regulatory scrutiny. From understanding the diverse account types available to non-residents, to mastering the account opening process and navigating the complexities of international tax implications, this guide provides a comprehensive overview of managing a Swiss bank account.

We’ll dissect the step-by-step procedures for account application, comparing the processes for individuals and corporations. A detailed look at account management, security measures, and available online banking platforms will equip you with the knowledge to confidently manage your finances. We’ll also examine the tax implications for individuals residing in various countries, explore wealth management strategies, and compare the Swiss banking system with other international financial centers.

Real-world examples and case studies further illuminate the practical applications of managing a Swiss bank account.

Understanding Swiss Banking

Switzerland’s reputation as a global financial center is deeply rooted in its long history of banking secrecy. This tradition, while contributing significantly to its economic prominence, has also faced intense scrutiny and undergone substantial regulatory changes in recent decades. Understanding the evolution of Swiss banking practices, as well as the current legal framework, is crucial for anyone considering engaging with Swiss financial institutions.Swiss banking secrecy, historically, was largely based on a combination of strong legal protections and a cultural ethos of discretion.

While not explicitly codified as a blanket prohibition of information sharing, Swiss laws provided significant barriers to accessing client data, fostering a culture of confidentiality that attracted significant international wealth. This system, however, faced increasing pressure from international organizations and governments concerned about its potential use for tax evasion, money laundering, and other illicit activities.

The Current Regulatory Landscape of Swiss Bank Accounts

The modern regulatory landscape governing Swiss bank accounts is vastly different from its past. Driven by international pressure and domestic policy shifts, Switzerland has significantly increased its transparency and cooperation with foreign authorities. Key legislation, such as the OECD’s Common Reporting Standard (CRS), requires Swiss banks to automatically exchange information with tax authorities in participating countries. This means that the era of untraceable, anonymous accounts is effectively over.

The Swiss Financial Market Supervisory Authority (FINMA) actively enforces strict anti-money laundering (AML) and know-your-customer (KYC) regulations, requiring banks to diligently verify the identities of clients and monitor their transactions for suspicious activity. Furthermore, Switzerland is a signatory to numerous international treaties and agreements aimed at combating financial crime, significantly reducing the opportunities for illicit activities.

Types of Swiss Bank Accounts, Switzerland Bank Account

Several types of accounts are available in Switzerland, each tailored to specific client needs and financial objectives. The choice of account depends on factors such as residency status, investment goals, and risk tolerance.While specific offerings vary among banks, common account types include:

- Private Banking Accounts: These accounts cater to high-net-worth individuals, offering personalized wealth management services, investment advice, and access to a range of sophisticated financial products.

- Savings Accounts: These accounts offer a secure place to deposit funds and earn interest, although interest rates may be relatively modest compared to other jurisdictions.

- Current Accounts: These accounts are designed for everyday banking needs, providing debit cards and facilities for managing transactions.

- Investment Accounts: These accounts allow for the management of investments in various asset classes, including stocks, bonds, and other securities, often with the assistance of professional advisors.

It is important to note that opening and maintaining a Swiss bank account requires a thorough due diligence process, including the provision of extensive documentation to verify identity and source of funds. The specific requirements may vary depending on the bank and the type of account. Moreover, while Switzerland offers a stable and secure banking environment, it’s crucial to carefully consider all applicable fees and charges associated with each account type.

Account Opening Process

Opening a Swiss bank account, particularly for non-residents, involves a more rigorous process than in many other jurisdictions. This is due to Switzerland’s strict regulations regarding anti-money laundering (AML) and know-your-customer (KYC) compliance. The process demands thorough documentation and a clear understanding of your financial activities.

Steps Involved in Opening a Swiss Bank Account for Non-Residents

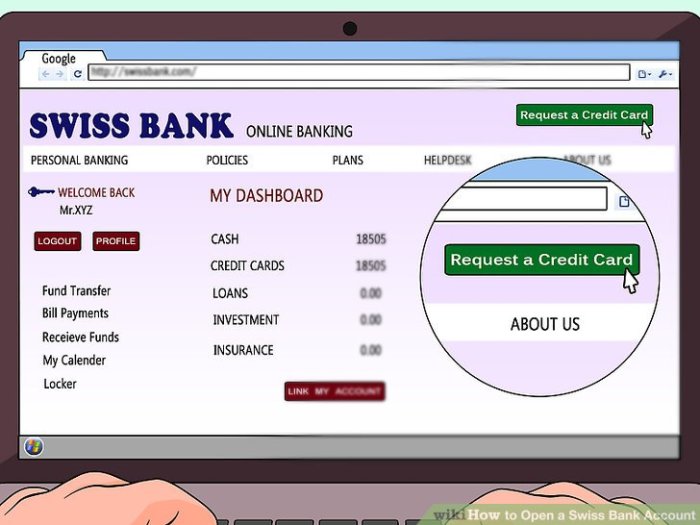

The account opening process typically begins with an initial consultation with the bank. This allows the bank to assess your suitability as a client and understand your financial needs. Following this initial assessment, you’ll be guided through the necessary documentation and application procedures. The bank will then conduct due diligence checks, which may involve verifying your identity and the source of your funds.

