Register Offshore Company: Navigating the complex world of offshore business structures requires careful consideration. This guide delves into the intricacies of registering an offshore company, exploring various jurisdictions, company types, and the associated costs and legal implications. We’ll examine the benefits and drawbacks of different jurisdictions, providing a clear understanding of the registration process, ongoing compliance, and potential risks.

Understanding these factors is crucial for making informed decisions and ensuring legal compliance.

From choosing the optimal jurisdiction based on tax implications and regulatory frameworks to selecting the appropriate company type—whether it’s an IBC, LLC, or foundation—we provide a step-by-step walkthrough of the entire process. We’ll cover essential documentation, the roles of registered agents and nominee directors, and strategies for minimizing registration costs. Furthermore, we’ll address ongoing compliance requirements, potential risks, and offer illustrative examples of legitimate offshore company use cases.

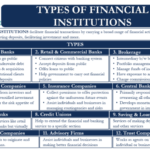

Types of Offshore Companies: Register Offshore Company

Choosing the right type of offshore company is crucial for optimizing tax efficiency, liability protection, and operational structure. The selection depends heavily on the specific business goals, risk tolerance, and the nature of the planned activities. Several popular structures offer distinct advantages and disadvantages. Understanding these nuances is key to making an informed decision.

International Business Company (IBC)

International Business Companies (IBCs) are among the most common types of offshore companies. They are typically established in jurisdictions known for their favorable tax regimes and regulatory frameworks. IBCs are primarily used for holding assets, engaging in international trade, and conducting investment activities.

- Liability Protection: IBCs offer strong liability protection, separating the personal assets of the shareholders from the company’s liabilities.

- Management Structure: Management structures are flexible, ranging from sole proprietorship to complex corporate structures with multiple directors and shareholders.

- Tax Implications: IBCs generally do not pay taxes on their income in their jurisdiction of incorporation, but profits may be subject to taxation in the shareholders’ country of residence. This often requires careful tax planning to mitigate double taxation.

An example of a suitable business situation for an IBC would be a company based in the United States that wants to hold intellectual property rights in a low-tax jurisdiction, shielding those assets from US taxation until they are actively used to generate income in the US.

Limited Liability Company (LLC), Register Offshore Company

Limited Liability Companies (LLCs) offer a blend of partnership and corporate structures. They provide liability protection similar to corporations while offering the flexibility of a partnership in terms of management and taxation. The availability and specific characteristics of LLCs vary significantly depending on the jurisdiction.

- Liability Protection: LLCs offer members limited liability, shielding their personal assets from business debts and liabilities.

- Management Structure: LLCs can be member-managed (members directly manage the business) or manager-managed (managers appointed to run the business).

- Tax Implications: Tax treatment varies by jurisdiction. In some jurisdictions, LLCs are treated as pass-through entities, meaning profits and losses are passed through to the members’ personal income tax returns. In others, they may be taxed as corporations.

A suitable example would be a group of entrepreneurs launching an online business aiming for international expansion. The LLC structure would provide liability protection while allowing for flexible management and potentially favorable pass-through taxation.

Foundation

Foundations are legal entities established for specific purposes, often charitable or asset protection. They are particularly popular in certain jurisdictions known for their robust legal frameworks and privacy protections. They are less commonly used for purely commercial activities.

- Liability Protection: Foundations generally offer strong asset protection, separating the foundation’s assets from the founder’s or beneficiary’s personal assets.

- Management Structure: Foundations typically have a board of directors or similar governing body responsible for managing the foundation’s assets and activities.

- Tax Implications: The tax implications vary significantly depending on the jurisdiction and the foundation’s purpose. Some jurisdictions offer tax exemptions for certain types of foundations, while others may impose taxes on income or capital gains.

A high-net-worth individual seeking to protect a significant family inheritance for future generations might find a foundation structure advantageous. The foundation would manage the assets, offering protection from creditors and providing a framework for long-term wealth preservation.

Registering an offshore company presents both opportunities and challenges. While it can offer significant tax advantages and asset protection, navigating the legal and regulatory landscape requires careful planning and adherence to compliance standards. This guide has provided a foundational understanding of the key aspects involved, from choosing the right jurisdiction and company type to managing ongoing compliance and mitigating potential risks.

Remember, seeking professional advice from legal and financial experts is crucial before making any decisions. Thorough due diligence and a clear understanding of the implications are paramount to successfully establishing and maintaining an offshore company.