Offshore High Interest Savings Accounts offer a compelling alternative to traditional savings, promising higher returns and potential tax advantages. However, navigating this landscape requires understanding the intricacies of international banking, regulatory differences, and potential risks. This exploration delves into the key features, benefits, and drawbacks of offshore high-interest savings accounts, equipping you with the knowledge to make informed decisions.

This guide examines the factors influencing interest rates, including global economic conditions and the specific regulations of the chosen jurisdiction. We’ll compare the offerings of various countries, analyze the accessibility and management of these accounts, and delve into the crucial aspects of tax implications and legal compliance. Furthermore, we’ll assess the inherent risks involved and provide strategies for mitigating them, including effective currency risk management techniques.

Understanding Offshore High-Interest Savings Accounts

Offshore high-interest savings accounts offer individuals and businesses the opportunity to earn higher returns on their deposits than may be available domestically. These accounts are held in banks or financial institutions located outside of an individual’s country of residence, and they present a unique set of considerations regarding regulation, accessibility, and risk. Understanding the nuances of these accounts is crucial for making informed financial decisions.

Key Features of Offshore High-Interest Savings Accounts

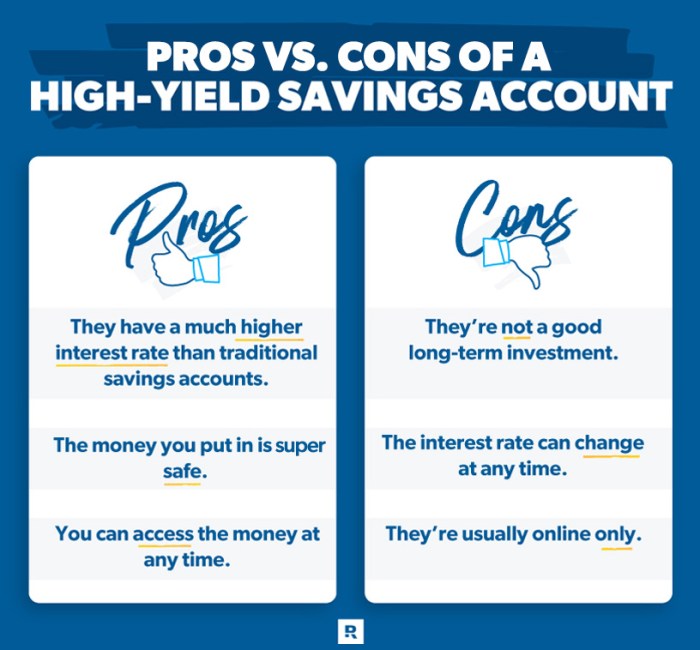

Offshore high-interest savings accounts typically share several key features, though specific offerings vary significantly depending on the jurisdiction and financial institution. Common characteristics include higher interest rates compared to domestic options, varying levels of accessibility, and different regulatory environments. Account holders should carefully consider the implications of these features before opening an account. Some accounts may offer additional services, such as currency exchange options or international wire transfer capabilities.

However, these services may come with additional fees.

Regulatory Differences Between Offshore and Domestic Savings Accounts

A primary distinction between offshore and domestic savings accounts lies in the regulatory frameworks governing them. Domestic accounts are subject to the regulations of the account holder’s home country, which typically includes deposit insurance schemes protecting funds up to a certain limit. Offshore accounts, conversely, fall under the jurisdiction of the country where the bank is located. These regulations may differ significantly, potentially offering less stringent oversight or different levels of depositor protection.

Understanding the regulatory landscape of the chosen jurisdiction is paramount. This includes considering the stability of the banking system and the strength of the legal framework protecting depositors.

Interest Rate Comparisons: Offshore vs. Domestic Markets

Interest rates offered on offshore high-interest savings accounts often exceed those available in many domestic markets. The precise difference varies depending on global economic conditions, the specific country offering the account, and the prevailing interest rate environment. For instance, during periods of low interest rates in developed economies, offshore accounts in emerging markets might offer significantly higher returns.

