International Online Bank Account: Navigating the world of global finance can feel daunting, but the right online banking solution can transform your experience. This guide unravels the complexities of international online bank accounts, exploring their benefits, security considerations, and how to choose the perfect fit for your needs, whether you’re a frequent traveler, a global business owner, or simply seeking enhanced financial flexibility.

We’ll delve into the nuances of offshore accounts, multi-currency options, and the crucial role of regulatory compliance.

From understanding the key features that differentiate international accounts from domestic ones to navigating the intricacies of fees and charges, this comprehensive resource equips you with the knowledge to make informed decisions. We’ll also examine real-world examples, showcasing both the advantages and potential pitfalls of international online banking, helping you avoid common mistakes and maximize the benefits.

Choosing the Right International Online Bank: International Online Bank Account

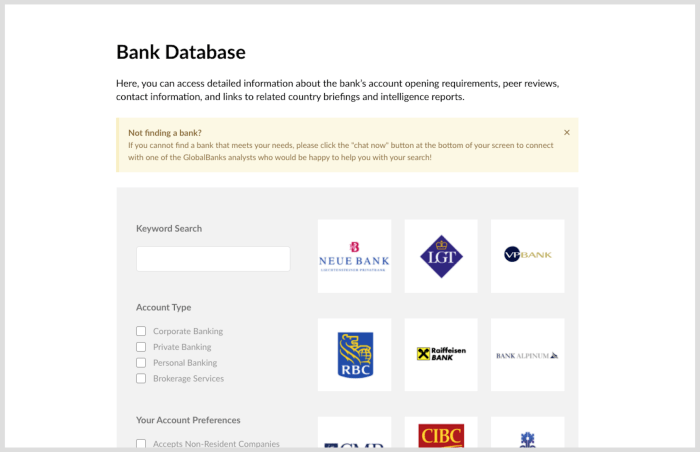

Opening an international online bank account offers numerous benefits, from managing finances across borders to accessing competitive exchange rates. However, the sheer number of providers available can make choosing the right one a daunting task. Careful consideration of several key factors is crucial to ensure the selected bank aligns perfectly with your individual needs and financial goals.

Factors to Consider When Selecting an International Online Bank

Selecting an international online bank requires a thorough assessment of your specific requirements. Key considerations include the bank’s security measures, the range of services offered, the associated fees, and the quality of customer support. A strong emphasis should be placed on understanding the regulatory environment the bank operates within, ensuring compliance with international financial regulations and data protection laws.

Furthermore, evaluating the bank’s user interface and overall user experience is vital for seamless account management.

Comparison of Services and Features Offered by Different Providers

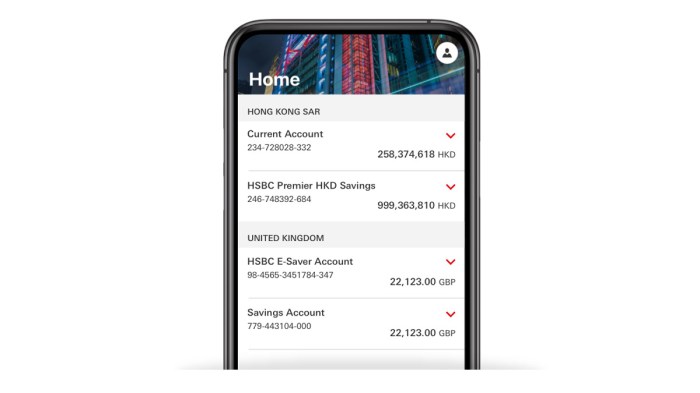

International online banks offer a diverse range of services and features, catering to various customer profiles and financial needs. Some providers specialize in offering low fees and basic banking services, while others provide more comprehensive packages including investment options, currency exchange services, and international money transfers. A key differentiator lies in the availability of mobile banking apps, offering convenient account access and management on the go.

The availability of multilingual customer support and the breadth of supported currencies are also crucial factors to consider, ensuring ease of use and accessibility for international customers. Consider the specific features you require, such as debit cards, credit cards, international money transfer capabilities, and investment platforms, and compare the offerings of various banks accordingly.

