Offshore Alert: The term evokes images of urgent warnings, complex regulations, and potentially devastating consequences. This exploration delves into the multifaceted world of offshore alerts, examining their diverse interpretations across financial, environmental, and security sectors. We’ll navigate the legal complexities, explore technological advancements in detection and response, and analyze real-world case studies to illuminate the crucial role of proactive risk management in mitigating these global challenges.

Understanding the implications of offshore alerts is paramount for businesses, governments, and individuals alike.

From the subtle shifts in financial markets signaling potential fraud to the catastrophic environmental damage caused by offshore oil spills, the consequences of ignoring or misinterpreting an offshore alert can be far-reaching. This in-depth analysis will equip readers with the knowledge to better understand, anticipate, and respond effectively to a wide range of offshore alerts, fostering a more secure and sustainable future.

Financial Implications of Offshore Alerts

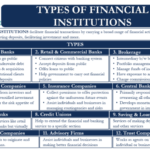

Offshore financial alerts, signaling potentially illicit activities involving offshore entities, carry significant financial implications across various sectors. These alerts can trigger immediate market reactions, impacting investor confidence, asset valuations, and regulatory scrutiny. Understanding the potential ramifications is crucial for businesses operating internationally and for regulators aiming to maintain financial stability.

Impact on Financial Markets

Offshore alerts can cause significant volatility in financial markets. The revelation of suspicious offshore transactions involving a publicly traded company, for instance, can lead to a sharp decline in its stock price as investors react to the perceived increased risk. This effect is amplified if the alert involves large sums of money or suggests systemic issues within the company’s financial structure.

The uncertainty created by such alerts can also discourage investment, impacting overall market liquidity and potentially triggering wider economic repercussions. For example, the Panama Papers leak, which revealed widespread offshore tax evasion, led to significant market fluctuations as investors reassessed the risks associated with various companies and jurisdictions.

Regulatory Responses to Offshore Financial Alerts

Regulatory bodies worldwide respond to offshore financial alerts with varying degrees of intensity, depending on the severity and nature of the suspected illicit activity. These responses often include investigations by financial intelligence units (FIUs), increased scrutiny of involved entities, and potential enforcement actions such as fines or criminal charges. International cooperation is crucial in addressing cross-border financial crimes, leading to joint investigations and information sharing between different regulatory authorities.

The implementation of stricter regulations, such as enhanced due diligence requirements for financial institutions and stricter anti-money laundering (AML) measures, is also a common response to the threat posed by offshore financial activities.

Risk Mitigation Strategies for Companies

Companies can employ various strategies to mitigate risks associated with offshore financial alerts. Robust due diligence processes, including thorough background checks on business partners and thorough screening of transactions, are essential. Implementing a strong compliance program that aligns with international AML/CFT standards is crucial. This involves regular internal audits, employee training on compliance procedures, and the establishment of clear reporting mechanisms for suspicious activities.

Furthermore, maintaining transparent and well-documented financial records significantly reduces the likelihood of attracting unwanted attention from regulators. Proactive engagement with regulatory bodies and a commitment to open communication can also help mitigate reputational damage in the event of an alert.

Hypothetical Scenario: Ignoring an Offshore Financial Alert

Imagine a multinational corporation, “GlobalCorp,” receives an offshore financial alert regarding a significant transaction involving one of its subsidiaries in a tax haven. GlobalCorp ignores the alert, assuming it is a false positive or a minor issue. However, the transaction is later revealed to be part of a larger money laundering scheme. The ensuing investigation exposes GlobalCorp’s negligence in failing to address the alert promptly.

This results in substantial fines, reputational damage leading to loss of investor confidence and market share, potential criminal charges against executives, and ultimately, significant financial losses for the company. The failure to act decisively on the alert transforms a potentially manageable situation into a catastrophic event.

