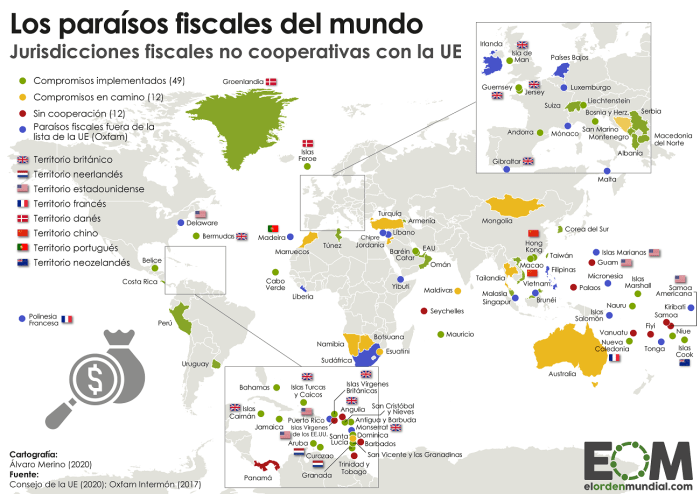

Offshore Countries represent a complex landscape of financial centers, tax havens, and low-regulation jurisdictions. These entities play a significant role in global finance, attracting businesses seeking advantages in taxation, regulation, and operational costs. Understanding the multifaceted nature of offshore jurisdictions requires examining their economic impact, legal frameworks, and ethical implications, all within the context of international trade and investment flows.

This exploration delves into the historical evolution, current practices, and future trends shaping this dynamic sector.

From the historical development of offshore financial centers to the contemporary challenges posed by tax avoidance and money laundering, we’ll analyze the intricate web of advantages and disadvantages associated with operating in these locations. We will explore case studies of successful and unsuccessful business ventures, providing insights into the factors that contribute to their outcomes. The impact of technological advancements, such as blockchain and cryptocurrency, on the future of offshore finance will also be considered.

Ethical and Social Implications

The utilization of offshore jurisdictions for financial activities raises significant ethical and social concerns. While offering potential benefits like reduced tax burdens and regulatory flexibility, the opacity surrounding these operations frequently facilitates illicit activities and creates imbalances in global economic fairness. Understanding the ethical dilemmas and societal impacts is crucial for developing effective regulatory frameworks and promoting responsible international finance.The ethical concerns surrounding offshore financial centers are multifaceted and deeply rooted in issues of fairness, transparency, and accountability.

Tax avoidance, facilitated by complex offshore structures, deprives governments of vital revenue needed for public services like healthcare, education, and infrastructure. This disproportionately affects developing nations with limited tax bases, exacerbating existing inequalities. Furthermore, the lack of transparency in offshore financial transactions creates an environment ripe for money laundering, enabling criminal organizations to conceal the proceeds of their illegal activities and undermining the rule of law.

The potential for corruption further compounds these issues, eroding public trust in institutions and hindering economic development.

Tax Avoidance and Money Laundering

Offshore jurisdictions are often criticized for their role in facilitating tax avoidance and money laundering. Sophisticated legal structures, coupled with lax regulatory environments in some offshore centers, allow individuals and corporations to shift profits to low-tax jurisdictions, minimizing their tax liabilities in their home countries. This practice deprives governments of substantial tax revenue, hindering their ability to provide essential public services and potentially widening the gap between the rich and the poor.

Similarly, the lack of transparency and robust due diligence procedures in some offshore jurisdictions makes them attractive havens for money launderers, who can easily conceal the origins of illicit funds through complex financial transactions. The resulting damage to the global financial system and the erosion of public trust are substantial. Examples of high-profile cases involving the use of offshore accounts for tax evasion and money laundering regularly appear in the news, highlighting the severity of the problem.

The Panama Papers and the Pandora Papers leaks, for example, exposed the widespread use of offshore structures by wealthy individuals and corporations to evade taxes and conceal assets.

