Best Offshore Savings Accounts Interest Rates: Unlocking higher returns on your savings often involves exploring options beyond your domestic market. This comprehensive guide delves into the world of offshore savings accounts, examining the advantages and disadvantages, exploring various account types, and providing a detailed comparison of different jurisdictions. We’ll navigate the complexities of interest rate calculations, currency fluctuations, and the crucial legal and tax implications involved in managing your finances internationally.

From understanding the regulatory environments governing offshore banking to selecting a reputable institution and mitigating potential risks, we’ll equip you with the knowledge to make informed decisions. We’ll analyze key economic indicators influencing interest rates, explore best practices for account selection, and offer a step-by-step guide to opening an offshore savings account. This guide provides illustrative examples, demonstrating how different interest rates and currency fluctuations impact your returns, ensuring you’re well-prepared to navigate this exciting, yet complex, financial landscape.

Understanding Offshore Savings Accounts

Offshore savings accounts offer individuals and businesses the opportunity to deposit funds in banks located outside their country of residence. This practice, while offering potential benefits, also carries inherent risks and requires careful consideration of various factors. Understanding these intricacies is crucial before making a decision.

Advantages and Disadvantages of Offshore Savings Accounts

Offshore savings accounts present a range of potential advantages, including potentially higher interest rates compared to domestic options, enhanced asset protection from creditors or legal actions in the account holder’s home country, and diversification of assets across different jurisdictions. However, disadvantages include potential complications with currency exchange rates, higher fees, stricter regulatory compliance, and potential difficulties accessing funds quickly.

The regulatory environment of the chosen jurisdiction also significantly impacts the overall experience.

Regulatory Environments Governing Offshore Banking

The regulatory landscape for offshore banking varies significantly across jurisdictions. Some countries, like Switzerland and the Cayman Islands, are known for their strict banking secrecy laws and robust regulatory frameworks, offering a high degree of confidentiality. Others, such as Singapore and Hong Kong, prioritize transparency and international cooperation, adhering to stricter anti-money laundering (AML) and know-your-customer (KYC) regulations. The level of regulatory oversight directly impacts the security and stability of the accounts, as well as the ease of access and compliance requirements.

Choosing a jurisdiction with a well-established and reputable regulatory framework is paramount.

Types of Offshore Savings Accounts

Offshore savings accounts are offered in various forms, each with its own characteristics. High-yield accounts typically offer higher interest rates but may come with specific requirements or limitations. Fixed-term accounts provide a guaranteed interest rate for a specified period, offering stability but limiting access to funds until maturity. Other options may include accounts with specific features tailored to individual needs, such as accounts designed for international businesses or those with wealth management services integrated.

The choice depends on individual financial goals and risk tolerance.

Fees Associated with Offshore Savings Accounts

Several fees are typically associated with offshore savings accounts. These can include account opening fees, monthly maintenance fees, wire transfer fees for deposits and withdrawals, and potentially currency conversion fees. Some banks may also charge fees for inactivity or for exceeding certain transaction limits. It’s essential to thoroughly review the fee schedule of any prospective bank before opening an account to avoid unexpected expenses.

These fees can vary significantly depending on the bank and the specific account type.

Comparison of Offshore Banking Jurisdictions

| Jurisdiction | Interest Rates | Taxation | Regulatory Stability |

|---|---|---|---|

| Cayman Islands | Variable, potentially high | Generally tax-neutral | High |

| Switzerland | Moderate to high | Complex tax system, dependent on residency | High |

| Singapore | Competitive | Transparent tax system | High |

| Hong Kong | Competitive | Territorial tax system | High |

Note

Interest rates are subject to change and vary depending on the specific bank and account type. Tax implications are complex and depend on individual circumstances and applicable tax treaties.*

Factors Affecting Interest Rates

Offshore savings account interest rates are influenced by a complex interplay of economic factors, both global and local. Understanding these influences is crucial for investors seeking to maximize their returns. These rates are not static; they fluctuate based on various economic indicators and policy decisions.

Key Economic Indicators Influencing Offshore Interest Rates

Several key economic indicators significantly impact offshore savings account interest rates. These indicators provide insights into the overall health and stability of an economy, influencing investor confidence and, subsequently, interest rates offered by banks. A strong economy typically supports higher interest rates, while a weakening economy may lead to lower rates.

