Swiss Bank Account Opening: Securing your financial future in Switzerland involves navigating a complex yet rewarding process. This guide unravels the intricacies of opening a Swiss bank account, from eligibility requirements and account types to the crucial aspects of security, confidentiality, and tax implications. We’ll demystify the process, offering a clear understanding of what to expect at each stage, empowering you to make informed decisions.

Understanding the Swiss banking system is key to successful account opening. This involves familiarizing yourself with different account types, their associated fees, and the specific documentation required. We’ll explore the various options available, helping you choose the account best suited to your financial goals, whether it’s wealth management, retirement planning, or simply secure savings.

Types of Swiss Bank Accounts

Opening a Swiss bank account offers access to a range of financial products tailored to diverse needs and investment strategies. Understanding the nuances of each account type is crucial for maximizing benefits and aligning your account with your specific financial goals. The choice depends heavily on your financial objectives, risk tolerance, and the volume of assets you intend to manage.

Savings Accounts

Swiss savings accounts are designed for secure deposit and accumulation of funds. They typically offer lower interest rates compared to investment accounts but provide a high degree of capital protection. Funds are readily accessible, making them suitable for short-term savings goals or emergency funds. Fees are generally low, often tied to account maintenance or specific transactions. For individuals prioritizing capital preservation and easy access to funds, a savings account is a prudent choice.

Checking Accounts

Checking accounts in Switzerland facilitate everyday transactions. They allow for debit card usage, online banking, and direct debits, making them essential for managing regular expenses. Interest rates are usually minimal or nonexistent. Fees can vary depending on the bank and may include monthly maintenance charges or fees for specific transactions like wire transfers. These accounts are ideal for managing daily finances and facilitating regular payments.

Investment Accounts

Investment accounts provide avenues for wealth growth through diverse investment vehicles such as stocks, bonds, mutual funds, and other financial instruments. These accounts offer higher potential returns compared to savings accounts but also carry a greater level of risk. Fees can be more complex, including management fees, transaction fees, and potentially performance-based fees. The choice of investment strategy within the account depends on individual risk tolerance and long-term financial goals.

For long-term wealth building and retirement planning, an investment account is often the preferred option.

Wealth Management Accounts

Wealth management accounts offer a comprehensive suite of services beyond basic banking. These accounts often include personalized financial planning, portfolio management, and access to a wider range of investment products. They cater to high-net-worth individuals seeking sophisticated wealth management strategies. Fees are typically higher, reflecting the personalized service and complex financial solutions provided. These accounts are suitable for individuals with significant assets requiring proactive wealth management and sophisticated investment strategies.

A typical example might include a client with several million Swiss Francs seeking diversified investments and tax optimization strategies.

Comparison of Account Types

The table below summarizes the key features and differences between the various Swiss bank account types.

| Account Type | Primary Purpose | Risk Level | Interest Rate | Fees | Ideal for |

|---|---|---|---|---|---|

| Savings Account | Capital preservation, short-term savings | Low | Low | Low | Emergency funds, short-term goals |

| Checking Account | Daily transactions, expense management | Low | Low/None | Variable | Everyday banking needs |

| Investment Account | Wealth growth, long-term investment | Moderate to High | Variable | Variable | Retirement planning, long-term wealth building |

| Wealth Management Account | Comprehensive wealth management, high-net-worth individuals | Variable | Variable | High | Sophisticated investment strategies, tax optimization |

The Account Opening Process

Opening a Swiss bank account involves a rigorous process designed to uphold Switzerland’s strict financial regulations and maintain its reputation for banking secrecy and security. This process prioritizes due diligence and verification to prevent money laundering and other financial crimes. The steps involved are comprehensive and may vary slightly depending on the specific bank and the type of account being opened.

Application Form Completion, Swiss Bank Account Opening

The application form is the cornerstone of the account opening process. It requires detailed personal and financial information. Applicants must accurately complete all fields, providing verifiable information. Inaccurate or incomplete information will lead to delays or rejection. Typical fields include full legal name, address, date of birth, nationality, occupation, source of funds, and the desired account type.

