What Does Offshore Mean? This question unlocks a world of complex business strategies, encompassing everything from manufacturing and outsourcing to investment and global expansion. Understanding the intricacies of offshore operations requires navigating legal frameworks, financial implications, ethical considerations, and technological advancements. This comprehensive guide delves into each aspect, providing clarity and insights into the multifaceted nature of offshore business practices.

From identifying key offshore regions and understanding their regulatory environments to evaluating the financial benefits and risks involved, we’ll explore the complete spectrum of offshore activities. We’ll examine both the potential cost savings and the challenges associated with managing remote teams and ensuring ethical labor practices. Real-world case studies will illustrate the successes and failures of offshore ventures, highlighting crucial lessons learned for businesses considering this strategic approach.

Geographic and Legal Aspects of Offshore Operations: What Does Offshore Mean

Offshore operations encompass a complex interplay of geographical locations and diverse legal frameworks. Understanding these aspects is crucial for businesses considering or already engaged in such activities, as they significantly impact operational efficiency, tax liabilities, and overall compliance. This section will explore key regions, favorable jurisdictions, relevant legal frameworks, tax implications, and essential legal considerations for businesses involved in offshore operations.

Key Regions for Offshore Business Activities

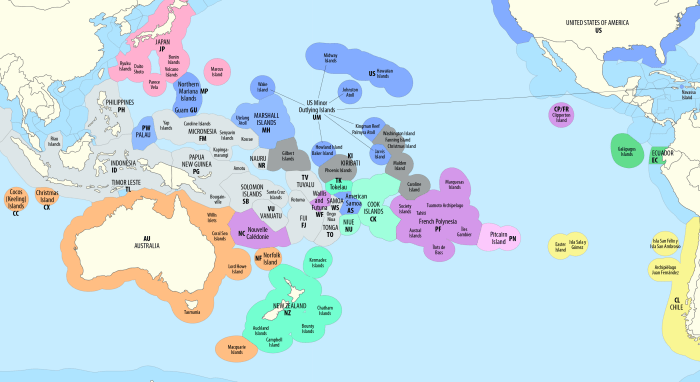

Several regions globally are recognized as hubs for offshore business activities, attracting companies due to their favorable regulatory environments and strategic locations. These regions often boast robust infrastructure, skilled workforces, and established legal frameworks specifically designed to support offshore operations. The Caribbean, particularly islands like the Cayman Islands, Bermuda, and the British Virgin Islands, are well-known examples. Asia, with jurisdictions like Hong Kong, Singapore, and Mauritius, also presents significant opportunities.

Furthermore, Europe offers options such as Malta and Ireland, known for their advantageous tax regimes and business-friendly regulations. The specific appeal of each region often depends on factors like industry, desired tax benefits, and access to specific markets.

Examples of Countries with Favorable Offshore Business Regulations

Certain countries have implemented legal and regulatory frameworks specifically designed to attract offshore businesses. These frameworks often include streamlined company registration processes, simplified tax structures, and robust intellectual property protection. The Cayman Islands, for example, are renowned for their sophisticated financial services sector and well-established regulatory framework governing offshore entities. Singapore offers a stable political environment, a highly developed infrastructure, and a pro-business approach, making it attractive for various industries.

Similarly, Ireland’s advantageous corporate tax rate has made it a popular destination for multinational corporations establishing offshore operations. The specific benefits offered by each country vary, and businesses should carefully consider their individual needs and circumstances when selecting a jurisdiction.

Legal and Regulatory Frameworks Governing Offshore Operations

The legal and regulatory frameworks governing offshore operations differ significantly across jurisdictions. These frameworks encompass various aspects, including company formation, taxation, compliance requirements, and dispute resolution mechanisms. Many offshore jurisdictions follow common law principles, while others have civil law systems. The specific regulations governing areas like data privacy, intellectual property rights, and anti-money laundering (AML) compliance vary widely.

Businesses must ensure thorough due diligence and seek expert legal advice to understand and comply with the specific legal and regulatory requirements of the jurisdiction in which they operate. Failure to comply can lead to severe penalties, including fines and legal action.

Implications of Tax Laws and Treaties on Offshore Activities

Tax laws and international tax treaties play a crucial role in shaping the landscape of offshore operations. Many jurisdictions offer attractive tax incentives to attract foreign investment. However, businesses must navigate complex international tax regulations to avoid double taxation and ensure compliance with both domestic and international tax laws. Tax treaties between countries can help mitigate double taxation, but their provisions vary widely.

