Offshore Shelf Company structures offer intriguing possibilities for businesses seeking strategic advantages. Understanding their legal framework, tax implications, and operational nuances is crucial for navigating this complex landscape. This guide delves into the intricacies of establishing and maintaining an offshore shelf company, providing a comprehensive overview of its benefits, risks, and best practices.

From defining the legal parameters and comparing them to onshore counterparts to exploring popular jurisdictions and navigating the setup process, we’ll unravel the essential elements of offshore shelf company management. We’ll also address critical compliance requirements, financial considerations, and potential pitfalls, equipping you with the knowledge to make informed decisions.

Definition and Purpose of Offshore Shelf Companies: Offshore Shelf Company

Offshore shelf companies, often perceived as mysterious entities, are in reality legally established companies registered in jurisdictions known for their favorable tax regulations and relaxed corporate governance requirements. Understanding their function requires navigating a complex legal landscape and appreciating the strategic motivations behind their creation.Offshore shelf companies are incorporated in a jurisdiction different from where the company conducts its primary business operations.

Their legal definition varies slightly depending on the specific jurisdiction, but generally, they are legitimate entities that comply with the laws of their registration country. Crucially, however, they are often “shelf” companies, meaning they were pre-formed and are ready for immediate acquisition, offering a quicker route to market entry than establishing a company from scratch. This pre-formed status is a key differentiator.

Legal Definition of an Offshore Shelf Company

The legal definition hinges on the jurisdiction of incorporation. Each jurisdiction has its own Companies Act or equivalent legislation governing company formation, registration, and ongoing compliance. Generally, an offshore shelf company is a legally registered entity, complying with the specific laws of its jurisdiction of incorporation, but operating outside of that jurisdiction for business purposes. The crucial aspect is the separation between the place of incorporation and the place of primary business activity.

This separation often results in access to different legal frameworks, tax regimes, and regulatory environments.

Purposes for Establishing an Offshore Shelf Company

The primary purposes for establishing an offshore shelf company often revolve around tax optimization, asset protection, and privacy. Many businesses use them to reduce their overall tax burden by taking advantage of lower corporate tax rates or specific tax treaties available in certain jurisdictions. Asset protection is another key driver, shielding assets from potential legal liabilities or creditors in the company’s home country.

Finally, some companies seek the increased privacy offered by offshore jurisdictions with more lenient disclosure requirements.

Comparison of Offshore Shelf Companies and Onshore Companies

| Feature | Offshore Shelf Company | Onshore Company |

|---|---|---|

| Incorporation | Registered in a jurisdiction different from primary business operations. | Registered in the same jurisdiction as primary business operations. |

| Taxation | Subject to the tax laws of the jurisdiction of incorporation, potentially offering lower tax rates. | Subject to the tax laws of the jurisdiction of operation, typically higher tax rates. |

| Regulation | Subject to the regulations of the jurisdiction of incorporation, potentially less stringent. | Subject to the regulations of the jurisdiction of operation, typically more stringent. |

| Privacy | Potentially offers greater privacy due to less stringent disclosure requirements. | Subject to more stringent disclosure requirements. |

| Asset Protection | May offer enhanced asset protection from creditors and legal liabilities. | Generally offers less asset protection. |

Industries Utilizing Offshore Shelf Companies

Several industries frequently utilize offshore shelf companies for strategic advantages. These include international trade, shipping, finance, and real estate. For instance, a shipping company might register its vessels in a jurisdiction with favorable maritime laws and lower taxes, reducing operational costs. Similarly, international trading companies might utilize offshore structures to optimize tax efficiency on cross-border transactions. Financial institutions sometimes leverage offshore entities for specific financial products or investment strategies.

Real estate developers may use offshore structures for holding properties in different countries, minimizing tax implications and simplifying management.

Jurisdictions Popular for Offshore Shelf Companies

Choosing the right jurisdiction for establishing an offshore shelf company involves careful consideration of various factors, including tax implications, regulatory frameworks, and ease of setup. Several jurisdictions have become popular due to their attractive features for international businesses. This section will analyze five prominent jurisdictions, highlighting their respective tax systems, regulatory environments, and overall ease of incorporation.

