Setting Up An Offshore Account can seem daunting, a realm of complex regulations and financial intricacies. But understanding the process, from choosing the right jurisdiction to navigating the account opening procedures, is crucial for individuals and businesses seeking international financial diversification, asset protection, or tax optimization. This guide unravels the complexities, offering a clear roadmap to navigate this often-misunderstood world of offshore finance.

We’ll explore the various types of offshore accounts, compare key jurisdictions, and delve into the essential steps involved in establishing and managing your account securely and compliantly.

This comprehensive guide demystifies the process of setting up an offshore account, covering everything from understanding the different types of accounts available and the benefits and drawbacks of each, to choosing the right jurisdiction, navigating the account opening process, and managing your account securely and compliantly. We’ll examine the tax implications, discuss potential risks, and provide illustrative examples of how offshore accounts can be utilized in various scenarios.

By the end, you’ll have a clearer understanding of whether an offshore account is right for you and how to proceed if it is.

Understanding Offshore Accounts

Offshore accounts, held in banks or other financial institutions outside an individual’s or company’s country of residence, offer a range of financial strategies. Understanding their complexities, however, requires careful consideration of various factors, including the legal and tax implications involved. This section will explore the different types of offshore accounts, their advantages and disadvantages, and a comparison of popular offshore banking jurisdictions.

Types of Offshore Accounts

Several types of offshore accounts cater to diverse financial needs. These include traditional bank accounts offering basic deposit and withdrawal services, investment accounts facilitating access to international markets, and trust accounts providing asset protection and estate planning solutions. More specialized accounts, such as those designed for international trade or holding precious metals, also exist. The choice of account type depends largely on individual financial goals and risk tolerance.

Benefits and Drawbacks of Offshore Accounts

Establishing an offshore account presents both potential benefits and drawbacks. Benefits can include asset protection from legal claims or political instability in one’s home country, access to a wider range of investment opportunities, and potential tax advantages (though this is highly dependent on individual circumstances and applicable tax treaties). Drawbacks, however, include increased complexity in managing finances across borders, higher account maintenance fees, and potential regulatory scrutiny depending on the jurisdiction and the account holder’s activities.

Compliance with all relevant reporting requirements is crucial to avoid legal penalties.

Regulatory Environments of Offshore Jurisdictions

Offshore jurisdictions vary significantly in their regulatory environments. Some, like those in the Caribbean or the British Crown Dependencies, are known for their established financial sectors with relatively lenient regulatory frameworks, attracting international investors. Others may have stricter regulations and higher levels of transparency, aligning with international standards to combat money laundering and tax evasion. Understanding the specific regulatory framework of a chosen jurisdiction is paramount before establishing an offshore account.

The level of transparency, the strength of anti-money laundering (AML) and know-your-customer (KYC) regulations, and the overall stability of the jurisdiction are key factors to consider.

Comparison of Offshore Banking Jurisdictions

The following table compares key features of four popular offshore banking jurisdictions. It is important to note that these are general comparisons, and specific regulations and fees can vary depending on the individual bank and account type. Always conduct thorough due diligence before choosing a jurisdiction.

| Jurisdiction | Taxation | Fees | Account Minimums |

|---|---|---|---|

| Cayman Islands | No direct taxation on personal income or corporate profits; tax treaties with various countries may apply. | Vary widely depending on the bank and account type; expect higher fees compared to domestic banks. | Can range from a few thousand to hundreds of thousands of dollars, depending on the account type and bank. |

| British Virgin Islands (BVI) | No direct taxation on personal income or corporate profits; tax treaties may apply. | Similar to Cayman Islands, with fees varying significantly. | Similar range to Cayman Islands, depending on account type and bank. |

| Switzerland | Complex tax system with both federal and cantonal taxes; tax treaties with many countries. Strict banking secrecy laws are weakening under international pressure. | Fees vary depending on the bank and account type; generally higher than in some Caribbean jurisdictions. | Generally higher minimums than in Caribbean jurisdictions, often in the tens of thousands of dollars or more. |

| Singapore | Territorial tax system; taxes only income sourced within Singapore. Known for its robust regulatory framework and transparency. | Fees vary depending on the bank and account type; competitive with other major financial centers. | Minimums vary depending on the bank and account type; generally higher than some Caribbean jurisdictions but lower than Switzerland. |

Choosing a Jurisdiction: Setting Up An Offshore Account

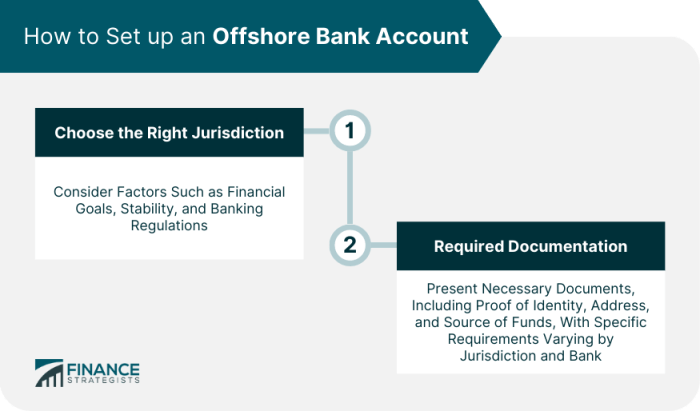

Selecting the right jurisdiction for your offshore account is a crucial decision with significant long-term implications for your finances and legal standing. The optimal location depends on a complex interplay of factors, requiring careful consideration of legal frameworks, tax regimes, and the overall stability of the financial center. A well-informed choice can lead to substantial benefits, while a poor one can expose you to unnecessary risks and complications.

