Numbered Bank Accounts offer a unique level of privacy and security for managing finances. These accounts, unlike traditional accounts, utilize a number instead of the account holder’s name, providing a layer of anonymity beneficial in various situations, from protecting personal assets to managing complex business transactions. Understanding the features, regulations, and potential risks associated with numbered bank accounts is crucial for anyone considering this financial tool.

This guide delves into the intricacies of numbered bank accounts, exploring their definition, functionality, legal aspects, security measures, and practical applications. We’ll compare them to traditional accounts, discuss the level of anonymity they provide, and examine the fees and regulations surrounding their use in different jurisdictions. We aim to provide a clear and comprehensive understanding of this specialized banking service.

Illustrative Examples (No actual images, just descriptive text): Numbered Bank Account

Visual representations of numbered bank account statements and related processes can significantly enhance understanding. These illustrations help clarify the unique features and security measures associated with this type of account. The following descriptions provide detailed accounts of such visuals.

Numbered Bank Account Statement Visual Representation

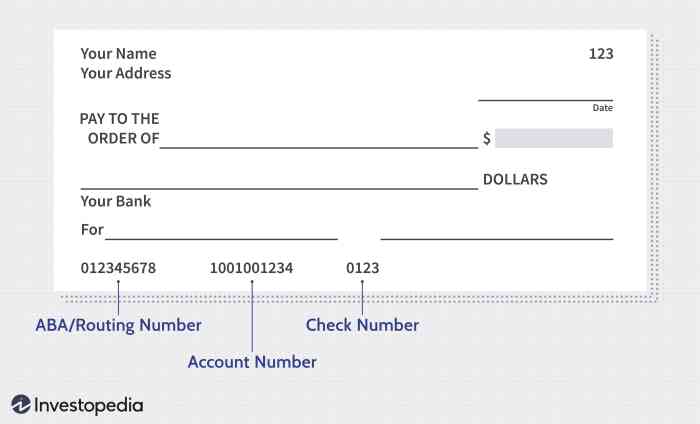

A typical numbered bank account statement would feature a clean, minimalist design, prioritizing security and clarity. The statement would likely use a sans-serif font like Arial or Helvetica for its readability. Key information, such as the account number (displayed discreetly, perhaps partially obscured), transaction history (date, description, debit/credit amount), and account balance, would be prominently displayed in clearly defined sections.

A header would include the bank’s logo and the account holder’s identification details (though possibly limited to a client reference number rather than a name and address). Security features might include watermarks, microprinting, or a unique serial number to prevent forgery. The overall color scheme would be subdued, avoiding bright or attention-grabbing colors to maintain a professional and secure appearance.

The layout would be structured in a tabular format, maximizing space efficiency and ease of data comprehension.

Fund Transfer Process Illustration

A graphic depicting fund transfers into and out of a numbered bank account would show multiple pathways. Arrows would illustrate the flow of money. For incoming funds, the graphic could show options such as wire transfers (depicted with a stylized image of a computer network), electronic transfers (shown with a digital icon), and physical deposits (represented by a bank deposit slip).

Outgoing funds would similarly show options: wire transfers, electronic payments (including online banking platforms and mobile apps), and potentially checks (though less common with numbered accounts for security reasons). Each method would be clearly labeled and visually distinct. The graphic might use different colors to represent different transfer types, further enhancing clarity. The overall tone of the graphic would be professional and informative, avoiding unnecessary embellishments.

Comparison of Numbered Bank Account Types Infographic

An infographic comparing different types of numbered bank accounts would use a tabular format to present key features and fees. Columns might represent different account types (e.g., basic numbered account, premium numbered account, offshore numbered account), while rows would list factors such as account minimum balance, monthly fees, transaction fees (wire transfers, electronic transfers, etc.), and available services (e.g., online banking access, debit card availability).

The infographic would utilize a consistent color scheme and clear visual cues (e.g., color-coding, icons) to highlight key differences between the account types. A legend would clearly define the meaning of each color or icon used. The data presented would be factual and verifiable, sourced from the bank’s official fee schedule or other reliable documentation. The overall design would be visually appealing and easy to understand, even for users with limited financial literacy.

Numbered bank accounts present a compelling solution for individuals and businesses seeking enhanced privacy and security in their financial dealings. While offering significant advantages, understanding the associated legal frameworks and potential risks is paramount. This guide has explored the key aspects of numbered bank accounts, from their definition and functionality to the legal and security considerations involved. By carefully weighing the benefits and drawbacks, individuals and businesses can determine if a numbered bank account aligns with their specific financial needs and risk tolerance.