Understanding the implications of tax laws and treaties is critical for optimizing tax efficiency and minimizing potential tax liabilities. Ignoring these implications can result in significant financial penalties and legal repercussions.

Common Legal Considerations for Businesses Engaging in Offshore Operations

Understanding the legal landscape is paramount for successful offshore operations. Before engaging in such activities, businesses should carefully consider several key aspects:

- Company Formation and Structure: Choosing the appropriate legal structure (e.g., LLC, IBC) is crucial, aligning with business goals and the specific regulatory environment.

- Tax Implications: A thorough understanding of tax laws, treaties, and potential double taxation issues is essential for compliance and minimizing tax liabilities.

- Regulatory Compliance: Adherence to local laws and regulations concerning AML, data privacy, and other relevant areas is vital to avoid penalties.

- Intellectual Property Protection: Securing intellectual property rights in the chosen jurisdiction is crucial for protecting valuable assets.

- Contractual Agreements: All agreements with offshore partners should be carefully drafted and legally sound to protect the business’s interests.

- Dispute Resolution: Understanding the mechanisms for resolving disputes in the chosen jurisdiction is important for mitigating risks.

- Reputational Risk: Engaging in offshore operations can have reputational implications; businesses must maintain transparency and ethical conduct.

Ethical and Social Considerations of Offshore Practices

Offshore operations, while offering numerous economic benefits, present significant ethical and social challenges. Balancing the pursuit of cost-effectiveness with the well-being of workers and the environment is crucial for responsible business practices. This section examines the ethical implications of offshore labor practices, environmental concerns, and the broader social responsibilities associated with offshore operations.

Worker Rights and Fair Wages in Offshore Operations

Ensuring fair wages and upholding worker rights in offshore settings is paramount. Exploitation, including substandard wages, unsafe working conditions, and the denial of basic labor rights, is a pervasive concern in many offshore industries. International labor standards, such as those set by the International Labour Organization (ILO), provide a framework for protecting worker rights, but enforcement remains a significant challenge.

Best practices involve rigorous auditing of suppliers, transparent supply chains, and active engagement with local communities to understand and address concerns. Companies like Patagonia, known for their commitment to ethical sourcing, actively monitor their supply chains to ensure fair labor practices are upheld throughout their production process. Conversely, the garment industry has historically faced criticism for offshore practices that prioritize low costs over worker well-being.

Best Practices for Ethical and Responsible Offshore Operations

Implementing robust ethical guidelines and actively monitoring their effectiveness are essential for responsible offshore operations. This includes establishing clear codes of conduct that address worker rights, environmental protection, and community engagement. Independent audits, conducted by reputable third-party organizations, can provide objective assessments of compliance. Furthermore, fostering open communication channels with stakeholders, including workers, local communities, and NGOs, allows for early identification and resolution of ethical concerns.

Companies should invest in training programs to educate employees on ethical considerations and provide mechanisms for reporting violations. A commitment to transparency and accountability is vital, involving the publication of regular reports detailing progress on ethical initiatives.

Environmental Impact of Offshore Activities

Offshore activities, particularly in sectors like oil and gas extraction and aquaculture, can have significant environmental consequences. Oil spills, habitat destruction, and pollution from waste disposal pose serious threats to marine ecosystems. The extraction of natural resources can lead to biodiversity loss and disruption of delicate ecological balances. Best practices involve the implementation of stringent environmental impact assessments, the adoption of environmentally friendly technologies, and the establishment of robust monitoring and mitigation strategies.

For instance, advancements in renewable energy technologies are leading to a shift away from fossil fuel extraction in offshore environments. However, the environmental footprint of renewable energy projects also needs careful consideration and management.

Social Responsibilities: Onshore vs. Offshore Operations

The social responsibilities of businesses operating onshore and offshore share many similarities but also exhibit crucial differences. Onshore operations are typically subject to more stringent regulations and greater public scrutiny. Offshore, the regulatory environment can be less robust, and oversight may be more challenging. However, the ethical principles underpinning responsible business conduct remain consistent regardless of location.

Companies operating offshore have a responsibility to engage with local communities, respect their cultures, and contribute to their economic development. This includes providing fair wages, investing in local infrastructure, and minimizing the negative social impacts of their operations. The difference lies in the practical challenges of enforcing ethical standards and the level of accountability in different jurisdictions.