International Online Bank Comparison

The following table compares five international online banks, highlighting their key features, associated fees, and customer support options. Note that fees and features can change, so always verify the most up-to-date information on the bank’s official website.

| Bank Name | Key Features | Fees | Customer Support |

|---|---|---|---|

| Wise (formerly TransferWise) | Low-cost international money transfers, multi-currency accounts, debit card | Transaction fees vary depending on the transfer amount and currency; some account maintenance fees may apply. | Email, phone, and online help center. |

| Revolut | Multi-currency accounts, international money transfers, debit card, travel insurance options | Fees vary depending on the plan chosen; free plans have limitations on features and transfer amounts. | In-app chat, email, and social media support. |

| N26 | Multi-currency accounts, debit card, mobile-first banking experience | Fees vary depending on the plan chosen; some plans offer free ATM withdrawals. | In-app chat and email support. |

| Payoneer | Mass payment solutions for businesses, global payment services | Fees vary depending on the service used; typically charges for receiving and sending payments. | Email, phone, and online help center. |

| Monese | Multi-currency accounts, debit card, international money transfers | Fees vary depending on the plan chosen; some plans offer free ATM withdrawals. | In-app chat, email, and phone support. |

Regulatory Compliance and Legal Aspects

Navigating the world of international online banking necessitates a thorough understanding of the complex legal and regulatory landscape. This involves awareness of diverse jurisdictional laws, varying standards of compliance, and the potential ramifications of non-compliance. Understanding these aspects is crucial for both the bank and the customer to ensure secure and legally sound financial transactions.International online banking operates within a framework of national and international regulations designed to prevent financial crime and protect consumers.

These regulations vary significantly across countries, creating a complex web of rules and requirements that institutions and individuals must navigate. Failure to comply can result in severe penalties, including hefty fines, legal action, and reputational damage. The core principles underpinning these regulations focus on transparency, accountability, and the prevention of illicit activities.

Know Your Customer (KYC) and Anti-Money Laundering (AML) Regulations

Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are cornerstones of international financial regulation. KYC procedures require banks to verify the identity of their customers, gathering sufficient information to understand their business activities and assess their risk profile. AML regulations aim to prevent the use of the banking system for money laundering, terrorist financing, and other illicit activities.

These regulations mandate robust due diligence processes, including customer screening, transaction monitoring, and suspicious activity reporting. For example, a bank might require identification documents, proof of address, and information about the source of funds for high-value transactions. Non-compliance can lead to significant fines and legal repercussions for both the bank and the customer. The implementation of robust KYC/AML programs is essential for maintaining the integrity of the financial system.

Tax Laws and Reporting Requirements for International Accounts

International banking accounts often involve cross-border transactions that trigger tax implications in multiple jurisdictions. Customers must understand and comply with the tax laws of their country of residence and any other relevant jurisdictions. This includes reporting income earned from interest, dividends, or other investments held in the account. Failure to accurately report foreign income can lead to significant tax penalties and legal consequences.

The complexity of international tax laws necessitates professional tax advice for individuals and businesses with international accounts. For example, the US Foreign Account Tax Compliance Act (FATCA) requires foreign financial institutions to report information about US account holders to the Internal Revenue Service. Similarly, the Common Reporting Standard (CRS) facilitates the automatic exchange of financial account information between participating countries.

These regulations highlight the importance of transparency and accurate reporting in international finance.

Customer Support and Accessibility

The seamless operation of an international online bank hinges significantly on the quality and accessibility of its customer support. A robust support system is crucial not only for resolving issues but also for fostering trust and loyalty among a diverse international clientele. Effective communication and readily available assistance are paramount to a positive user experience.International online banks typically offer a multi-channel approach to customer support, recognizing the varying preferences and technological capabilities of their global user base.

This approach ensures that assistance is accessible regardless of location or technological proficiency.

Customer Support Channels

International online banks generally provide a range of customer support channels designed to cater to diverse customer needs and preferences. These commonly include email support, offering a written record of the interaction; live chat, providing immediate assistance for quick queries; and telephone support, ideal for complex issues requiring detailed explanations. Some banks also leverage social media platforms for initial contact and simpler inquiries, offering a more informal and readily accessible point of contact.

