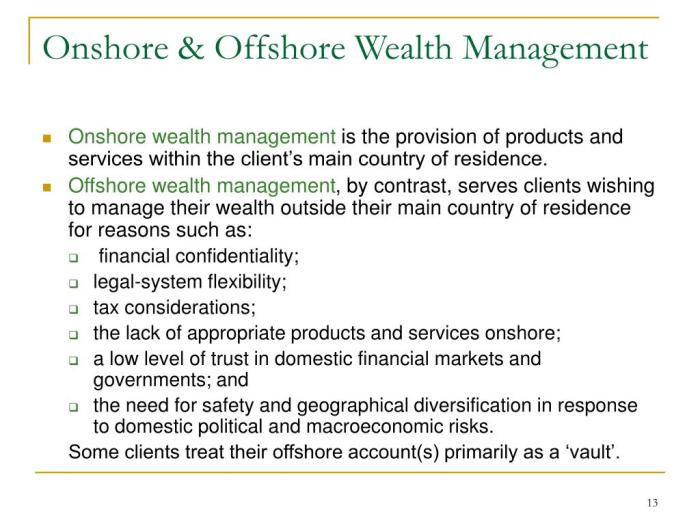

Offshore Wealth Management unveils a world of sophisticated financial strategies, offering high-net-worth individuals and families a pathway to optimize their wealth through international diversification and tax efficiency. This involves strategically positioning assets in jurisdictions with favorable tax laws and robust regulatory frameworks. Understanding the intricacies of offshore wealth management requires careful consideration of various factors, including legal compliance, investment vehicles, and risk mitigation.

This guide delves into the core principles of offshore wealth management, exploring its benefits and risks, suitable investment vehicles, and the crucial aspects of regulatory compliance. We’ll analyze different offshore jurisdictions, comparing their tax regimes and regulatory environments to help you make informed decisions. We also address ethical considerations and the future trajectory of this evolving field.

Benefits and Risks of Offshore Wealth Management

Offshore wealth management, the practice of managing assets in jurisdictions outside one’s country of residence, presents a complex landscape of potential benefits and significant risks. Understanding these aspects is crucial for individuals considering this strategy, as it requires careful planning and expert advice to navigate the legal and financial complexities involved. This section will delve into the key advantages and disadvantages associated with offshore wealth management, providing a balanced perspective to inform decision-making.

Tax Advantages of Offshore Wealth Management

Many individuals utilize offshore jurisdictions to potentially reduce their overall tax burden. This is achieved through leveraging tax treaties, favorable tax rates, and specific investment structures offered in certain countries. For example, some jurisdictions offer lower capital gains taxes or no inheritance taxes, leading to significant savings compared to higher-tax domestic environments. However, it’s crucial to emphasize that tax optimization should always be conducted within the bounds of legal compliance.

Improper utilization of offshore structures can lead to severe penalties, including fines and legal repercussions. Proper due diligence and consultation with qualified tax professionals are paramount.

Asset Protection Benefits of Offshore Jurisdictions

Offshore jurisdictions often provide enhanced asset protection features compared to domestic legal systems. Robust legal frameworks in some locations offer stronger protection against creditors, lawsuits, and even political instability. This can be particularly beneficial for high-net-worth individuals with substantial assets who wish to safeguard their wealth from potential threats. The specific level of protection varies significantly depending on the chosen jurisdiction and the legal structures employed.

For instance, certain jurisdictions offer sophisticated trust structures that provide a higher degree of asset shielding than those available domestically.

Legal and Regulatory Risks of Offshore Wealth Management

The use of offshore structures is not without significant legal and regulatory risks. Navigating the complex international regulatory landscape requires meticulous planning and adherence to all applicable laws. Failure to comply can lead to serious consequences.

- Regulatory Non-Compliance: Violating the tax laws of one’s home country or the regulations of the offshore jurisdiction can result in substantial penalties, including fines, imprisonment, and asset seizure.