Legal and Regulatory Aspects of Offshore Alerts

Offshore alerts, signaling potential financial crimes or regulatory breaches in offshore jurisdictions, necessitate a thorough understanding of the complex legal and regulatory landscape governing these activities. Navigating this landscape requires knowledge of international treaties, national laws, and the varied approaches different jurisdictions take to enforcement. This section details the key legal frameworks and penalties associated with offshore alerts.

Key Legal Frameworks Governing Offshore Activities Related to Alerts, Offshore Alert

Numerous international and national legal frameworks influence the handling of offshore alerts. International cooperation is crucial due to the transnational nature of many financial crimes. Key frameworks include the OECD’s Common Reporting Standard (CRS), designed to combat tax evasion through automatic exchange of financial account information, and the Financial Action Task Force (FATF) Recommendations, which set international standards for combating money laundering and terrorist financing.

These standards often form the basis for national legislation in various jurisdictions. Specific national laws, such as those related to anti-money laundering (AML) and know-your-customer (KYC) regulations, also play a significant role in investigating and responding to offshore alerts. For example, the USA PATRIOT Act significantly expanded the powers of US authorities to investigate and prosecute financial crimes, including those with offshore connections.

Comparison of Legal Approaches in Different Jurisdictions to Offshore Alerts

Jurisdictions vary considerably in their approaches to offshore alerts. Some, like the United States, have aggressive enforcement mechanisms and extensive extraterritorial reach, actively pursuing individuals and entities suspected of financial crimes regardless of their location. Others may have less robust regulatory frameworks or limited resources for investigation and prosecution. The level of transparency and cooperation between jurisdictions also differs significantly, impacting the effectiveness of investigations and the sharing of information related to offshore alerts.

For instance, jurisdictions with strong banking secrecy laws may present challenges to international investigations, while those with active participation in international information sharing initiatives facilitate more efficient responses to alerts. The European Union, through its AML directives, promotes a more harmonized approach within its member states, but significant differences still exist in enforcement practices.

International Treaties and Agreements Relevant to Offshore Alerts

Several international treaties and agreements play a vital role in addressing offshore alerts. The United Nations Convention Against Corruption (UNCAC), for example, provides a framework for international cooperation in investigating and prosecuting corruption, often involving offshore entities. Tax information exchange agreements (TIEAs) facilitate the exchange of information between tax authorities to combat tax evasion, which frequently utilizes offshore structures.

Multilateral agreements like the CRS further strengthen international cooperation by automating the exchange of financial account information. These treaties and agreements often contain provisions for mutual legal assistance, allowing jurisdictions to request and provide assistance in investigations and prosecutions related to offshore alerts. The effectiveness of these agreements, however, depends on the willingness of participating jurisdictions to actively cooperate and enforce their provisions.

Penalties for Non-Compliance with Offshore Alert Regulations

Penalties for non-compliance with regulations related to offshore alerts vary widely depending on the jurisdiction and the specific violation. These penalties can include substantial financial fines, imprisonment for individuals, and the revocation of licenses for businesses. In some jurisdictions, civil penalties may also be imposed, such as the forfeiture of assets obtained through illegal activities. The severity of penalties often reflects the gravity of the offense and the level of intent.

For instance, knowingly engaging in money laundering through offshore accounts typically carries much harsher penalties than unintentional regulatory breaches. Furthermore, international cooperation can lead to the imposition of penalties in multiple jurisdictions, significantly increasing the consequences of non-compliance.

Ultimately, navigating the complex landscape of offshore alerts requires a multi-pronged approach. Proactive monitoring, robust regulatory frameworks, technological innovation, and a commitment to responsible practices are all crucial elements in mitigating risks and ensuring a safer, more sustainable future. By understanding the diverse interpretations and implications of offshore alerts, we can collectively work towards preventing future crises and building resilience against global challenges.

The case studies presented highlight the importance of swift, informed responses; a proactive stance is not just prudent but essential for safeguarding our shared environment and economic stability.