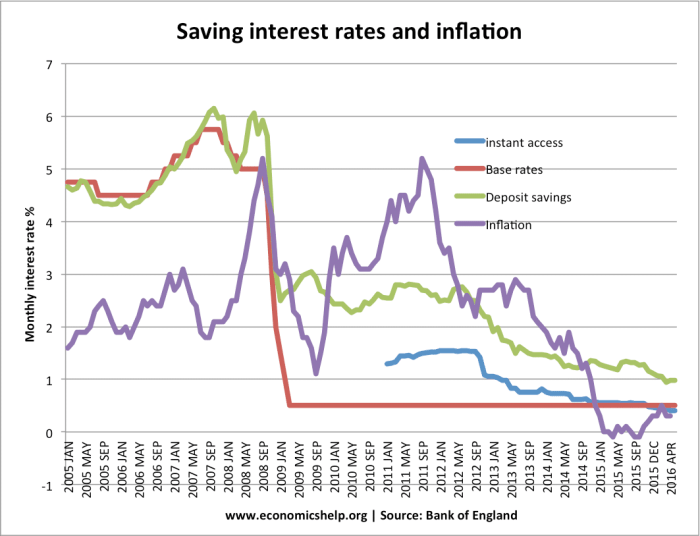

- Inflation Rates: High inflation erodes the purchasing power of money, prompting central banks to increase interest rates to curb inflation. Conversely, low inflation may lead to lower interest rates.

- Unemployment Rates: Low unemployment often indicates a strong economy, potentially leading to higher interest rates. High unemployment, on the other hand, may suggest economic weakness and lower interest rates.

- Economic Growth: Robust economic growth usually correlates with higher interest rates, reflecting investor confidence and increased demand for credit. Slow economic growth or recession may lead to lower rates.

- Government Debt Levels: High levels of government debt can increase borrowing costs, potentially influencing interest rates offered on savings accounts.

Impact of Global Monetary Policy on Offshore Interest Rates

Global monetary policies, particularly those of major central banks like the Federal Reserve (US) and the European Central Bank (ECB), significantly impact offshore interest rates. These policies influence global capital flows and currency exchange rates, directly affecting the interest rates offered by offshore banks.For example, if the Federal Reserve raises interest rates, it can attract capital from other countries, including those with offshore banking centers.

This increased demand for US dollars can lead to higher interest rates offered by banks in those centers to remain competitive and attract deposits. Conversely, a decrease in US interest rates can have the opposite effect.

Currency Exchange Rates and Returns on Offshore Savings Accounts

Currency exchange rates play a crucial role in determining the overall return on offshore savings accounts. The interest earned in a foreign currency must be converted back to the investor’s home currency. Fluctuations in exchange rates can significantly impact the final return.For instance, an investor depositing funds in a high-interest account denominated in Swiss francs (CHF) will see their returns affected by the CHF/USD exchange rate.

If the CHF appreciates against the USD during the investment period, the investor will receive a higher return in USD terms. However, if the CHF depreciates, the return in USD will be lower than initially anticipated, even if the interest rate on the account was high.

Comparison of Interest Rates Offered by Different Offshore Banks

Offshore banks in different jurisdictions offer varying interest rates on savings accounts. These differences are influenced by factors such as the country’s economic conditions, regulatory environment, and the bank’s risk profile. It’s important to note that these rates are constantly changing. A direct comparison requires checking the current rates offered by each bank.

| Country | Bank (Hypothetical) | Interest Rate (Annual, Hypothetical) | Currency |

|---|---|---|---|

| Switzerland | Swiss Bank A | 2.5% | CHF |

| Singapore | Singapore Bank B | 1.8% | SGD |

| Cayman Islands | Cayman Bank C | 1.5% | USD |

Hypothetical Scenario: Interest Rates and Currency Fluctuations

Let’s consider an investor depositing $10,000 USD into two different offshore savings accounts: one in Switzerland (CHF) and one in Singapore (SGD). Scenario 1: The Swiss bank offers 2.5% annual interest on CHF deposits. The initial exchange rate is 1 USD = 0.90 CHF. After one year, the investor earns 225 CHF in interest (10,000 USD

- 0.90 CHF/USD

- 0.025). If the CHF/USD exchange rate remains unchanged, the investor receives approximately $250 USD (225 CHF / 0.90 CHF/USD).

Scenario 2: The Singaporean bank offers 1.8% annual interest on SGD deposits. The initial exchange rate is 1 USD = 1.35 SGD. After one year, the investor earns 243 SGD in interest (10,000 USD

- 1.35 SGD/USD

- 0.018). If the SGD/USD exchange rate remains unchanged, the investor receives approximately $180 USD (243 SGD / 1.35 SGD/USD).

However, if the CHF depreciates to 1 USD = 1.00 CHF during the year, the investor’s return in USD from the Swiss account would be significantly reduced. Conversely, if the SGD appreciates, the investor’s return in USD from the Singaporean account would be increased. This illustrates the importance of considering currency exchange rate risk when investing in offshore savings accounts.

