Euro Bank Account: Navigating the world of international finance often requires a robust and reliable banking solution. This comprehensive guide delves into the intricacies of opening, managing, and maximizing the benefits of a Euro bank account, whether you’re a resident or non-resident of the Eurozone. We’ll cover everything from the various account types available and the associated fees to the crucial security measures you need to know to protect your funds.

Understanding the nuances of Euro bank accounts is crucial for individuals and businesses operating within or interacting with the Eurozone. This guide aims to demystify the process, providing clear explanations and practical advice to help you make informed decisions about your financial management within the European Union’s monetary system. From choosing the right account to navigating international transactions, we’ll equip you with the knowledge to confidently manage your finances in Euros.

Opening a Euro Bank Account

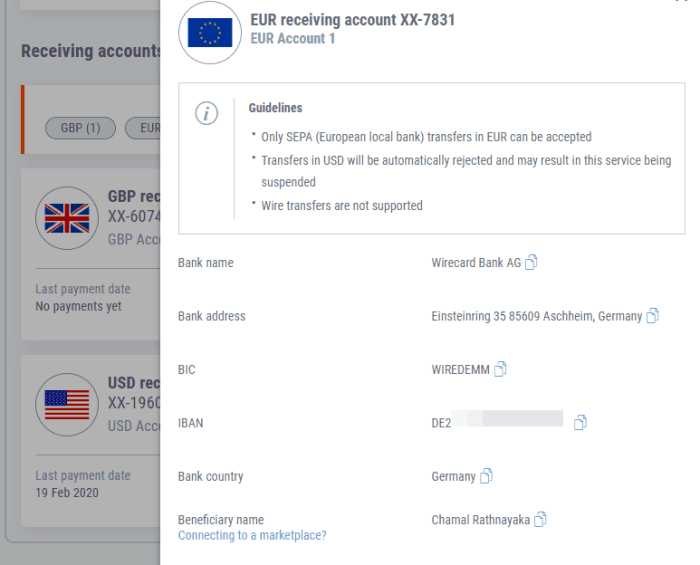

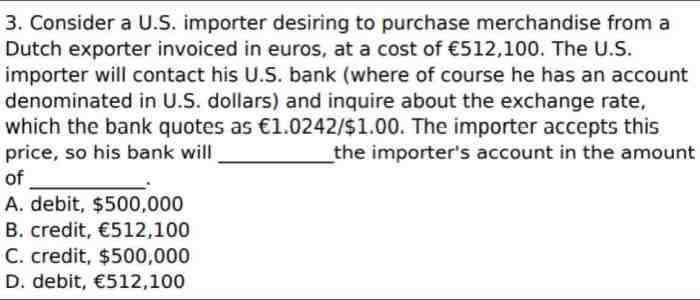

A Euro bank account is a bank account denominated in euros (€), the official currency of the Eurozone. It allows individuals and businesses to conduct financial transactions in euros, providing access to a wide range of banking services within the Eurozone and internationally. These accounts offer a variety of benefits, particularly for those living, working, or conducting business within the Eurozone, or those frequently dealing in euros.Holding a Euro bank account offers several key advantages.

These include the ability to receive and send payments in euros without incurring currency conversion fees, access to a stable and widely accepted currency, and the potential for better interest rates on savings compared to accounts held in some other currencies. Furthermore, a Euro account can simplify international transactions within the Eurozone, reducing complexities and costs associated with cross-border payments.

The account type chosen will impact the specific benefits received.

Types of Euro Bank Accounts

Euro bank accounts are available in various forms, each tailored to different needs and user profiles. The most common types include personal, business, and joint accounts.

| Account Type | Primary User | Key Features | Typical Uses |

|---|---|---|---|

| Personal Euro Account | Individuals | Debit card, online banking, direct debits, savings options | Personal expenses, salary payments, savings |

| Business Euro Account | Businesses, sole traders, freelancers | Online banking, international payment options, merchant services, higher transaction limits | Business transactions, invoicing, payroll, international trade |

| Joint Euro Account | Two or more individuals | Shared access, multiple debit cards, joint ownership | Shared finances, couples, business partnerships |

Choosing the Right Euro Bank Account

Opening a Euro bank account offers numerous benefits, from accessing the Eurozone’s economic stability to facilitating international transactions. However, the sheer number of banks and account types available can make the selection process daunting. Choosing wisely requires careful consideration of several key factors to ensure the account aligns perfectly with your individual needs and financial goals.