Once all checks are completed and approved, the account will be opened. The entire process can take several weeks, or even months, depending on the complexity of your situation and the bank’s internal procedures.

Required Documentation for Account Application

A comprehensive set of documents is typically required to support your application. This usually includes a valid passport or national identity card, proof of address (such as a utility bill or bank statement), and documentation verifying the source of your funds. Depending on the bank and the type of account, additional documents may be requested. These could include tax returns, employment contracts, or business registration documents.

It is crucial to ensure that all documentation is accurate, up-to-date, and properly translated if not in English, German, French, or Italian.

Comparison of Account Opening Procedures: Individuals vs. Corporations

The account opening process differs significantly between individuals and corporations. Individuals generally need to provide personal identification documents and proof of address, along with documentation explaining the source of their funds. Corporations, on the other hand, face a more complex process. They need to provide corporate registration documents, articles of incorporation, details about the beneficial owners, and financial statements.

The due diligence process for corporations is often more extensive, involving verification of the company’s legitimacy and financial standing. Furthermore, corporate accounts often require more detailed information about the intended use of the account and the anticipated transaction volumes.

Fees Associated with Different Account Types

The fees associated with Swiss bank accounts vary considerably depending on the type of account, the services offered, and the bank itself. The following table provides a general overview; it is crucial to contact the specific bank for the most up-to-date and accurate fee schedule.

| Account Type | Annual Fee (CHF) | Transaction Fee (CHF) | Minimum Balance (CHF) |

|---|---|---|---|

| Private Banking Account | 1,500 – 5,000+ | Variable, often waived for high-volume clients | 50,000 – 250,000+ |

| Standard Savings Account | 50 – 200 | 1 – 5 | 0 – 10,000 |

| Corporate Account | 500 – 3,000+ | Variable, dependent on transaction type and volume | 10,000 – 100,000+ |

| Investment Account | Variable, dependent on assets under management | Variable, often included in management fees | Variable, dependent on investment strategy |

Tax Implications and Reporting

Opening a Swiss bank account introduces complexities regarding tax implications and reporting obligations. The tax treatment of funds held in a Swiss account varies significantly depending on the account holder’s country of residence and the specific nature of the assets held within the account. Understanding these implications is crucial for compliance and avoiding potential penalties.The reporting requirements for foreign accounts are also subject to international regulations and bilateral agreements.

Failure to comply with these regulations can lead to severe financial consequences. This section details the tax implications and reporting requirements associated with Swiss bank accounts for residents of various countries, emphasizing the importance of seeking professional tax advice tailored to individual circumstances.

Tax Implications for Residents of Different Countries

The tax implications of holding a Swiss bank account differ substantially based on the individual’s country of residence. Residents of countries with strict reporting requirements, such as the United States, face stringent regulations regarding foreign account disclosure. Conversely, residents of countries with less stringent regulations may have fewer reporting obligations. Tax treaties between Switzerland and other nations also play a significant role in determining the tax treatment of income generated from Swiss accounts.

For instance, a resident of a country with a tax treaty with Switzerland might benefit from reduced withholding taxes on certain types of income. Conversely, a resident of a country without a tax treaty may face higher taxes on the same income. The tax residency status of the account holder is paramount in determining the applicable tax rules.

For example, a U.S. citizen living abroad may still be considered a U.S. tax resident, triggering reporting requirements under the Foreign Bank Account Report (FBAR) and Foreign Account Tax Compliance Act (FATCA).

Reporting Requirements for Foreign Accounts

Many countries mandate the reporting of foreign bank accounts, including those held in Switzerland. These reporting requirements are designed to combat tax evasion and ensure transparency in international financial transactions. The specific requirements vary considerably from country to country. For example, the U.S. requires citizens and residents to report foreign bank accounts with over $10,000 through the FBAR and FATCA.

Failure to comply with these reporting obligations can result in substantial penalties, including financial fines and even criminal prosecution. Similarly, many other countries have implemented their own versions of foreign account reporting regulations. These regulations often require individuals to declare the balance of their foreign accounts on their annual tax returns, providing details of income earned and taxes paid abroad.

The level of detail required varies depending on the jurisdiction. It is essential to understand and comply with the specific reporting requirements of your country of residence.

