Offshore Interest Rates represent a complex and dynamic aspect of the global financial system. These rates, unlike their onshore counterparts, are influenced by a multitude of international factors, ranging from global economic growth and inflation to geopolitical events and the monetary policies of major economies. Understanding these influences is crucial for investors, businesses, and policymakers alike, as fluctuations in offshore interest rates can significantly impact capital flows, currency exchange rates, and overall economic stability.

This exploration delves into the intricacies of offshore interest rates, examining the key players involved, the factors that drive their fluctuations, and the investment strategies employed to navigate this dynamic market. We’ll analyze the regulatory frameworks in place, discuss the potential risks and rewards associated with offshore interest rate investments, and provide illustrative scenarios to demonstrate their impact on various stakeholders.

Investment Strategies Related to Offshore Interest Rates

Offshore interest rates present unique opportunities for investors seeking diversification and potentially higher returns. Understanding the dynamics of these rates, however, requires a sophisticated approach, considering factors like currency fluctuations and geopolitical risks. Effective strategies leverage interest rate differentials between countries to generate profits, while carefully managing inherent risks.

Interest Rate Differential Arbitrage

This strategy focuses on exploiting differences in interest rates between two or more countries. For example, an investor might deposit funds in a high-yielding offshore account in a country with a significantly higher interest rate than their home country. The profit comes from the interest earned, less any currency exchange losses or transaction costs. Successful implementation requires careful forecasting of currency movements and a thorough understanding of the economic and political stability of the countries involved.

A simple example would be depositing funds in a high-interest-bearing account in a country like Australia (assuming higher rates than the investor’s home country) and converting the returns back to the home currency at the end of the investment term. The success of this strategy hinges on the interest rate differential exceeding any potential currency exchange losses.

Offshore Bond Investments

Investing in offshore bonds issued by foreign governments or corporations can offer exposure to diverse interest rate environments. These bonds, denominated in a foreign currency, offer a fixed income stream with potential for capital appreciation if interest rates fall. However, currency fluctuations can significantly impact the overall return, and credit risk associated with the issuer must be carefully assessed.

For instance, investing in Euro-denominated government bonds issued by a stable European nation could provide a steady stream of income, but the investor needs to consider the potential impact of Euro/USD exchange rate changes on their overall return.

Comparison of Strategies Based on Risk Tolerance and Return Expectations, Offshore Interest Rates

Investment strategies related to offshore interest rates vary significantly in risk and return profiles. High-yield deposit accounts in emerging markets, for example, may offer significantly higher returns than domestic accounts but carry greater currency and political risks. Conversely, investing in highly-rated government bonds from developed countries offers lower returns but significantly reduced risk. An investor with a high-risk tolerance and a long-term horizon might favor emerging market investments, while a conservative investor might prefer lower-risk, developed-market bonds.

The optimal strategy depends entirely on the investor’s individual circumstances and risk appetite.

Risks Associated with Offshore Interest Rate Investments

Several risks are inherent in offshore interest rate investments. These include:

- Currency Risk: Fluctuations in exchange rates can significantly impact the return on investments denominated in foreign currencies. A decline in the value of the foreign currency relative to the investor’s home currency will reduce the overall return.

- Political Risk: Political instability in the country where the investment is made can lead to capital controls, restrictions on repatriation of funds, or even loss of principal.

- Interest Rate Risk: Changes in interest rates can affect the value of fixed-income investments. Rising interest rates can lead to capital losses on bonds.

- Credit Risk: The risk of default by the issuer of bonds or other debt instruments is always present, particularly with lower-rated issuers.

- Liquidity Risk: Some offshore investments may be less liquid than domestic investments, making it difficult to sell them quickly without incurring losses.

Regulation and Oversight of Offshore Interest Rates

The global landscape of offshore interest rates is a complex web of financial activity, requiring robust regulatory frameworks to maintain stability and prevent illicit activities. These frameworks vary significantly across jurisdictions, reflecting differing priorities and levels of financial sophistication. Effective oversight is crucial not only for the integrity of individual markets but also for the broader stability of the international financial system.Regulatory Frameworks Governing Offshore Interest Rate MarketsOffshore interest rate markets are subject to a patchwork of regulations, depending on the location of the financial institution, the type of instrument involved, and the nationality of the parties involved.