Choosing the Right Account: Best Offshore Savings Accounts Interest Rates

Opening an offshore savings account requires careful planning and due diligence. This process involves understanding your financial goals, researching potential banks, and meticulously completing the necessary paperwork. Making informed decisions at each stage ensures a smooth and successful account opening experience.

Step-by-Step Guide to Opening an Offshore Savings Account

The process of opening an offshore savings account typically involves several key steps. First, identify your financial objectives and research banks offering accounts aligned with those goals. Next, gather the necessary documentation, including proof of identity and address, and complete the application form. Following this, you’ll need to transfer funds into the account, and finally, you should regularly monitor your account activity and statements.

Each step requires attention to detail and adherence to the bank’s specific requirements.

Researching and Selecting a Reputable Offshore Bank

Selecting a reputable offshore bank is crucial for the security and accessibility of your funds. Consider factors such as the bank’s regulatory compliance, financial stability, and the range of services offered. Thorough research, including checking independent reviews and ratings, is vital. Comparing different banks based on their fees, interest rates, and customer service helps identify the best fit for your needs.

Transparency in fees and operations is a key indicator of a reputable institution.

Necessary Documentation and Account Opening Procedures

The specific documentation required varies depending on the bank and your jurisdiction. However, generally, you will need a valid passport or national ID, proof of address (such as a utility bill), and potentially additional documents depending on the amount of money being deposited. The account opening process typically involves completing an application form, providing the necessary documentation, and potentially undergoing a KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance check.

The entire process may take several weeks to complete.

Key Factors to Consider When Comparing Offshore Savings Account Options

Several key factors should be weighed when comparing different offshore savings account options. These include the interest rate offered, the minimum deposit requirements, the accessibility of funds, the fees charged for transactions and account maintenance, and the level of customer service provided. Understanding the tax implications in your home country and the offshore jurisdiction is also essential. Consider the bank’s reputation, security measures, and the ease of communication.

Checklist of Questions to Ask Potential Offshore Banks, Best Offshore Savings Accounts Interest Rates

Before opening an account, it’s advisable to clarify several key aspects with the potential bank. Inquire about the interest rate and its calculation method, the minimum balance requirements, and any associated fees. Clarify the procedures for depositing and withdrawing funds, the security measures in place to protect your account, and the availability of customer support in your preferred language.

Also, confirm the bank’s regulatory compliance and its licensing information. Understanding the tax implications and reporting requirements is also crucial.

Tax Implications and Legal Considerations

Holding funds in offshore savings accounts introduces a layer of complexity regarding tax obligations and legal compliance. Understanding the relevant regulations and potential liabilities is crucial for individuals and entities considering this financial strategy. Failure to comply with reporting requirements can lead to significant penalties and legal repercussions.

Tax Implications for Various Nationalities

The tax implications of holding funds in offshore savings accounts vary significantly depending on an individual’s nationality and the tax laws of their country of residence. Many countries have specific rules governing the reporting and taxation of foreign income, including interest earned on offshore accounts. For example, US citizens are generally required to report all worldwide income, including interest from offshore accounts, on their annual tax returns, regardless of whether the income is taxed in the foreign jurisdiction.

In contrast, some countries may offer tax exemptions or credits for foreign-sourced income, while others may employ a territorial tax system, taxing only income earned within their borders. The specific rules will depend on the relevant tax treaties and domestic tax laws.

Offshore Account Reporting Requirements

Most countries require the reporting of offshore accounts that hold assets above a certain threshold. These reporting requirements often involve filing specific forms with the tax authorities, providing details about the account’s balance, interest earned, and the financial institution holding the account. Failure to report these accounts can result in significant penalties, including back taxes, interest, and even criminal prosecution.

The specific reporting requirements vary greatly depending on the country of residence. For instance, the US Foreign Bank Account Report (FBAR) requires US citizens and residents to report foreign financial accounts with an aggregate balance exceeding $10,000 at any point during the calendar year. Similar reporting requirements exist in other countries, with varying thresholds and reporting procedures.

Risks and Liabilities of Non-Compliance

Non-compliance with offshore account reporting requirements carries substantial risks and liabilities. Penalties can range from significant financial fines to criminal charges, depending on the severity of the violation and the jurisdiction involved. Furthermore, non-compliance can damage an individual’s credit rating and reputation, making it difficult to obtain loans or other financial services in the future. In some cases, non-compliance can even lead to the seizure of assets held in the offshore account.

The potential consequences underscore the importance of meticulous adherence to all relevant reporting requirements.

Impact of Tax Treaties

Tax treaties between countries can significantly affect the taxation of income earned from offshore savings accounts. These treaties often aim to prevent double taxation, ensuring that income is not taxed twice in both the country of residence and the country where the income originates. The specific provisions of a tax treaty will determine how interest earned on an offshore account is taxed, potentially leading to reduced tax liabilities or the elimination of double taxation.

