Offshore Trust Accounts offer a powerful tool for wealth preservation and asset protection, shielding assets from various legal and financial risks. Understanding the intricacies of offshore trusts, however, requires navigating complex legal and jurisdictional landscapes. This guide delves into the key aspects of establishing, managing, and leveraging the benefits of offshore trust accounts, providing a clear and comprehensive overview for those seeking to understand this sophisticated financial instrument.

From defining the fundamental characteristics and purposes of offshore trusts to exploring the legal frameworks of various popular jurisdictions, we’ll examine the crucial elements involved in establishing and managing these accounts. We’ll also address the inherent risks and discuss strategies for mitigating them, ensuring a balanced perspective on this complex financial strategy. The information provided aims to equip readers with the knowledge necessary to make informed decisions regarding the use of offshore trust accounts.

Definition and Purpose of Offshore Trust Accounts

Offshore trust accounts are legal entities established in a jurisdiction different from the settlor’s (the person establishing the trust) country of residence. They function as a vehicle for holding and managing assets, offering various benefits related to asset protection, tax optimization, and estate planning, often with a focus on confidentiality. These trusts are governed by the laws of the jurisdiction where they are established, not the settlor’s home country.Offshore trust accounts differ fundamentally from onshore trusts primarily in their location and the legal frameworks governing them.

The choice of offshore jurisdiction is often driven by specific legal and tax advantages offered by that jurisdiction, such as favorable inheritance laws, robust asset protection statutes, or lower tax rates on trust income. The increased complexity associated with managing an offshore trust compared to an onshore trust often necessitates the use of specialized legal and financial professionals.

Characteristics of Offshore Trust Accounts

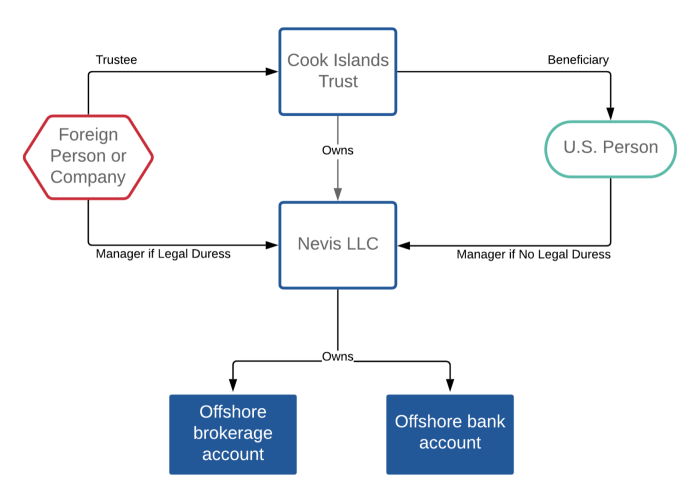

Offshore trust accounts are characterized by several key features. They involve a settlor who transfers assets to a trustee, who manages those assets according to the terms Artikeld in the trust deed. Beneficiaries are the individuals or entities who ultimately benefit from the trust assets. Crucially, the separation of legal ownership (the trustee) and beneficial ownership (the beneficiaries) provides a layer of asset protection.

Confidentiality is often a significant draw, with many jurisdictions offering strict privacy laws surrounding offshore trust structures. However, it’s important to note that the level of confidentiality varies considerably between jurisdictions, and international regulations are increasingly scrutinizing such structures. Transparency and compliance with international standards are therefore crucial considerations.

Purposes of Establishing Offshore Trust Accounts

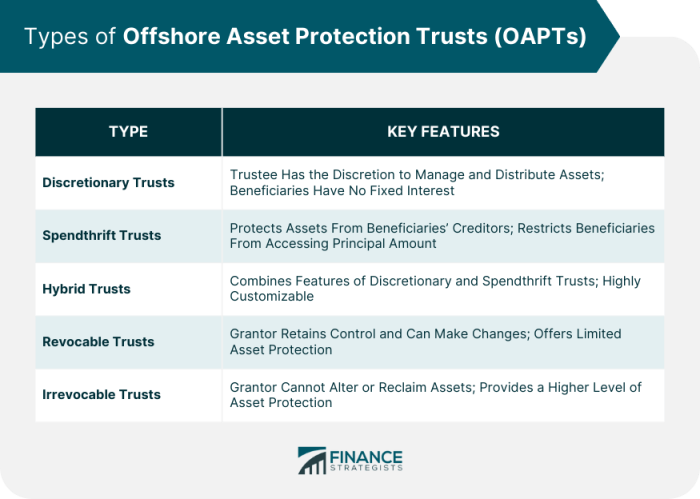

Offshore trusts serve a variety of purposes, tailored to the individual needs and circumstances of the settlor. Common objectives include asset protection from creditors or lawsuits, minimizing inheritance taxes, managing assets across borders, facilitating estate planning for complex family situations, and providing for the financial well-being of beneficiaries. For high-net-worth individuals with significant international assets, offshore trusts can provide a centralized and efficient mechanism for managing their wealth across different jurisdictions.

