Swiss Bank Account Online: Securing your financial future through a Swiss bank account might seem daunting, but understanding the legal framework, account types, and security measures involved can demystify the process. This guide navigates you through the intricacies of opening and managing a Swiss online bank account, addressing common concerns and providing a clear path to financial security and privacy.

From navigating the complexities of KYC/AML regulations to comparing different account types and their features, we’ll equip you with the knowledge to make informed decisions. We’ll also delve into the security protocols implemented by Swiss banks, highlighting the measures designed to protect your assets and personal information. Understanding the associated fees and tax implications is crucial, and we’ll provide transparent explanations to ensure you’re fully prepared.

Types of Online Swiss Bank Accounts and Their Features

Choosing the right online Swiss bank account depends heavily on your individual financial needs and goals. Swiss banks offer a range of accounts, each designed to cater to specific requirements, from simple savings to sophisticated investment strategies. Understanding the nuances of each account type is crucial for making an informed decision.

Savings Accounts

Savings accounts in Swiss online banks are designed for accumulating funds and earning interest. They typically offer lower risk compared to investment accounts, making them ideal for short-term financial goals or emergency funds. Features generally include online access for managing funds, competitive (though often modest) interest rates, and straightforward account management tools. Fees may vary depending on the bank and the specific account features.

Some banks may waive fees for accounts meeting minimum balance requirements.

Checking Accounts

Online checking accounts in Switzerland provide everyday banking functionality. These accounts are designed for regular transactions, such as receiving salaries, paying bills, and making online purchases. Features usually include debit cards for ATM withdrawals and point-of-sale transactions, online bill pay services, and mobile banking apps. While interest rates on checking accounts are generally low or nonexistent, the convenience and accessibility make them essential for managing daily finances.

Fees may apply for certain transactions or if minimum balance requirements are not met.

Investment Accounts

Investment accounts offered by Swiss online banks allow individuals to invest in a variety of financial instruments, such as stocks, bonds, and mutual funds. These accounts offer the potential for higher returns compared to savings accounts, but also carry a higher degree of risk. Features often include access to online trading platforms, investment research tools, and portfolio management capabilities.

Fees can vary significantly depending on the bank, the types of investments, and the trading volume. Some banks may charge account maintenance fees, while others may charge transaction fees or commission fees on trades.

Comparative Table of Online Swiss Bank Accounts

| Account Type | Minimum Deposit (CHF) | Interest Rate (approx. %) | Fees (Examples) |

|---|---|---|---|

| Savings Account | 500 | 0.5 – 1.5 | Monthly maintenance fee (potential waiver with minimum balance), transaction fees (some banks) |

| Checking Account | 0 | 0 – 0.1 | ATM withdrawal fees (international), overdraft fees |

| Investment Account | Variable (depending on investment strategy) | Variable (depending on market performance) | Account maintenance fee, trading commissions, currency conversion fees |

Note

Interest rates and fees are approximate and subject to change. Always check the specific terms and conditions with the bank.*

Visual Representation of Account Features

Imagine a Venn diagram. The largest circle represents “Online Accessibility,” encompassing all three account types (Savings, Checking, Investment). A smaller circle within the “Online Accessibility” circle, labeled “Interest Earning,” overlaps significantly with the “Savings Account” but also slightly with “Investment Account.” A third circle, “Transaction Functionality,” largely overlaps with “Checking Account,” but also has a smaller intersection with “Investment Account” (for buying and selling investments).

The size of each circle and the degree of overlap visually represent the relative importance of features for each account type. For example, the “Interest Earning” circle would be smaller for checking accounts than savings accounts, reflecting the generally lower interest rates. The size of the “Fees” area (represented as shading within each circle) could vary to illustrate the potential cost differences between accounts.

Opening a Swiss Bank Account Online

Opening a Swiss bank account online offers convenience and efficiency, but it’s crucial to understand the process and necessary steps to ensure a smooth application. While the specific requirements may vary slightly between banks, the general process remains consistent. This guide Artikels the typical steps involved, highlighting potential challenges and best practices for success.