Social and Economic Impacts

Offshore activities have significant social and economic consequences for both developed and developing nations. Developed nations often experience revenue losses due to tax avoidance, leading to reduced public spending and potential pressure on social welfare programs. Developing countries, however, face even more severe consequences. The loss of tax revenue can hinder their ability to invest in essential infrastructure, education, and healthcare, perpetuating cycles of poverty and inequality.

Furthermore, the influx of illicit money through money laundering can destabilize economies, fueling corruption and undermining the rule of law. This can lead to social unrest and political instability, further hindering economic development. The concentration of wealth in offshore accounts also exacerbates global income inequality, creating a disparity between those who can exploit these systems and those who bear the brunt of the consequences.

Potential Solutions

The negative consequences of offshore operations can be mitigated through a multi-pronged approach involving international cooperation and strengthened domestic regulations.

The following measures are crucial:

- Increased Transparency and Information Sharing: International agreements promoting the automatic exchange of financial information between countries can help shed light on hidden transactions and deter tax evasion and money laundering.

- Strengthened Due Diligence Procedures: Implementing stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations globally can help prevent the use of offshore jurisdictions for illicit activities.

- Global Tax Cooperation: International tax treaties and agreements can help ensure that multinational corporations pay their fair share of taxes, preventing tax base erosion and profit shifting (BEPS).

- Enhanced Regulatory Oversight: Improving regulatory frameworks in both onshore and offshore jurisdictions, including stronger enforcement mechanisms, is vital to deterring illegal activities.

- Public Awareness Campaigns: Educating the public about the risks and consequences of offshore tax avoidance and money laundering can encourage greater scrutiny and demand for greater transparency.

Offshore Countries and Global Finance

Offshore countries play a significant role in the global financial system, acting as facilitators of international capital flows and influencing global financial stability. Their unique regulatory environments and tax structures attract substantial foreign investment, impacting the overall flow of capital across borders. Understanding this complex interplay is crucial for comprehending the dynamics of the global economy.Offshore banking and investment significantly impact global financial stability, both positively and negatively.

While they can facilitate cross-border investments and provide diversification opportunities, they also present risks related to money laundering, tax evasion, and regulatory arbitrage. The impact depends heavily on the effectiveness of regulatory frameworks and international cooperation in overseeing these financial activities.

The Role of Offshore Countries in Facilitating International Capital Flows

Offshore financial centers (OFCs) facilitate international capital flows by offering a range of services, including banking, investment management, and insurance, often with lower regulatory burdens and more favorable tax regimes than onshore jurisdictions. This attracts foreign investment, enabling businesses and individuals to hold assets and conduct transactions outside their home countries. The ease of establishing offshore companies and trusts contributes to the efficient movement of capital across borders.

For example, companies might use offshore entities to manage international subsidiaries, reducing tax burdens or streamlining complex financial transactions. Individuals might utilize offshore accounts for asset protection or wealth management purposes. This free flow of capital can stimulate economic growth, but also poses challenges to tax authorities and regulators globally.

The Impact of Offshore Banking and Investment on Global Financial Stability

Offshore banking and investment activities can both enhance and threaten global financial stability. On one hand, they can diversify investment portfolios and promote capital mobility, leading to increased economic efficiency. However, the lack of transparency and robust regulation in some OFCs can create vulnerabilities. The potential for illicit financial flows, including money laundering and tax evasion, poses a systemic risk to the global financial system.

Furthermore, the concentration of financial assets in offshore jurisdictions can exacerbate financial crises if these centers experience instability. For example, the collapse of a major offshore bank could trigger a domino effect, impacting global markets. Effective international cooperation and enhanced regulatory oversight are therefore essential for mitigating these risks.