However, it’s crucial to remember that higher interest rates often correlate with higher levels of risk. A thorough comparison of interest rates from reliable sources is essential before making any investment decisions. Consider comparing rates from various banks in different countries to identify the best options for your specific needs.

Examples of Countries Offering Offshore High-Interest Savings Accounts

Several countries are known for offering offshore high-interest savings accounts. These include, but are not limited to, countries in the Caribbean, such as the Bahamas and Barbados, and certain jurisdictions in Europe and Asia. The attractiveness of these locations often stems from their stable political environments, favorable tax regimes, and established banking sectors. However, potential investors should carefully research the specific regulations and risks associated with each jurisdiction before making a decision.

It’s important to note that the perceived benefits of these accounts should be carefully weighed against the associated risks and potential complexities.

Comparative Analysis of Offshore Savings Accounts

The following table compares the features of offshore high-interest savings accounts from three hypothetical countries (Country A, Country B, and Country C). Note that these are illustrative examples, and actual rates and conditions may vary significantly depending on the specific financial institution and prevailing market conditions. Always consult official sources for the most up-to-date information.

| Feature | Country A | Country B | Country C |

|---|---|---|---|

| Interest Rate (Annual) | 4.5% | 6.0% | 3.8% |

| Minimum Deposit | $10,000 | $25,000 | $5,000 |

| Account Fees (Annual) | $50 | $100 | $25 |

| Accessibility | Online and Branch | Online Only | Online and Branch |

Accessibility and Account Management

Opening and managing an offshore high-interest savings account involves a specific set of procedures and considerations. Understanding these processes is crucial for maximizing the benefits and mitigating potential risks associated with these accounts. This section details the steps involved, the necessary documentation, potential challenges, security measures, and common account management platforms.Accessing and managing offshore high-interest savings accounts requires careful planning and adherence to specific procedures.

The process often involves navigating international regulations and understanding the unique features of the chosen financial institution.

Account Opening Procedures

Opening an offshore high-interest savings account typically begins with identifying a reputable financial institution in a jurisdiction that offers favorable tax and regulatory environments. This usually involves researching various banks and comparing their interest rates, fees, and account features. The application process then involves completing an application form, providing supporting documentation, and undergoing a due diligence process to verify identity and financial background.

This process can vary significantly depending on the chosen bank and the jurisdiction. For example, some banks may require video verification, while others may request physical documentation mailed to their offices.

Required Documentation

To open an offshore high-interest savings account, individuals will generally need to provide a range of documentation to verify their identity and financial standing. This commonly includes a valid passport or national ID card, proof of address (such as a utility bill or bank statement), and information about the source of funds. Some institutions may also request tax identification numbers, references, and financial statements to assess the applicant’s risk profile.

The level of scrutiny can vary significantly depending on the bank’s anti-money laundering (AML) and know-your-customer (KYC) policies, as well as the jurisdiction’s regulatory framework. Failure to provide complete and accurate documentation can lead to delays or rejection of the application.

Challenges in Accessing Funds

Accessing funds held in offshore accounts can present certain challenges. These challenges may include potential delays in wire transfers due to international banking regulations and the need for currency conversions. Additionally, some jurisdictions may impose restrictions on the frequency or amount of withdrawals. Understanding these potential limitations is crucial before opening an account. For example, a sudden need for large sums of money might be difficult to meet if the account is subject to significant withdrawal restrictions or lengthy processing times.

Security Measures

Offshore high-interest savings accounts typically employ robust security measures to protect customer funds and information. These measures often include advanced encryption technologies to safeguard online transactions and data, multi-factor authentication protocols for account access, and fraud monitoring systems to detect and prevent unauthorized activity. Regular security audits and compliance with international security standards are also common practices among reputable offshore banks.

The specific security features will vary depending on the institution and the chosen account type.

Account Management Platforms

Many offshore banks offer online banking platforms that allow customers to manage their accounts remotely. These platforms typically provide features such as account balance viewing, transaction history tracking, fund transfers, and customer support access. Some institutions may also offer mobile banking apps for convenient account management on the go. Examples of such platforms may include proprietary systems developed by the individual banks or integration with third-party financial management software.

