Offshore Asset Protection Trusts offer a sophisticated strategy for safeguarding assets from various financial and legal risks. This powerful tool allows individuals and families to shield their wealth from creditors, lawsuits, and even divorce proceedings, providing a significant level of financial security. Understanding the intricacies of establishing and managing such a trust is crucial for maximizing its protective capabilities and mitigating potential pitfalls.

This exploration delves into the core concepts of Offshore Asset Protection Trusts, examining the legal frameworks, jurisdictional considerations, and administrative procedures involved. We’ll analyze the various asset protection mechanisms, explore potential risks, and present illustrative case studies showcasing both successful and unsuccessful implementations. By the end, you’ll possess a comprehensive understanding of how these trusts function and whether they align with your specific financial goals.

Definition and Purpose of Offshore Asset Protection Trusts

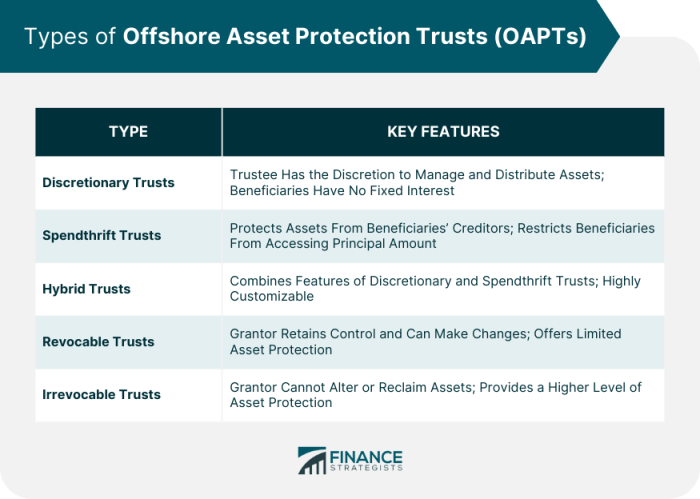

Offshore Asset Protection Trusts (OAPT) are legal entities established in jurisdictions with favorable asset protection laws, designed to safeguard assets from creditors and potential legal liabilities. These trusts operate under a specific legal framework, separating the beneficial ownership of assets from the legal ownership, thus creating a layer of protection. The primary purpose is to preserve wealth and minimize the risk of asset seizure due to unforeseen circumstances, such as lawsuits, divorce proceedings, or business failures.An OAPT achieves its legal and financial objectives through several key mechanisms.

Firstly, it establishes a clear separation between the settlor (the person establishing the trust), the trustee (the entity managing the trust), and the beneficiaries (the individuals who ultimately benefit from the trust assets). This separation shields assets from the settlor’s personal creditors. Secondly, the choice of jurisdiction is crucial; jurisdictions with robust asset protection laws and strong judicial systems offer greater protection.

Finally, the trust document itself, carefully drafted by legal professionals, dictates the terms and conditions under which the assets are managed and distributed, further reinforcing asset protection.

Common Assets Held in Offshore Asset Protection Trusts

Common assets held within OAPTs include real estate, both residential and commercial properties located globally; liquid assets such as stocks, bonds, and mutual funds; valuable collectibles, such as art, antiques, and jewelry; and business interests, including ownership stakes in companies or intellectual property rights. The specific assets held within a trust will depend on the settlor’s individual circumstances and financial goals.

It’s important to note that the inclusion of certain assets might be subject to specific legal considerations and tax implications within the chosen jurisdiction.

Comparison with Other Asset Protection Strategies

OAPTs differ from other asset protection strategies in several key ways. Unlike domestic trusts, which are subject to the laws and jurisdiction of the settlor’s home country, OAPTs benefit from the legal framework of a foreign jurisdiction known for its strong asset protection laws. This offers a higher degree of protection against judgments and legal actions originating in the settlor’s home country.

Compared to holding assets directly in an offshore company, an OAPT offers a more robust layer of protection because the assets are held in trust, further separating them from the settlor’s personal liabilities. Furthermore, unlike strategies such as simply moving assets offshore without the protection of a trust structure, an OAPT provides a formally recognized and legally defined framework for asset protection.

The choice of the most appropriate strategy depends heavily on individual circumstances, risk tolerance, and specific asset protection needs.

Establishing an Offshore Asset Protection Trust requires careful consideration of numerous factors, from jurisdiction selection and trust structure to ongoing administrative responsibilities and potential risks. While offering substantial asset protection, it’s crucial to approach this strategy with informed decision-making, guided by expert legal and financial counsel. The ultimate effectiveness hinges on meticulous planning, proactive management, and a thorough understanding of the legal landscape in the chosen jurisdiction.

Ultimately, a well-structured Offshore Asset Protection Trust can provide invaluable peace of mind, securing your hard-earned wealth for generations to come.