Some jurisdictions, known as offshore financial centers (OFCs), have developed comprehensive regulatory regimes, while others rely on a more limited approach. For example, the British Virgin Islands, a prominent OFC, has established regulatory bodies to oversee banking and investment activities, including those involving offshore interest rates. These bodies implement anti-money laundering (AML) and know-your-customer (KYC) regulations, conduct audits, and impose penalties for non-compliance.

Conversely, less regulated jurisdictions may offer greater anonymity but pose a higher risk of financial crime. The level of regulation directly impacts the transparency and stability of the offshore interest rate market within that jurisdiction.

Anti-Money Laundering and Financial Crime Prevention Measures

Preventing money laundering and other financial crimes within the offshore interest rate market requires a multi-faceted approach. This includes stringent KYC procedures, requiring financial institutions to verify the identity and source of funds for all clients. Transaction monitoring systems are also crucial for detecting suspicious activity, flagging large or unusual transactions for further investigation. International standards, such as those set by the Financial Action Task Force (FATF), provide a benchmark for AML/CFT (Combating the Financing of Terrorism) compliance.

Furthermore, many jurisdictions have implemented enhanced due diligence measures for high-risk clients or countries, further strengthening the regulatory framework. Penalties for non-compliance can range from fines to the closure of financial institutions. The effectiveness of these measures depends on the resources and political will of the regulatory authorities involved.

International Cooperation in Regulating Offshore Interest Rate Activities

International cooperation is essential for effectively regulating offshore interest rate markets. The interconnected nature of these markets means that regulatory gaps in one jurisdiction can be exploited by criminals in others. International organizations like the FATF play a crucial role in setting global standards and promoting information sharing between regulatory bodies. Bilateral agreements between countries also facilitate cooperation in investigations and the enforcement of regulations.

However, challenges remain in ensuring consistent enforcement across different jurisdictions, especially when dealing with complex cross-border transactions. Effective international cooperation relies on mutual trust, transparency, and a shared commitment to combating financial crime.

Challenges in Enforcing Regulations in the Offshore Interest Rate Market

Enforcing regulations in the offshore interest rate market presents significant challenges. These include the difficulty of monitoring transactions in jurisdictions with weak regulatory frameworks or limited resources. The use of sophisticated financial instruments and complex corporate structures can make it difficult to trace the flow of funds and identify the beneficial owners. Furthermore, the lack of transparency in some offshore markets hinders effective oversight.

Jurisdictional conflicts can also arise when investigating cross-border transactions, creating delays and hindering enforcement efforts. The constant evolution of financial technology and the emergence of new financial instruments also pose challenges to regulators, requiring continuous adaptation and innovation in their regulatory approaches.

Offshore Interest Rates and Global Economic Stability

Fluctuations in offshore interest rates exert a powerful influence on the global economy, impacting capital flows, investment decisions, and overall financial stability. Understanding this influence is crucial for policymakers and investors alike, as these rates act as a significant lever in the complex machinery of international finance.Offshore interest rates significantly impact global capital flows by influencing the attractiveness of investment in different countries.

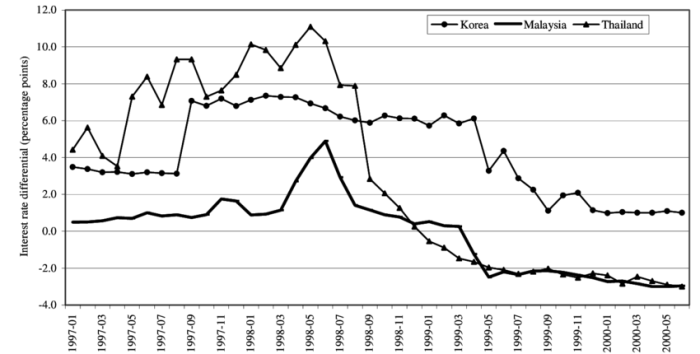

Higher offshore rates tend to draw capital from countries with lower rates, leading to an appreciation of the currency in the high-rate jurisdiction and a depreciation in the low-rate jurisdiction. Conversely, lower offshore rates can stimulate capital outflows, potentially leading to currency devaluation and economic instability in the originating country. This dynamic creates a constant interplay between global capital markets and the policies of individual nations.