For example, a tax treaty between the US and a particular country might specify that interest earned in that country by a US citizen is only taxed in the US, or that a credit is available to offset taxes paid in the foreign country. Understanding the relevant tax treaties is crucial for determining the appropriate tax reporting strategy.

Determining the Appropriate Tax Reporting Strategy

Determining the appropriate tax reporting strategy for offshore savings accounts requires a careful consideration of several factors, including the individual’s nationality, residency status, the country where the account is held, and the relevant tax treaties. It’s highly recommended to seek professional advice from a qualified tax advisor or financial planner experienced in international taxation. They can help individuals navigate the complex web of regulations and ensure compliance with all applicable laws.

This professional guidance is particularly important for individuals with complex financial situations or those holding assets in multiple jurisdictions. A proactive approach to tax planning can significantly reduce the risks associated with offshore accounts and ensure compliance with all applicable laws.

Illustrative Examples of Offshore Savings Accounts

Understanding the nuances of offshore savings accounts requires examining real-world examples. The following illustrates three distinct offshore account options, highlighting their unique features, potential returns, and associated costs. Remember that interest rates and fees are subject to change, and it’s crucial to consult the provider directly for the most up-to-date information.

Example 1: High-Yield Account with a Global Bank

This example focuses on a high-yield savings account offered by a large, internationally recognized bank. These accounts often prioritize competitive interest rates but may have higher minimum deposit requirements and potentially higher fees.Minimum Deposit Requirement: $100,000 USDInterest Rate Structure: Variable interest rate, currently at 4.5% per annum, compounded monthly. The rate is subject to change based on prevailing market conditions and the bank’s internal policies.Associated Fees: A monthly maintenance fee of $25 USD applies.

Wire transfer fees may apply depending on the origin and method of deposit.Hypothetical Scenario: Let’s assume a $100,000 deposit. In a stable economic climate with consistent interest rates, the account would yield approximately $4,500 in interest annually, after deducting the $300 annual maintenance fee. However, if interest rates decrease to 3.5%, the annual interest would drop to $3,500 (after fees), highlighting the impact of market fluctuations on returns.

Conversely, an increase in interest rates to 5.5% would yield approximately $5,500 (after fees).

Example 2: Fixed-Term Deposit with an Offshore Bank in a Tax-Haven Jurisdiction

This option involves a fixed-term deposit with a bank located in a jurisdiction known for its favorable tax regulations. These accounts usually offer a fixed interest rate for a specified period, providing predictable returns but limiting accessibility to funds.Minimum Deposit Requirement: $50,000 USDInterest Rate Structure: Fixed interest rate of 3.8% per annum for a 2-year term, compounded annually. The rate is guaranteed for the duration of the term.Associated Fees: No monthly maintenance fees.

Early withdrawal penalties may apply, typically equivalent to a percentage of the accrued interest.Hypothetical Scenario: A $50,000 deposit locked in for two years at 3.8% would yield approximately $3,800 in interest over the term. This return remains consistent regardless of market fluctuations during the two-year period. However, if funds are needed before the maturity date, the early withdrawal penalty could significantly reduce the overall return.

For example, a 1% penalty on accrued interest would reduce the net interest earned by $38.

Example 3: Multi-Currency Account with an International Broker

This example features a multi-currency account offered by an international brokerage firm. These accounts offer flexibility in managing multiple currencies but may have more complex fee structures.Minimum Deposit Requirement: $25,000 USDInterest Rate Structure: Interest rates vary depending on the currency held. For example, USD might earn 2.5% per annum, while EUR might earn 3% per annum. Rates are variable and subject to market conditions.Associated Fees: Transaction fees apply for currency conversions.

Inactivity fees may also apply if the account remains dormant for an extended period.Hypothetical Scenario: With a $25,000 USD deposit earning 2.5% interest, the account would yield approximately $625 annually. If a portion of the funds is converted to EUR at a specific exchange rate and earns 3%, the overall return would depend on the exchange rate fluctuations and the amount converted.

The impact of transaction fees on the overall profitability should also be considered. If the market conditions worsen and the interest rates decrease, the return would be proportionally lower. Conversely, an increase in interest rates would lead to higher returns.

Successfully navigating the world of offshore savings accounts requires careful consideration of various factors, from interest rates and currency fluctuations to tax implications and regulatory compliance. By understanding the advantages and disadvantages, diligently researching potential institutions, and prioritizing security and risk mitigation, you can effectively leverage offshore savings accounts to potentially optimize your financial returns. Remember, thorough due diligence and professional financial advice are crucial for making informed decisions tailored to your specific circumstances.