A Timeline of Significant Events in the History of Offshore Finance

The history of offshore finance is marked by periods of rapid growth interspersed with regulatory crackdowns and attempts at greater transparency.

| Date | Event | Significance |

|---|---|---|

| 1950s-1970s | Emergence of major offshore financial centers like the Bahamas, Cayman Islands, and Bermuda. | Driven by post-war economic growth and a desire for tax havens. |

| 1980s-1990s | Increased scrutiny of offshore finance due to concerns about money laundering and tax evasion. | International organizations like the OECD began to address these issues. |

| 2000s-Present | Implementation of international regulatory frameworks like the OECD’s Common Reporting Standard (CRS) and the Financial Action Task Force (FATF) recommendations. | Aimed at enhancing transparency and combating illicit financial flows. |

| 2008 | Global Financial Crisis highlighted the interconnectedness of global financial systems and the risks associated with opaque offshore finance. | Led to further regulatory reforms and increased international cooperation. |

Case Studies of Specific Offshore Locations

This section provides detailed case studies of three distinct offshore jurisdictions: the British Virgin Islands (BVI), Ireland, and Singapore. Each case study examines the economic model and regulatory framework, highlighting their attractiveness for various business types and the challenges and opportunities they present. The analysis considers factors such as tax rates, legal infrastructure, and ease of doing business.

British Virgin Islands (BVI): A Haven for Asset Protection and International Business

The British Virgin Islands (BVI) has long been a popular offshore jurisdiction, renowned for its robust legal framework and favorable tax regime. Its primary economic driver is the provision of financial and corporate services.

The BVI’s economic model centers around facilitating international business and asset protection. Its regulatory framework, based on English common law, is considered stable and transparent, attracting numerous international companies, particularly in the financial sector. The absence of corporate income tax and a low rate of capital gains tax makes the BVI highly attractive for asset holding companies and investment vehicles.

However, the BVI’s reliance on the financial sector makes it vulnerable to global economic fluctuations and international regulatory pressure aimed at combating tax evasion and money laundering. While the BVI offers a stable and predictable legal environment, the high cost of living and limited domestic market can pose challenges for businesses seeking to establish a physical presence. Technology startups might find the BVI less attractive due to the limited access to venture capital and a smaller talent pool compared to other locations.

Financial institutions, however, find the jurisdiction particularly advantageous for structuring international investments and managing assets.

Ireland: A European Hub for Technology and Multinational Corporations, Offshore Countries

Ireland’s strategic location within the European Union, coupled with its competitive corporate tax rate and skilled workforce, has transformed it into a major hub for multinational corporations, particularly in the technology sector.

Ireland’s economic model emphasizes attracting foreign direct investment (FDI) through a combination of favorable tax policies, a highly educated workforce, and a pro-business regulatory environment. Its 12.5% corporate tax rate has been a significant draw for multinational corporations, particularly in the technology and pharmaceutical sectors. Ireland’s membership in the EU provides access to the single market, simplifying trade and investment within Europe.

However, Ireland’s dependence on FDI makes it vulnerable to global economic downturns. The country faces challenges in maintaining its competitive tax advantage in the face of international pressure for tax harmonization. While Ireland is highly attractive for technology startups due to its talent pool, access to funding, and proximity to major European markets, manufacturing companies may find the high labor costs a deterrent.

The relatively high cost of living and property prices also present challenges for businesses.

Singapore: A Leading Asian Financial Center and Innovation Hub

Singapore’s success as an offshore financial center stems from its strategic location, robust infrastructure, political stability, and commitment to attracting foreign investment. Its highly developed legal system and pro-business policies make it an attractive destination for a wide range of businesses.

Singapore’s economic model focuses on building a dynamic and diversified economy through strategic investments in infrastructure, education, and innovation. Its highly developed legal and regulatory framework ensures a stable and predictable business environment. Singapore offers a wide range of tax incentives and benefits to attract foreign investment across various sectors. The country’s strategic location in Southeast Asia provides access to a large and growing market.

However, Singapore faces challenges in maintaining its competitiveness in the face of rising labor costs and increasing competition from other Asian economies. The high cost of living and doing business can be a deterrent for some businesses. While Singapore is attractive to both technology startups and financial institutions due to its robust infrastructure, access to funding, and skilled workforce, manufacturing companies might find the high labor costs and limited land availability a challenge.