Ethical Assessment of Offshore Operations: A Flowchart

The following flowchart Artikels the steps involved in conducting a thorough ethical assessment of offshore operations:[Imagine a flowchart here. The flowchart would begin with “Initiate Ethical Assessment,” branching to “Identify Stakeholders” (workers, communities, environment, etc.), then to “Define Ethical Standards” (based on international norms and company policy), followed by “Conduct Risk Assessment” (identifying potential ethical violations), then “Develop Mitigation Strategies” (actions to reduce risks), then “Implement and Monitor” (put strategies into action and track progress), and finally “Report and Improve” (publish findings and make necessary adjustments).

Each step would have further sub-steps, potentially visualized with additional branching lines within the flowchart.]

Case Studies of Offshore Successes and Failures

Offshore outsourcing, while offering significant potential benefits, also presents considerable risks. Understanding both the triumphs and pitfalls of offshore ventures is crucial for businesses considering this strategy. Examining specific case studies allows for a nuanced understanding of the factors influencing success and failure, highlighting the importance of meticulous planning and robust risk management.

Successful Offshore Ventures: Case Studies

Several companies have successfully leveraged offshore operations to achieve significant growth and cost savings. These successes demonstrate that with careful planning and execution, offshore outsourcing can be a highly effective strategy.

| Company | Industry | Offshore Location | Key Success Factors |

|---|---|---|---|

| Tata Consultancy Services (TCS) | Information Technology | India | Strong domestic talent pool, robust infrastructure, established processes, focus on client relationship management, and continuous improvement initiatives. TCS’s success stems from its ability to scale operations rapidly while maintaining high quality standards. Their investment in training and development has been a key differentiator. |

| Accenture | Management Consulting and IT Services | Multiple locations globally (including India, Philippines, and Eastern Europe) | Strategic location selection based on talent availability and cost-effectiveness, strong project management capabilities, and a focus on building long-term relationships with clients. Accenture’s success highlights the importance of diversification and adaptability in offshore operations. They’ve successfully navigated various economic and political climates. |

| Amazon | E-commerce and Cloud Computing | Multiple locations globally (including India, China, and Ireland) | Leveraging lower labor costs in certain regions for customer service and fulfillment, strategic partnerships with local providers, and a focus on data security and compliance. Amazon’s success emphasizes the need for robust risk mitigation strategies, particularly in areas with differing data privacy regulations. Their global reach allows for better service to diverse customer bases. |

Challenging Offshore Ventures: Case Studies, What Does Offshore Mean

Conversely, numerous companies have faced significant challenges and even failures in their offshore endeavors. These cases illustrate the potential pitfalls and underscore the need for thorough due diligence and proactive risk management.

| Company | Industry | Offshore Location | Key Failure Factors |

|---|---|---|---|

| [Hypothetical Company A] (Illustrative Example) | Manufacturing | Vietnam | Inadequate due diligence regarding local regulations and labor laws, leading to compliance issues and significant fines. Poor communication and cultural differences resulted in project delays and quality control problems. Lack of robust contingency planning for unforeseen circumstances exacerbated the issues. |

| [Hypothetical Company B] (Illustrative Example) | Software Development | Eastern Europe | Underestimation of the time and resources required for effective knowledge transfer and collaboration across geographical boundaries. Difficulties in managing remote teams and ensuring consistent quality of work. Lack of clear communication protocols and project management tools contributed to significant delays and cost overruns. |

| [Hypothetical Company C] (Illustrative Example) | Customer Service | Philippines | Failure to adequately train offshore staff on company-specific procedures and customer service standards. Language barriers and cultural misunderstandings resulted in poor customer satisfaction ratings and increased customer churn. Insufficient oversight and monitoring of offshore operations led to a decline in service quality. |

Analysis of Success and Failure Factors

The case studies highlight the critical role of comprehensive planning and proactive risk management in determining the success or failure of offshore ventures. Successful companies demonstrate meticulous due diligence, robust communication strategies, strong project management capabilities, and a focus on building long-term relationships with offshore partners. Failures, on the other hand, often stem from inadequate planning, poor communication, cultural misunderstandings, insufficient training, and a lack of contingency planning.

The importance of choosing the right offshore location based on factors such as infrastructure, talent pool, regulatory environment, and cost-effectiveness is also evident.

Ultimately, understanding what “offshore” means in a business context requires a holistic view, encompassing financial, legal, ethical, and technological considerations. While the potential benefits of cost savings and global reach are undeniable, businesses must carefully weigh these against the inherent risks and challenges. Thorough planning, robust risk management, and a commitment to ethical practices are paramount for success in the dynamic landscape of offshore operations.

By understanding the nuances Artikeld in this guide, businesses can make informed decisions and navigate the complexities of offshore ventures effectively.