- Lack of Transparency and Due Diligence: Choosing opaque jurisdictions or failing to conduct thorough due diligence on financial institutions and intermediaries can expose individuals to fraud and other financial risks.

- Reputational Damage: Association with offshore jurisdictions, even when legitimate, can sometimes attract negative publicity and damage one’s reputation.

- Enforcement Challenges: Recovering assets or resolving disputes in offshore jurisdictions can be complex and time-consuming due to jurisdictional differences and legal complexities.

- Political and Economic Instability: Investing in politically or economically unstable offshore jurisdictions can lead to significant losses due to currency fluctuations, political upheaval, or regulatory changes.

Examples of Offshore Wealth Management Strategies

Successful strategies typically involve a combination of careful planning, diversification, and compliance with all applicable laws. A well-structured offshore trust, for instance, can provide both asset protection and tax efficiency, provided it’s established and managed correctly, in consultation with legal and financial professionals. Conversely, unsuccessful strategies often involve a lack of transparency, non-compliance with regulations, or reliance on poorly researched or unregulated financial institutions.

The collapse of certain offshore investment schemes in the past serves as a cautionary tale of the risks involved in inadequate due diligence and poor planning. For example, the Madoff Ponzi scheme highlights the dangers of investing in unregulated entities, regardless of their offshore location.

Offshore Investment Vehicles: Offshore Wealth Management

Offshore investment vehicles offer a range of options for individuals and entities seeking to diversify their assets and potentially optimize their tax liabilities. The choice of vehicle depends heavily on individual circumstances, risk tolerance, and investment goals. Understanding the nuances of each vehicle is crucial for making informed decisions.

Types of Offshore Investment Vehicles

Several types of offshore investment vehicles cater to diverse needs. These include trusts, foundations, and international business companies (IBCs), each possessing unique characteristics and implications.

Offshore Trusts, Offshore Wealth Management

Offshore trusts are legal entities where a trustee manages assets for the benefit of beneficiaries. The trust deed Artikels the terms and conditions governing the trust’s operation. Trusts offer asset protection, estate planning benefits, and potential tax advantages, depending on the jurisdiction and structure. However, establishing and managing a trust can be complex and expensive, requiring legal and financial expertise.

The level of control retained by the settlor (the person establishing the trust) varies depending on the trust’s structure.

Offshore Foundations

Similar to trusts, offshore foundations are legal entities that hold and manage assets for specific purposes. However, unlike trusts, foundations typically have a more formal structure and are governed by a foundation charter. Foundations offer strong asset protection and are often used for philanthropic purposes or family wealth management. The complexity and cost associated with establishing and maintaining an offshore foundation can be substantial.

Regulations and legal frameworks surrounding foundations vary significantly across jurisdictions.

International Business Companies (IBCs)

IBCs are companies incorporated in offshore jurisdictions known for their favorable tax regulations and minimal regulatory requirements. They are often used for international trade, holding assets, and conducting business activities globally. IBCs provide a degree of confidentiality and can facilitate tax optimization strategies. However, IBCs can attract scrutiny from tax authorities in the investor’s home country, and maintaining compliance with international regulations is crucial to avoid penalties.

The lack of stringent regulatory oversight in some jurisdictions can also present risks.

Comparison of Offshore Investment Vehicles

The suitability of each vehicle varies significantly based on individual investor profiles and objectives. The following table summarizes the key characteristics of each:

| Investment Vehicle | Suitability | Tax Implications | Risk Profile |

|---|---|---|---|

| Offshore Trust | Asset protection, estate planning, tax optimization (depending on jurisdiction and structure). Suitable for high-net-worth individuals and families. | Tax implications vary significantly depending on the jurisdiction of the trust, the residence of the settlor and beneficiaries, and the type of assets held. Careful planning is essential to mitigate tax liabilities. | Moderate to high, depending on the complexity of the trust structure and the jurisdiction’s regulatory environment. |

| Offshore Foundation | Asset protection, philanthropic activities, family wealth management. Suitable for individuals and families with significant assets and long-term wealth preservation goals. | Similar to trusts, tax implications are jurisdiction-dependent and require careful planning. May offer tax benefits in specific circumstances. | Moderate to high, due to the complexity of establishing and managing a foundation. |

| International Business Company (IBC) | International trade, asset holding, business operations. Suitable for businesses operating internationally or seeking to optimize tax liabilities. | Tax implications depend on the jurisdiction of incorporation and the investor’s home country’s tax laws. Potential for tax optimization but also for increased scrutiny. | Moderate to high, depending on the jurisdiction’s regulatory environment and the transparency of the company’s operations. |