The country’s stringent regulations, while promoting transparency and stability, can also add complexity for some businesses.

Future Trends in Offshore Finance: Offshore Countries

The offshore finance industry, long characterized by secrecy and complex regulatory frameworks, stands at a crossroads. Technological advancements and evolving global regulatory pressures are reshaping its landscape, presenting both opportunities and challenges for jurisdictions and financial institutions alike. The future of offshore finance hinges on its ability to adapt to these transformative forces while maintaining a degree of stability and trust.Technological advancements, particularly in blockchain and cryptocurrency, are poised to significantly impact offshore finance.

These technologies offer the potential to enhance transparency, security, and efficiency in cross-border transactions, directly challenging the traditional reliance on opaque structures that have long defined the offshore world.

Blockchain and Cryptocurrency’s Impact on Offshore Finance

Blockchain technology, with its inherent transparency and immutability, could fundamentally alter the dynamics of offshore finance. The distributed ledger system offers the potential to track transactions with greater accuracy and reduce the risk of fraud and money laundering. Cryptocurrencies, operating outside traditional banking systems, could provide alternative channels for cross-border payments, potentially bypassing existing regulatory hurdles. For example, the use of stablecoins pegged to fiat currencies could facilitate smoother and more efficient transactions between offshore entities.

However, the decentralized nature of cryptocurrencies also presents challenges for regulators seeking to maintain control and prevent illicit activities. The ongoing evolution of regulatory frameworks for cryptocurrencies will significantly influence their adoption within the offshore finance sector. The potential for increased transparency through blockchain could lead to a decline in the use of offshore jurisdictions for illicit activities, while the ease and speed of cryptocurrency transactions could attract new players to the offshore market.

Predictions for Offshore Jurisdictions in a Changing Global Landscape

The future of offshore jurisdictions will be defined by their ability to adapt to a more transparent and interconnected global financial system. Jurisdictions that fail to modernize their regulatory frameworks and enhance transparency are likely to see a decline in their attractiveness to international businesses. Those that proactively embrace regulatory compliance, technological innovation, and sustainable economic development will likely thrive.

For instance, jurisdictions that actively develop regulatory sandboxes for fintech innovations and collaborate internationally on information sharing could attract a new generation of businesses seeking secure and efficient offshore solutions. Conversely, jurisdictions clinging to outdated secrecy laws and resisting international cooperation will likely face increasing pressure and potential isolation from the global financial system. This could lead to a shift in the dominance of offshore centers, with jurisdictions embracing transparency and innovation gaining a competitive edge.

Potential Regulatory Reforms Reshaping Offshore Finance

Significant regulatory reforms are anticipated to further reshape the offshore finance industry. Increased international cooperation in tax information exchange, enhanced due diligence requirements for financial institutions, and stricter anti-money laundering (AML) and counter-terrorist financing (CTF) regulations are expected. The OECD’s Common Reporting Standard (CRS) has already significantly increased the transparency of cross-border financial flows, reducing the attractiveness of jurisdictions that previously offered significant levels of secrecy.

Future reforms may focus on enhancing the effectiveness of existing regulations, addressing the challenges posed by new technologies, and promoting a more level playing field between onshore and offshore financial centers. For example, the development of global standards for regulating cryptocurrencies and digital assets will be crucial in shaping the future of offshore finance. The implementation of robust regulatory frameworks for digital assets could mitigate the risks associated with their use while also unlocking their potential to improve efficiency and transparency in the offshore sector.

The world of offshore countries presents a compelling narrative of global finance, intertwined with economic opportunities, legal complexities, and ethical considerations. While offering potential benefits for businesses seeking favorable operating environments, offshore jurisdictions also raise concerns regarding tax evasion and financial stability. Navigating this landscape effectively requires a thorough understanding of the legal and regulatory frameworks, as well as a commitment to ethical and responsible business practices.

The future of offshore finance will likely be shaped by technological innovations and evolving global regulations, necessitating ongoing adaptation and vigilance.