Examples of Tax Treaties Between Switzerland and Other Nations

Switzerland has established numerous tax treaties with various countries to avoid double taxation and promote international cooperation in tax matters. These treaties often Artikel specific rules for the taxation of income generated from Swiss bank accounts held by residents of the treaty partner country. For example, a tax treaty between Switzerland and the United Kingdom might stipulate that dividends paid from a Swiss company to a UK resident are taxed only in the UK, avoiding double taxation in both countries.

These treaties typically define the conditions under which income earned from a Swiss account will be taxed in Switzerland or the resident’s country, and the rates of withholding tax applied. Specific details of these treaties are readily available from the relevant tax authorities of each participating country and from the Swiss Federal Tax Administration. It is crucial to consult these treaties to understand the specific implications for your tax situation.

Wealth Management in Switzerland

Switzerland’s reputation for discretion, stability, and robust financial regulations makes it a prime location for high-net-worth individuals (HNWIs) seeking sophisticated wealth management services. Swiss banks offer a comprehensive suite of services designed to preserve, grow, and transfer wealth across generations. These services are tailored to individual needs and risk tolerances, leveraging the expertise of seasoned professionals and access to a diverse range of investment opportunities.Swiss banks provide a wide array of wealth management services, catering to the diverse needs of their clientele.

These services extend beyond simple account management and encompass a holistic approach to financial well-being.

Wealth Management Services Offered by Swiss Banks

Swiss banks offer a comprehensive range of wealth management services, including portfolio management, financial planning, estate planning, and family office services. Portfolio management involves the active oversight and management of client investments, aiming to maximize returns while mitigating risk. Financial planning encompasses long-term financial goals, retirement planning, and tax optimization strategies. Estate planning focuses on the efficient and legally sound transfer of wealth to heirs, minimizing potential tax liabilities.

Finally, family office services provide comprehensive support for managing the complex financial affairs of ultra-high-net-worth families. These services often include investment management, tax advisory, legal counsel, and philanthropic guidance.

Investment Options Available to Clients

Clients of Swiss banks have access to a diverse range of investment options, allowing for tailored portfolios aligned with their individual risk profiles and financial objectives. These options include traditional asset classes such as equities (stocks), fixed income (bonds), and real estate, as well as alternative investments such as private equity, hedge funds, and commodities. The availability of specific investment products will vary depending on the client’s risk profile, investment goals, and the bank’s offerings.

Sophisticated investment strategies, such as hedging and diversification, are frequently employed to manage risk and enhance returns.

Hypothetical Investment Portfolio for a High-Net-Worth Individual

A hypothetical investment portfolio for a high-net-worth individual with a long-term investment horizon and a moderate risk tolerance might be structured as follows:

| Asset Class | Allocation (%) | Rationale |

|---|---|---|

| Equities (Global Diversified) | 40 | Provides long-term growth potential through exposure to a diversified range of global markets. |

| Fixed Income (Global Bonds) | 30 | Offers stability and income generation, mitigating some of the volatility associated with equities. |

| Real Estate (Direct Investment & REITs) | 15 | Provides diversification and potential for inflation hedging. |

| Alternative Investments (Private Equity & Hedge Funds) | 10 | Offers potentially higher returns but with increased risk; carefully selected to diversify overall portfolio risk. |

| Cash and Equivalents | 5 | Provides liquidity and acts as a buffer during market downturns. |

Note: This is a hypothetical portfolio and does not constitute financial advice. The optimal asset allocation will depend on individual circumstances, risk tolerance, and financial goals. Professional financial advice should always be sought before making any investment decisions.

Illustrative Case Studies: Switzerland Bank Account

This section presents a fictional case study to illustrate the process of opening and managing a Swiss bank account, including international fund transfers and tax considerations. Understanding these practical aspects is crucial for individuals considering utilizing Swiss banking services.

Successful Business Owner Opening a Swiss Bank Account

Maria Garcia, a successful entrepreneur in the tech industry, decided to open a Swiss bank account to diversify her assets and benefit from Switzerland’s robust financial system. After researching several Swiss banks, she chose a private bank known for its wealth management services and discretion. Her initial consultation involved discussions about her financial goals, risk tolerance, and investment preferences.

The bank provided her with a comprehensive package outlining the required documentation, including proof of identity, address, and source of funds. The process involved completing detailed application forms, providing references, and undergoing a due diligence process to verify her identity and the origin of her wealth. Once approved, Maria was assigned a dedicated relationship manager who assisted her with account setup, online banking access, and ongoing financial management.

Maria subsequently transferred funds from her existing US bank account to her newly opened Swiss account.