Required Documentation and Verification Procedures

Successful online account opening hinges on providing accurate and complete documentation. Swiss banks adhere to strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, requiring thorough verification of your identity and the source of your funds. Expect to provide a range of documents, including a valid passport or national identity card, proof of address (recent utility bill or bank statement), and potentially additional documentation depending on the account type and the amount of funds you intend to deposit.

The verification process usually involves uploading clear, high-resolution scans or photos of these documents. Some banks may also require video verification or a physical meeting depending on the risk assessment.

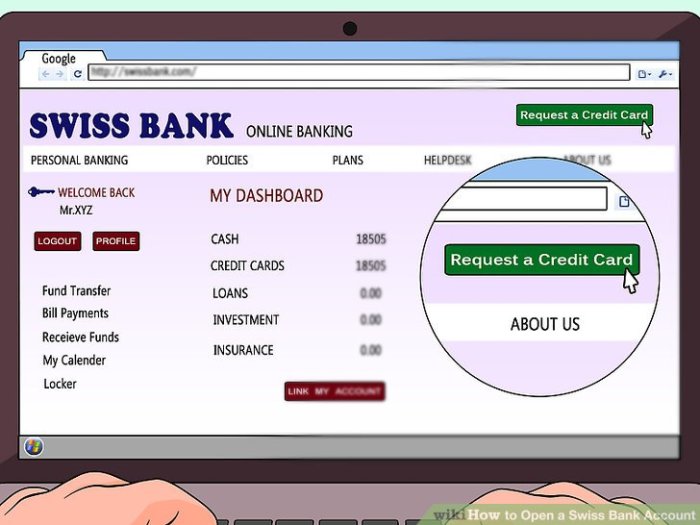

Step-by-Step Account Opening Process

The online application process typically follows a structured sequence of steps. Careful attention to detail at each stage is essential to avoid delays or rejection.

- Account Selection: Choose the appropriate account type based on your needs (e.g., private, business, savings). Carefully review the terms and conditions, fees, and features of each option.

- Online Application Form Completion: Complete the online application form accurately and thoroughly. This includes personal details, contact information, employment details, and financial information. Any inaccuracies can lead to delays or rejection.

- Document Upload: Upload clear, high-resolution scans or photos of the required identification documents and proof of address. Ensure the documents are legible and meet the bank’s specified requirements.

- Identity Verification: Undergo the identity verification process, which may involve video identification, submission of additional documents, or other verification methods as determined by the bank’s security protocols.

- Source of Funds Declaration: Provide a clear and detailed explanation of the source of your funds. This is a critical step to comply with AML regulations. Expect to provide documentation supporting your declarations.

- Account Activation: Once your application is approved and the verification process is complete, your account will be activated. You will likely receive confirmation via email or post.

- Initial Deposit (if required): Some banks may require an initial deposit to activate the account. The minimum deposit amount will vary depending on the bank and account type.

Best Practices for Efficient and Accurate Application, Swiss Bank Account Online

Efficiency and accuracy are key to a smooth account opening process. Prepare all necessary documentation beforehand, ensuring high-quality scans or photos. Double-check all information entered into the application form for accuracy. If you encounter any difficulties, contact the bank’s customer support for assistance. Consider keeping a record of all communication and documents submitted throughout the process.

Potential Challenges and Obstacles

Potential challenges include insufficient or inaccurate documentation, failure to meet the bank’s requirements for identity verification, or difficulties in demonstrating the legitimate source of funds. Delays may occur due to processing times or additional verification checks. Some banks may also reject applications based on their risk assessment. Understanding these potential hurdles and preparing accordingly can significantly increase your chances of a successful application.

Opening a Swiss bank account online offers significant advantages, but it’s crucial to approach the process with careful planning and a thorough understanding of the regulations and associated costs. By understanding the legal framework, security measures, and tax implications, you can confidently navigate the process and leverage the benefits of Swiss banking. Remember to always prioritize secure practices and choose a reputable institution.

Your financial well-being is paramount.