Impact of Offshore Interest Rate Fluctuations on Global Capital Flows

Changes in offshore interest rates directly affect the return on investment in different countries. When offshore rates rise, investors seeking higher returns may move their funds to jurisdictions offering these higher yields, increasing capital inflows into those markets. This inflow, in turn, can strengthen the currency of the receiving country and potentially lead to increased economic activity. Conversely, a decline in offshore rates can trigger capital outflows as investors seek better returns elsewhere, potentially weakening the currency and slowing economic growth.

The magnitude of these effects depends on various factors, including the size of the interest rate differential, the overall global economic climate, and the regulatory environment in each country.

Potential for Offshore Interest Rates to Contribute to Financial Instability

The interconnected nature of global financial markets means that fluctuations in offshore interest rates can trigger cascading effects, potentially leading to financial instability. For instance, a sudden and unexpected increase in offshore rates could trigger a rapid outflow of capital from emerging markets, leading to currency crises and debt defaults. This is because many emerging market economies borrow heavily in foreign currencies, and a sharp increase in offshore interest rates makes servicing this debt considerably more expensive, potentially pushing them into insolvency.

This can then have a ripple effect across the global financial system. Similarly, a rapid and unexpected decrease in offshore interest rates could lead to excessive risk-taking and asset bubbles, ultimately leading to market corrections and potential instability.

Historical Examples of Offshore Interest Rates’ Influence on Global Economic Events

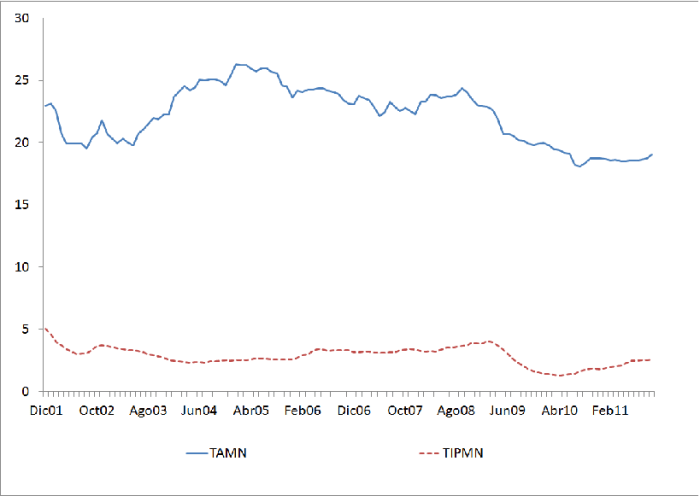

The 1997-98 Asian financial crisis provides a stark example of the destabilizing potential of offshore interest rates. Rising US interest rates attracted significant capital outflows from Asian economies, exposing their vulnerabilities and triggering a series of currency devaluations and financial crises. Similarly, the 2008 global financial crisis was partly fueled by low offshore interest rates in the years leading up to the crisis, which encouraged excessive borrowing and risk-taking, ultimately contributing to the collapse of the housing market and the subsequent global recession.

These events underscore the importance of carefully managing offshore interest rates to mitigate the risk of global financial instability.

Interconnectedness of Offshore Interest Rates and Other Macroeconomic Indicators

Offshore interest rates are intricately linked to other macroeconomic indicators, such as inflation, exchange rates, and economic growth. For example, rising inflation in a major economy might prompt central banks to raise interest rates, impacting offshore rates and potentially leading to capital outflows from other countries. Similarly, changes in exchange rates can influence the attractiveness of offshore investments, creating feedback loops between interest rates, currencies, and overall economic activity.

The complex interplay between these factors necessitates a holistic approach to understanding and managing the impact of offshore interest rates on the global economy. Ignoring these interconnected relationships can lead to unintended consequences and increased financial vulnerability.

Navigating the world of offshore interest rates requires a keen understanding of global economic trends, geopolitical dynamics, and the regulatory landscape. While opportunities for significant returns exist, it’s crucial to carefully assess the associated risks. By comprehending the factors that influence these rates and employing informed investment strategies, stakeholders can effectively manage their exposure and capitalize on the potential benefits within this complex and ever-evolving market.

Ultimately, a proactive approach to understanding offshore interest rates is vital for ensuring financial stability and maximizing investment opportunities in the global economy.