Selecting the right Euro bank account is crucial for maximizing efficiency and minimizing costs. A poorly chosen account can lead to unnecessary fees, inconvenient limitations, and ultimately, hinder your financial objectives. This section provides a comprehensive guide to help you navigate this important decision.

Factors to Consider When Selecting a Euro Bank Account

Before embarking on your search, creating a checklist of essential factors will streamline the process and help you make an informed decision. Prioritizing your needs will allow you to quickly eliminate unsuitable options.

- Account Fees and Charges: Analyze monthly maintenance fees, transaction fees (incoming and outgoing), ATM fees, and any other potential charges. Compare these across different banks to identify the most cost-effective option.

- Interest Rates: If you plan to maintain a significant balance, investigate the interest rates offered on deposit accounts. Higher interest rates can significantly improve your returns.

- Account Features and Services: Consider the features offered, such as online banking, mobile banking apps, debit/credit cards, international money transfer capabilities, and customer support availability.

- Minimum Balance Requirements: Check if there are minimum balance requirements to avoid penalties. Some accounts may require a substantial minimum balance to avoid monthly fees.

- Accessibility and Convenience: Evaluate the bank’s branch network, ATM accessibility, and the availability of multilingual customer support. Consider your location and how easily you can access the bank’s services.

- Security Measures: Prioritize banks with robust security measures, including two-factor authentication, fraud protection, and data encryption, to safeguard your funds.

- Regulatory Compliance: Ensure the bank is fully licensed and regulated by the relevant European authorities, guaranteeing the safety and security of your deposits.

Comparison of Euro Bank Accounts

A direct comparison of different banks’ offerings is essential for identifying the best fit. The table below illustrates a simplified comparison; it’s crucial to conduct your own in-depth research based on your specific requirements.

| Bank | Monthly Fee | Transaction Fee (Outgoing SEPA) | ATM Fee (Domestic) | Online Banking | Mobile App |

|---|---|---|---|---|---|

| Example Bank A | €5 | €0 | €0 | Yes | Yes |

| Example Bank B | €0 | €1 | €1.50 | Yes | Yes |

| Example Bank C | €2 | €0.50 | €0 | Yes | Yes |

Note: This table provides illustrative examples only. Actual fees and services can vary significantly. Always check the latest information directly with the respective banks.

Evaluating Bank Reputation and Trustworthiness

Verifying a bank’s reputation and trustworthiness is paramount to protecting your finances. Several methods can help assess a bank’s reliability.

- Check Online Reviews and Ratings: Explore independent review sites and forums to gauge customer experiences and identify any recurring complaints or concerns.

- Examine Financial Stability Ratings: Look for credit ratings from reputable agencies like Moody’s, Standard & Poor’s, or Fitch. Higher ratings indicate greater financial stability.

- Verify Licensing and Regulation: Confirm that the bank is properly licensed and regulated by the relevant European banking authorities. This ensures compliance with stringent financial regulations.

- Assess the Bank’s History and Track Record: Research the bank’s history and track record to identify any past instances of financial instability or regulatory issues.

Decision-Making Flowchart for Selecting a Euro Bank Account

A flowchart can simplify the decision-making process. This visual aid helps systematically evaluate different banks based on your prioritized criteria.

[Imagine a flowchart here. The flowchart would begin with a start node, branching into decisions based on the checklist factors (fees, interest rates, features, etc.). Each decision would lead to either a “yes” or “no” path, ultimately leading to the selection of a bank or a need for further research. The flowchart would visually represent the decision-making process, making it easier to compare different banks based on specific criteria.]

Securing a Euro bank account offers numerous advantages, from streamlined international transactions to access to a stable currency. This guide has provided a roadmap to help you navigate the process effectively, from understanding the different account types and associated fees to implementing robust security measures. Remember, careful planning and research are key to selecting the bank and account that best suit your specific financial needs and goals within the European Union’s financial landscape.

By understanding the intricacies Artikeld here, you can confidently manage your finances and leverage the benefits of operating within the Eurozone.