Regulatory Compliance and Due Diligence

Navigating the complex landscape of offshore wealth management necessitates a thorough understanding and unwavering commitment to regulatory compliance and robust due diligence procedures. Failure to adhere to international standards can result in significant legal and financial repercussions for both the client and the wealth management firm. This section details the crucial aspects of regulatory compliance and the essential due diligence steps involved in offshore wealth management.The importance of adhering to international regulations cannot be overstated.

These regulations are designed to combat financial crime, including money laundering, terrorist financing, and tax evasion. Key regulations impacting offshore wealth management include the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS). FATCA, enacted by the United States, requires foreign financial institutions to report on US account holders’ assets, while CRS, a global standard, facilitates the automatic exchange of financial account information between participating jurisdictions.

Compliance with these regulations is not merely a matter of avoiding penalties; it’s a fundamental aspect of maintaining ethical and transparent business practices.

FATCA and CRS Compliance

FATCA and CRS necessitate rigorous due diligence procedures to identify and report on US and other relevant jurisdiction’s taxpayers’ accounts. This includes obtaining and verifying client identification information, screening clients against sanctions lists, and accurately reporting account balances and transactions. Non-compliance can lead to significant financial penalties and reputational damage. For instance, a financial institution failing to report under FATCA could face substantial fines and the loss of access to the US financial system.

Similarly, non-compliance with CRS could lead to penalties imposed by participating jurisdictions.

Client Due Diligence Procedures

Effective due diligence is a cornerstone of responsible offshore wealth management. It involves a comprehensive process to verify the identity, source of funds, and intended use of assets by clients. This mitigates risks associated with financial crime and ensures compliance with relevant regulations. The process typically includes identity verification, background checks, source of funds documentation, and ongoing monitoring of client activities.

A Step-by-Step Compliance Process

Establishing and maintaining compliance with relevant regulations requires a structured approach. The following steps Artikel a comprehensive process:

- Client Onboarding and Identification: Thorough verification of client identity using reliable documentation, such as passports and utility bills, is crucial. This includes verifying addresses and beneficial ownership.

- Risk Assessment: A comprehensive risk assessment is performed to identify potential risks associated with the client and their transactions. This assessment helps determine the level of due diligence required.

- Source of Funds and Wealth Documentation: Clients are required to provide documentation outlining the source and legitimacy of their funds. This may include bank statements, tax returns, and other supporting evidence.

- Sanctions Screening: Clients are screened against international sanctions lists to ensure they are not subject to any restrictions or prohibitions.

- Ongoing Monitoring: Continuous monitoring of client accounts and transactions is essential to detect any suspicious activity or deviations from established risk profiles. This includes regular reviews of account activity and updates to client information.

- Reporting and Record Keeping: Maintaining accurate and detailed records of all due diligence procedures and regulatory reporting is vital for audit purposes and demonstrating compliance. This involves securely storing client documentation and transaction records.

- Regular Training and Updates: Staff involved in offshore wealth management must receive regular training on relevant regulations and best practices to ensure ongoing compliance. This includes updates on changes in regulations and evolving compliance requirements.

Successfully navigating the complexities of offshore wealth management demands a thorough understanding of international regulations, diverse investment options, and a proactive approach to risk management. By carefully weighing the potential benefits against inherent risks, and by prioritizing transparency and ethical practices, individuals and families can leverage offshore strategies to achieve their long-term financial goals. This guide serves as a starting point for your journey, encouraging further research and consultation with qualified professionals to create a personalized wealth management plan.