International Fund Transfer to a Swiss Account

Maria transferred funds from her US bank account via a wire transfer. This involved providing her Swiss bank with the necessary recipient details, including the account number, IBAN, and SWIFT code. Her US bank charged a wire transfer fee of $50, while the Swiss bank levied a corresponding receiving fee of CHF 50. The entire process took approximately three business days, although this timeframe can vary depending on the banks involved and any potential processing delays.

Maria’s relationship manager kept her informed of the transfer’s progress and provided her with confirmation once the funds had been credited to her Swiss account. She also received detailed statements outlining all fees associated with the transaction. It’s important to note that currency exchange rates can fluctuate, impacting the final amount received in Swiss Francs. Maria utilized a mid-market exchange rate for her transfer, minimizing potential losses due to currency fluctuations.

Tax Implications and Reporting for Maria Garcia

Maria’s relationship manager advised her on the tax implications of holding assets in Switzerland. As a US citizen, she is still subject to US tax laws on her worldwide income. The Swiss bank provided her with the necessary documentation for her annual US tax filings, including Form 8938 (Statement of Specified Foreign Financial Assets) and other relevant forms.

She was also advised on potential tax treaties between the US and Switzerland that might minimize her tax burden. Switzerland adheres to strict banking secrecy laws, but this does not negate the reporting obligations to her home country’s tax authorities. The Swiss bank emphasized the importance of accurate and timely reporting to avoid potential penalties. Maria understood that proactive tax planning and compliance were crucial to maintaining the legality and integrity of her Swiss banking arrangements.

Comparison with Other International Banking Centers

Switzerland’s renowned banking sector, characterized by its privacy, security, and stability, isn’t unique. Several other international financial centers offer comparable, albeit often distinct, services. Understanding these differences is crucial for individuals and businesses seeking to establish international banking relationships. This section compares and contrasts Swiss banking with those of other prominent financial hubs.This comparison focuses on key aspects of international banking, highlighting the similarities and differences between jurisdictions.

It’s important to remember that regulations and practices are subject to change, and independent professional advice should always be sought before making any financial decisions.

Account Opening Processes in Different Jurisdictions

The process of opening a bank account varies significantly across countries. While Switzerland is known for its rigorous due diligence and Know Your Customer (KYC) procedures, other countries may have more streamlined or less stringent requirements. This can impact the time and documentation needed to establish an account. For instance, opening an account in Singapore might involve a faster process compared to Switzerland, while the UK might require similar levels of due diligence but with different documentation specifics.

The complexity also varies depending on the type of account and the client’s profile.

Tax Regulations and Reporting Requirements

Tax implications are a critical consideration when choosing an international banking center. Switzerland, while maintaining a high level of banking secrecy, has undergone significant changes in its tax reporting policies in recent years, complying with international standards for transparency and information exchange. Other jurisdictions have different levels of tax transparency and reporting requirements. Some jurisdictions, such as the Cayman Islands, have traditionally offered greater tax advantages but face increasing pressure for greater transparency.

Conversely, countries like the UK have a comprehensive tax system with stringent reporting requirements.

Security Measures and Regulatory Frameworks

The security measures employed by banks vary across different countries, reflecting their respective regulatory frameworks and levels of technological advancement. Switzerland has a strong regulatory environment overseen by FINMA (the Swiss Financial Market Supervisory Authority), ensuring high standards of security and stability. Other countries, such as the United States and the UK, also have robust regulatory frameworks and sophisticated security measures in place.

However, the specific approaches to cybersecurity, fraud prevention, and data protection might differ, impacting the overall security profile of each banking system.

Comparative Table: Switzerland vs. Other International Banking Centers

| Country | Account Opening Process | Tax Regulations | Security Measures |

|---|---|---|---|

| Switzerland | Rigorous KYC/AML procedures, potentially lengthy process | High level of banking secrecy, but increasing transparency and information exchange | Strong regulatory framework (FINMA), high security standards |

| United Kingdom | Stringent KYC/AML procedures, relatively efficient process | Comprehensive tax system with stringent reporting requirements | Robust regulatory framework (FCA), sophisticated security measures |

| Singapore | Generally efficient process, with robust KYC/AML compliance | Transparent tax system with international standards | Strong regulatory framework (MAS), emphasis on financial technology and cybersecurity |

| United States | Process varies significantly by state and institution, KYC/AML compliance is mandatory | Complex tax system with federal and state regulations | Robust regulatory framework (various agencies), strong emphasis on consumer protection |

Opening and managing a Switzerland Bank Account involves careful consideration of various factors, from regulatory compliance and tax implications to security and wealth management strategies. This guide has provided a detailed roadmap, outlining the process from initial application to long-term account management. By understanding the nuances of Swiss banking, you can make informed decisions that align with your financial goals and ensure the security and privacy of your assets.

Remember to always seek professional advice tailored to your specific circumstances.