Strategic asset allocation and tax optimization are also key drivers in the decision to establish an offshore trust.

Comparison of Offshore and Onshore Trust Accounts

While both offshore and onshore trusts involve the transfer of assets to a trustee for the benefit of beneficiaries, their key differences lie in jurisdiction and legal frameworks. Onshore trusts are governed by the laws of the settlor’s home country, offering greater simplicity and familiarity with the legal processes involved. Offshore trusts, conversely, are subject to the laws of a foreign jurisdiction, potentially offering advantages in terms of asset protection, tax efficiency, and privacy.

However, this also introduces greater complexity in terms of administration, legal compliance, and potential regulatory scrutiny. The choice between an onshore and offshore trust depends heavily on the settlor’s specific circumstances, financial goals, and risk tolerance.

Examples of Assets Held in Offshore Trusts

A wide range of assets can be held within offshore trusts. Common examples include real estate holdings in multiple countries, publicly traded stocks and bonds, privately held company shares, intellectual property rights, valuable collections (art, antiques), and bank accounts. The specific types of assets held will depend on the settlor’s portfolio and the objectives of the trust. The trustee is responsible for managing and investing these assets according to the terms of the trust deed and in the best interests of the beneficiaries.

Diversification of assets across different jurisdictions and asset classes is a common strategy within offshore trust structures.

Jurisdiction and Legal Framework: Offshore Trust Accounts

Choosing the right jurisdiction for an offshore trust is crucial, as it significantly impacts the legal protection afforded to the settlor and beneficiaries, as well as the tax implications. The legal framework of each jurisdiction dictates the rules governing trust creation, administration, and eventual distribution of assets. Careful consideration of these factors is essential for establishing a successful and legally sound offshore trust.

Key Offshore Trust Jurisdictions and Their Legal Frameworks

Several jurisdictions have established themselves as popular choices for establishing offshore trusts. These jurisdictions generally offer attractive legal frameworks, including robust asset protection laws, sophisticated trust legislation, and a stable political and economic environment. The specific legal framework varies significantly between jurisdictions, influencing the choice for specific circumstances. Factors like the settlor’s residency, the beneficiaries’ locations, and the nature of the assets held in trust all play a role in jurisdiction selection.

Tax Implications and Regulations in Popular Jurisdictions

Tax implications are a major consideration when establishing an offshore trust. Different jurisdictions have varying tax regimes that affect the trust’s income, capital gains, and distributions to beneficiaries. Some jurisdictions offer tax exemptions or favorable tax rates for offshore trusts, while others impose significant taxes. Understanding the tax implications in the chosen jurisdiction is critical for tax planning and compliance.

Professional tax advice is often necessary to navigate the complexities of international tax law.

Legal Protections for Beneficiaries and Settlors, Offshore Trust Accounts

Offshore trusts often provide significant legal protection for both settlors and beneficiaries. The level of protection varies depending on the jurisdiction and the specific terms of the trust deed. Many jurisdictions offer strong asset protection laws, shielding trust assets from creditors and lawsuits. This protection can be particularly important for high-net-worth individuals or those facing potential legal challenges.

The specific legal protections offered include things like creditor protection, confidentiality provisions, and clear rules regarding trust administration.

Comparative Analysis of Offshore Trust Jurisdictions

The following table compares four popular jurisdictions for offshore trusts, highlighting key aspects of their legal frameworks, tax implications, and regulatory bodies. It’s important to note that this information is for general understanding and should not be considered exhaustive legal advice. Specific legal and tax advice should always be sought from qualified professionals.

| Jurisdiction | Tax Rates (Example – May Vary) | Legal System | Regulatory Body |

|---|---|---|---|

| British Virgin Islands (BVI) | Generally no direct taxation on trusts | Common Law | Financial Services Commission (FSC) |

| Cayman Islands | No direct taxation on trusts | Common Law | Cayman Islands Monetary Authority (CIMA) |

| Cook Islands | No direct taxation on trusts | Common Law | Financial Supervisory Commission (FSC) |

| Bermuda | Tax rates vary depending on the type of trust and income; may offer exemptions | Common Law | Bermuda Monetary Authority (BMA) |

Establishing and managing an offshore trust account requires careful consideration of numerous factors, including jurisdiction selection, asset protection strategies, and ongoing compliance with international regulations. While offshore trusts offer significant benefits in terms of wealth preservation and asset protection, understanding the potential risks and complexities is paramount. By thoroughly researching and understanding the legal frameworks and implications involved, individuals and families can make informed decisions that align with their specific financial goals and risk tolerance, ultimately leveraging the power of offshore trusts for long-term financial security.