Factors to Consider When Selecting a Jurisdiction

Several key factors influence the suitability of a jurisdiction for an offshore account. These include the jurisdiction’s legal and regulatory environment, its tax system, its political and economic stability, and the availability of banking and other financial services. Ignoring any of these aspects can lead to unforeseen challenges. A thorough assessment is paramount.

Legal and Tax Implications of Jurisdiction Selection

The legal framework of a chosen jurisdiction significantly impacts account management and asset protection. Some jurisdictions offer robust asset protection laws, shielding assets from creditors and legal claims. Others may have stricter reporting requirements or limitations on the types of assets held offshore. Tax implications are equally critical. Tax treaties between your home country and the chosen jurisdiction will determine your tax liability.

Understanding these implications is crucial for compliance and minimizing tax burdens. For example, some jurisdictions offer favorable tax rates for specific types of income or investments, while others may have stricter regulations concerning tax transparency. Failure to fully understand the tax ramifications could lead to severe penalties.

Reputation and Stability of Offshore Financial Centers

The reputation and stability of an offshore financial center are paramount. Reputable jurisdictions maintain strict regulatory standards, combating money laundering and promoting transparency. These jurisdictions often have a long history of providing secure and reliable financial services. Conversely, jurisdictions with questionable reputations may lack robust regulatory oversight, increasing the risk of fraud and instability. Choosing a well-established financial center with a strong regulatory framework significantly mitigates these risks.

For instance, jurisdictions like Switzerland and the Cayman Islands are known for their strong regulatory frameworks and financial stability, attracting significant international investment. In contrast, jurisdictions with a history of financial instability or lax regulatory enforcement should be avoided.

Decision-Making Flowchart for Jurisdiction Selection, Setting Up An Offshore Account

A structured approach is essential for navigating the complexities of jurisdiction selection. The following flowchart Artikels a systematic process:[Imagine a flowchart here. The flowchart would begin with a “Start” box, followed by a series of decision points represented by diamonds. These diamonds would present choices such as: “High Asset Protection Needed? (Yes/No)”, “Favorable Tax Regime Required?

(Yes/No)”, “Strong Regulatory Framework Important? (Yes/No)”, “Political and Economic Stability a Priority? (Yes/No)”. Each “Yes” or “No” answer would lead to different branches of the flowchart, eventually leading to a final decision box showing a selection of suitable jurisdictions based on the answers provided. The flowchart would visually represent the decision-making process, helping individuals systematically evaluate different jurisdictions based on their individual needs and priorities.]

Managing Your Offshore Account

Successfully managing an offshore account requires a proactive approach to security, monitoring, and risk mitigation. This involves understanding the unique challenges associated with international banking and implementing robust strategies to protect your assets and maintain compliance. Failing to do so can lead to significant financial and legal consequences.Proactive account management minimizes risks and maximizes the benefits of offshore banking.

Regular monitoring and adherence to best practices are crucial for maintaining the integrity and security of your funds.

Secure Account Management Best Practices

Effective offshore account management hinges on a multi-layered security approach. This includes choosing a reputable financial institution with robust security protocols, utilizing strong passwords and multi-factor authentication, and regularly reviewing account statements for any unauthorized activity. Furthermore, understanding the jurisdiction’s regulations and maintaining meticulous records of all transactions is vital for compliance and dispute resolution. Ignoring these aspects can leave your assets vulnerable to fraud or legal complications.

Account Monitoring and Reconciliation

Regular account monitoring and reconciliation are essential for detecting anomalies and preventing potential losses. This involves comparing bank statements with personal records of all transactions, identifying any discrepancies promptly, and contacting the bank immediately to investigate any suspicious activity. Automated reconciliation tools can streamline this process, but manual review remains crucial for identifying subtle irregularities. For instance, a consistently small discrepancy might indicate a skimming operation, while a large, unexpected transaction could signal a fraudulent activity.

Offshore Banking Risk Mitigation Strategies

Minimizing risks associated with offshore banking requires a comprehensive strategy. This includes diversifying your assets across multiple institutions and jurisdictions to reduce exposure to single-point failures, employing robust cybersecurity measures, and maintaining detailed records of all transactions and communications with the bank. Understanding and complying with all relevant tax and regulatory requirements in both your home jurisdiction and the offshore jurisdiction is also paramount.

Failure to do so can lead to severe penalties. For example, a company might choose to spread its funds across multiple banks in different jurisdictions, reducing the impact of any single institution’s failure or regulatory change.

Security Measures to Protect Your Offshore Account

Implementing robust security measures is paramount to safeguarding your offshore account.

- Utilize strong, unique passwords and enable multi-factor authentication (MFA) for all online banking access.

- Regularly review account statements for unauthorized transactions or suspicious activity.

- Keep your personal information, including passwords and account details, confidential and secure.

- Avoid using public Wi-Fi or unsecured networks to access your offshore account.

- Be cautious of phishing scams and other fraudulent attempts to obtain your account information.

- Choose a reputable and well-regulated financial institution with a proven track record of security.

- Regularly update your contact information with the bank to ensure timely communication.

- Consider employing professional financial advisors experienced in offshore banking to assist with account management and risk mitigation.

Establishing an offshore account requires careful consideration of numerous factors, from legal and tax implications to security and risk mitigation. While the potential benefits, such as asset protection and international financial diversification, are significant, it’s crucial to approach the process with informed decision-making and a commitment to full compliance with all relevant regulations. This guide has provided a framework for understanding the key aspects involved.

Remember to seek professional financial and legal advice tailored to your specific circumstances before making any decisions. Thorough research and expert guidance are essential for navigating the complexities of offshore banking successfully and minimizing potential risks.