The user experience and features offered can vary widely depending on the bank and its technological capabilities.

Tax Implications and Legal Considerations: Offshore High Interest Savings Accounts

Offshore high-interest savings accounts, while offering attractive returns, present complex tax and legal implications that require careful consideration. Understanding these implications is crucial for minimizing potential liabilities and ensuring compliance with both domestic and international regulations. Failure to do so can result in significant financial penalties and legal repercussions.

Tax Implications of Offshore High-Interest Savings Accounts

The tax implications of holding money in offshore high-interest savings accounts vary significantly depending on your country of residence and the specific account structure. Generally, interest earned on these accounts is considered taxable income in your home country, even if the account is held in a jurisdiction with lower or no taxes on interest income. Tax treaties between countries may influence how this income is taxed, but ultimately, you’re responsible for declaring and paying taxes on it in your country of residence.

This often involves completing specific tax forms and providing detailed information about your offshore accounts. Failure to declare this income can lead to substantial penalties, including back taxes, interest, and even legal action.

Legal Requirements and Regulations Associated with Offshore Accounts

Various legal requirements and regulations govern the establishment and operation of offshore high-interest savings accounts. These regulations vary significantly depending on the country where the account is held. Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are universally applied, requiring stringent identity verification and reporting procedures. These measures aim to prevent the use of offshore accounts for illicit activities.

Furthermore, countries may impose reporting requirements for residents holding offshore accounts, demanding detailed information about the account’s balance and transactions. Transparency and compliance are paramount, as non-compliance can lead to severe penalties. It’s crucial to thoroughly research and understand the specific regulations of the jurisdiction where you intend to open an account.

Potential Risks and Liabilities Associated with Offshore Banking

Offshore banking, while potentially lucrative, carries inherent risks and liabilities. These include the risk of fraud, the loss of principal due to bank failures or currency fluctuations, and the difficulties in resolving disputes with foreign financial institutions. The distance and jurisdictional differences can complicate legal recourse in case of problems. Furthermore, the regulatory environment in some offshore jurisdictions may be less stringent than in developed countries, leading to increased risks.

Understanding these risks and implementing appropriate safeguards is essential before engaging in offshore banking.

Examples of Varying Tax Implications

Consider two individuals: Alice, a US citizen holding an offshore account in a tax haven with no tax treaty with the US, and Bob, a UK citizen holding an offshore account in a country with a comprehensive tax treaty with the UK. Alice will be fully responsible for paying US taxes on the interest earned, regardless of the tax situation in the account’s location.

Bob, on the other hand, might benefit from reduced tax burdens due to the tax treaty, potentially leading to a more favorable tax treatment of his interest income. These examples highlight the significant impact that jurisdiction and tax treaties can have on the overall tax liability.

Steps to Comply with Tax Regulations Related to Offshore Accounts, Offshore High Interest Savings Accounts

The following flowchart illustrates the essential steps for complying with tax regulations related to offshore accounts:[Flowchart Description: The flowchart would visually represent a sequence of steps. It would begin with “Opening an Offshore Account,” branching into “Declare Account to Tax Authorities” and “Maintain Accurate Records of Transactions.” “Declare Account to Tax Authorities” would lead to “File Necessary Tax Forms,” which would then lead to “Pay Taxes on Interest Earned.” “Maintain Accurate Records of Transactions” would lead to “Prepare for Audits.” Both “Pay Taxes on Interest Earned” and “Prepare for Audits” would lead to a final box stating “Maintain Compliance.”]

Ultimately, the decision to utilize offshore high-interest savings accounts involves careful consideration of individual financial goals, risk tolerance, and a thorough understanding of the associated legal and tax implications. While the potential for higher returns is attractive, diligent research and professional financial advice are crucial to ensure a secure and profitable outcome. By weighing the benefits against the potential risks, you can determine if this financial strategy aligns with your overall investment strategy.