The availability and responsiveness of each channel are key indicators of the bank’s commitment to customer service. A well-designed support system integrates these channels seamlessly, allowing customers to easily switch between them as needed. For instance, a customer might start with a live chat for a quick question, then switch to email to follow up on a more detailed request.

Multilingual Support and Accessibility for International Customers

Providing multilingual support is not merely a convenience; it’s a necessity for international online banks. Customers are far more likely to trust and utilize a banking platform if they can communicate in their native language. Offering support in multiple languages significantly reduces language barriers, enabling customers to easily understand terms and conditions, navigate the platform, and resolve any issues they may encounter.

This includes not only the language of the interface but also the language of customer support agents. For example, a bank operating in Europe might offer support in English, French, German, Spanish, and Italian, reflecting the linguistic diversity of its customer base. The absence of multilingual support can lead to frustration, misunderstandings, and ultimately, lost customers.

Impact of Accessibility on Customer Experience

Accessibility is a crucial factor influencing the overall customer experience with an international online bank. A well-designed, accessible platform ensures that all users, regardless of their abilities, can easily access and use the bank’s services. This includes features such as screen reader compatibility for visually impaired users, keyboard navigation for users with motor impairments, and clear, concise language that is easy to understand.

An accessible platform promotes inclusivity and fosters a positive customer experience, while an inaccessible platform can create frustration, exclusion, and potentially legal issues. For example, a bank failing to provide adequate accessibility features might face legal action from customers with disabilities. Moreover, positive reviews and word-of-mouth referrals are often linked to a positive user experience, which in turn directly impacts the bank’s reputation and customer acquisition.

Conversely, negative experiences due to poor accessibility can damage a bank’s reputation and lead to customer churn.

Illustrative Case Studies

Real-world experiences with international online banking services offer valuable insights into both the advantages and potential drawbacks. Examining both positive and negative case studies provides a balanced perspective, helping prospective users make informed decisions. This section presents two contrasting experiences to illustrate the spectrum of possibilities.

Positive Experience: Streamlined Global Transactions with Wise

This case study details a positive experience using Wise (formerly TransferWise), an international money transfer service also offering multi-currency accounts. A freelance graphic designer based in the US, needing to regularly receive payments from clients in Europe and Asia, found traditional banking methods cumbersome and expensive. High transfer fees and unfavorable exchange rates significantly impacted their earnings. Switching to Wise provided a solution.

The platform offered transparent, low-cost international transfers, with exchange rates clearly displayed before confirmation. The multi-currency account allowed them to hold and manage funds in various currencies, avoiding conversion fees each time a payment was received. The user-friendly interface and mobile app facilitated easy tracking of transactions and managing their finances across borders. The overall experience was characterized by speed, efficiency, and significant cost savings compared to traditional banking.

The ability to receive payments in local currencies minimized losses due to currency exchange fluctuations, resulting in a substantial increase in their net income.

Negative Experience: Challenges with a Smaller International Bank, International Online Bank Account

Conversely, a different user encountered difficulties with a smaller, lesser-known international online bank. This individual, a small business owner operating an e-commerce store, opened an account to facilitate international transactions and receive payments from overseas customers. Initial setup was straightforward, but problems arose later. The bank’s customer support proved inadequate, with long wait times and unhelpful responses to inquiries.

The online platform lacked features offered by larger institutions, making transaction management complex. Further complicating matters, the bank experienced several periods of system downtime, hindering access to funds during critical moments. A significant issue arose when a large payment was delayed due to a technical glitch, causing a disruption to the business’s cash flow and resulting in late payments to suppliers.

While the issue was eventually resolved after numerous calls and emails, the experience highlighted the potential risks associated with smaller, less established international banks, emphasizing the importance of due diligence before selecting a provider. The lack of readily available customer support and the system instability demonstrated the need for thorough research and consideration of a bank’s reliability and technological infrastructure.

Successfully managing your finances across borders requires careful planning and a thorough understanding of the landscape. By weighing the advantages against the potential risks, and by choosing a reputable international online bank that aligns with your specific requirements, you can unlock a world of financial opportunities. This guide has armed you with the essential knowledge to confidently navigate the complexities of international online banking and make informed decisions that support your financial goals.

Remember to prioritize security, stay informed about regulations, and always choose a provider with robust customer support.