Popular Jurisdictions for Offshore Shelf Companies

Five jurisdictions frequently chosen for establishing offshore shelf companies are the British Virgin Islands (BVI), Cayman Islands, Seychelles, Belize, and Nevis. Each offers distinct advantages and disadvantages concerning taxation, regulation, and administrative processes.

Tax Implications in Popular Jurisdictions

The tax implications vary significantly across these jurisdictions. The BVI, Cayman Islands, and Seychelles are known for their zero-corporate tax regimes. This means companies registered in these locations generally do not pay corporate income tax on their profits, regardless of where the profits are earned. However, this does not mean complete tax exemption; certain indirect taxes or other fees might apply.

Belize offers a territorial tax system, meaning only profits sourced within Belize are subject to taxation. Nevis also boasts a low-tax environment with no corporate income tax on foreign-source income. It’s crucial to remember that while these jurisdictions offer favorable tax structures, international tax laws and reporting requirements in the company’s home country must still be adhered to.

Tax planning should always involve professional legal and financial advice.

Regulatory Frameworks Comparison

The regulatory frameworks in these jurisdictions differ in their complexity and stringency. The BVI and Cayman Islands are known for their well-established and transparent legal systems, offering a high degree of legal certainty. Seychelles also maintains a relatively robust regulatory environment. Belize and Nevis generally have less stringent regulatory requirements, leading to a potentially faster and less costly setup process.

However, this can also mean less oversight and potentially higher risks in terms of compliance. The choice of jurisdiction often reflects a balance between the desired level of regulatory scrutiny and the ease of setup.

Comparison of Ease of Setup, Cost, and Regulatory Burden

| Jurisdiction | Ease of Setup | Cost | Regulatory Burden |

|---|---|---|---|

| British Virgin Islands (BVI) | High | Medium-High | Medium |

| Cayman Islands | High | Medium-High | Medium |

| Seychelles | Medium-High | Medium | Medium-Low |

| Belize | High | Low-Medium | Low |

| Nevis | High | Low-Medium | Low |

Setting Up an Offshore Shelf Company

Establishing an offshore shelf company involves a multi-step process requiring careful planning and adherence to legal regulations. The specific requirements vary significantly depending on the chosen jurisdiction, but the general steps and potential pitfalls remain consistent. Understanding these aspects is crucial for ensuring a smooth and compliant setup.

Steps Involved in Establishing an Offshore Shelf Company

The process typically begins with selecting a suitable jurisdiction and then progresses through several key stages. These stages require meticulous attention to detail and often involve professional legal and financial assistance. Failing to adequately address any of these steps can lead to complications and delays.

- Jurisdiction Selection: Choosing a jurisdiction that aligns with your business goals and offers favorable tax and regulatory environments is paramount. Factors such as corporate tax rates, regulatory burdens, and the availability of double taxation treaties should be carefully considered.

- Company Name Selection and Availability Check: The chosen company name must comply with the jurisdiction’s naming conventions and be available for registration. This often involves a search to ensure no conflicts exist with existing registered entities.

- Registered Agent Appointment: Appointing a registered agent is usually mandatory. This agent acts as the official point of contact for legal and administrative communications with the government.

- Preparation and Submission of Incorporation Documents: This stage involves preparing and submitting the necessary documentation, including the Articles of Incorporation or Association, to the relevant registration authority. These documents Artikel the company’s structure, purpose, and regulations.

- Issuance of Certificate of Incorporation: Upon successful completion of the registration process, the jurisdiction’s relevant authority issues a Certificate of Incorporation, officially recognizing the company’s legal existence.

- Opening a Corporate Bank Account: Opening a bank account in the chosen jurisdiction or a reputable international banking center is essential for conducting financial transactions.

Necessary Documentation and Legal Requirements

The specific documentation required varies depending on the chosen jurisdiction, but common requirements include:

- Articles of Incorporation/Association: This foundational document Artikels the company’s structure, purpose, and rules of operation.

- Memorandum of Association (in some jurisdictions): This document details the company’s relationship with its shareholders and the outside world.

- Proof of Identity and Address of Directors and Shareholders: This is essential for compliance with anti-money laundering and know-your-customer (KYC) regulations.

- Registered Office Address: The company must maintain a registered office address within the jurisdiction.

- Nominee Directors and Shareholders (optional but common): Using nominee directors and shareholders can provide added privacy and asset protection.

Common Pitfalls to Avoid During Setup

Inadequate due diligence in choosing a jurisdiction and failing to comply with regulatory requirements are major pitfalls. Rushing the process, neglecting proper legal counsel, and selecting unsuitable service providers can also lead to significant complications. For example, choosing a jurisdiction with strict reporting requirements without understanding the implications can result in unexpected administrative burdens and penalties. Similarly, using unregistered agents or failing to comply with KYC regulations can lead to legal repercussions.

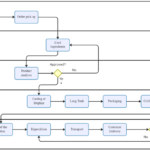

Flowchart Illustrating the Process of Establishing an Offshore Shelf Company

The flowchart would visually represent the steps Artikeld above. It would begin with “Jurisdiction Selection” as the starting point, followed by a series of boxes representing each step, connected by arrows indicating the sequential flow. Decision points, such as “Name Availability Check,” would branch out to “Name Available” and “Name Unavailable,” each leading to the subsequent steps. The final box would be “Certificate of Incorporation Issued,” signifying the successful completion of the process.

The flowchart would provide a clear, concise, and easily understandable visual representation of the entire process.

Legal and Regulatory Compliance

Maintaining legal and regulatory compliance is paramount for offshore shelf companies. Failure to do so can result in severe penalties, reputational damage, and even the dissolution of the company. Understanding and adhering to the specific regulations of the chosen jurisdiction is crucial for long-term operational success. This section Artikels the ongoing compliance requirements, the implications of non-compliance, common regulatory breaches, and essential compliance measures.

Ongoing Compliance Requirements

Offshore shelf companies, despite their often limited operational activity, are still subject to ongoing legal and regulatory obligations. These requirements vary significantly depending on the jurisdiction of incorporation. Common requirements include annual filings, maintaining registered agent services, and adhering to anti-money laundering (AML) and know-your-customer (KYC) regulations. Specific requirements may include submitting annual reports detailing the company’s financial status, directors’ information, and any changes in shareholding.

Furthermore, many jurisdictions mandate regular audits or inspections to ensure compliance with local laws. The precise nature and frequency of these requirements must be carefully researched and adhered to for each specific jurisdiction.

Implications of Non-Compliance

Non-compliance with the regulations governing offshore shelf companies can lead to a range of serious consequences. These can include hefty fines, legal action, and reputational damage. In severe cases, a company’s operating license might be revoked, leading to its immediate closure. The penalties for non-compliance can escalate significantly over time, making proactive compliance a cost-effective strategy in the long run.

Furthermore, non-compliance can expose the company and its directors to personal liability, potentially impacting personal assets. The implications extend beyond financial penalties, as a tarnished reputation can severely hinder future business endeavors.

Examples of Regulatory Breaches and Consequences

Several examples illustrate the potential consequences of non-compliance. For instance, failing to file annual reports on time can result in significant late filing penalties. Non-compliance with AML/KYC regulations, such as failing to properly verify the identities of beneficial owners, can lead to investigations, fines, and even criminal charges. Similarly, engaging in activities prohibited under the jurisdiction’s regulations, such as tax evasion or money laundering, can result in severe legal repercussions, including imprisonment.

A specific case might involve a company failing to maintain a registered agent, resulting in missed legal notices and subsequent penalties. The consequences can vary widely based on the severity and nature of the breach and the jurisdiction’s legal framework.

Essential Compliance Measures

Maintaining a compliant offshore shelf company requires a proactive and organized approach. Essential measures include appointing a qualified registered agent, meticulously maintaining accurate company records, ensuring timely submission of all required filings, and actively monitoring changes in regulations. Regular internal audits can help identify potential compliance gaps and ensure that all procedures align with the applicable laws. Engaging experienced legal and financial professionals familiar with offshore jurisdictions is highly recommended to navigate the complexities of compliance.

Finally, implementing robust internal controls and compliance programs will minimize the risk of regulatory breaches. A well-defined compliance program will include clear guidelines, training for personnel, and regular reviews to ensure effectiveness.

Successfully navigating the world of offshore shelf companies requires careful planning, meticulous execution, and a deep understanding of the legal and financial implications. By weighing the potential benefits against the inherent risks, and adhering to strict compliance standards, businesses can leverage these structures to achieve specific strategic objectives. This guide has provided a foundational understanding, but always seek expert legal and financial advice before embarking on this path.