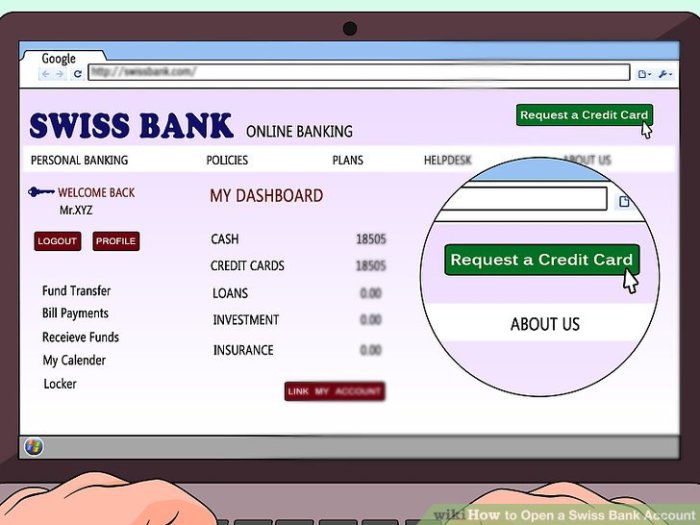

Many banks utilize online application portals, simplifying the process, but some may still require physical forms. It is crucial to double-check all entries for accuracy before submission.

Required Documentation Submission

Supporting documentation is essential to verify the information provided in the application form. This typically includes a valid government-issued identification (passport or national ID card), proof of address (utility bill or bank statement), and evidence of the source of funds. Depending on the account type and the bank’s requirements, additional documents may be requested, such as business registration documents for corporate accounts or tax returns.

All documents must be originals or certified copies, and translations may be needed if they are not in German, French, Italian, or English. Submitting high-quality, legible copies is crucial for efficient processing.

Verification and Approval Process

Once the application and supporting documentation are submitted, the bank initiates a thorough verification process. This involves checking the applicant’s identity, address, and the legitimacy of the source of funds. The bank may conduct background checks and utilize international databases to verify the information provided. This process can take several weeks, or even months, depending on the complexity of the application and the bank’s workload.

The bank will notify the applicant of the decision via email or mail. Approval hinges on the successful verification of all provided information and the bank’s assessment of the applicant’s financial standing and risk profile.

Account Opening Process Flowchart

A flowchart visually represents the steps involved in opening a Swiss bank account. It would begin with the “Application Submission” box, followed by a “Documentation Review” box. A decision point would then determine whether the documentation is complete and accurate. If yes, the process moves to “Verification and Due Diligence,” which leads to an “Approval/Rejection” decision point.

Approval leads to “Account Creation,” while rejection results in “Notification to Applicant.” Finally, the process concludes with “Account Activation” for approved applications. Each box would contain a brief description of the stage, visually representing the sequential nature of the account opening procedure.

Choosing a Swiss Bank: Swiss Bank Account Opening

Selecting the right Swiss bank for your needs requires careful consideration of several key factors. The Swiss banking landscape is diverse, with institutions catering to a range of client profiles and financial goals. Understanding these factors and how they apply to different banks is crucial for making an informed decision.

Key Factors in Selecting a Swiss Bank

The choice of a Swiss bank hinges on several interconnected factors. These include the bank’s reputation and financial stability, the services offered, the accessibility and responsiveness of its customer service, and the bank’s alignment with your specific financial needs and objectives. A thorough assessment of these aspects is essential to ensure a successful banking relationship.

Service Offerings Comparison

Swiss banks offer a spectrum of services, ranging from basic account management to highly specialized wealth management solutions. Some banks focus on private banking, catering to high-net-worth individuals with complex financial needs, while others specialize in corporate banking, providing services to businesses and corporations. A comparison of services might reveal that Bank A excels in wealth management with sophisticated investment strategies and global reach, while Bank B prioritizes corporate clients with streamlined international transaction services.

Furthermore, the availability of specific services like foreign exchange trading, private equity investments, or trust and estate planning will vary across institutions.

Reputation and Financial Stability of Swiss Banks

The reputation and financial stability of a Swiss bank are paramount. Swiss banks are renowned globally for their discretion, security, and adherence to strict regulatory standards. However, differences exist even within this high-standard environment. For example, a long-standing, established bank with a proven track record of stability and responsible financial management may offer a different level of security compared to a newer, rapidly growing institution.

Analyzing a bank’s credit rating, capital adequacy ratio, and history of compliance with regulatory requirements can provide valuable insights into its financial health and stability. Consult independent financial rating agencies for objective assessments.

Customer Service Accessibility and Responsiveness

The quality of customer service is another crucial consideration. Accessibility, responsiveness, and the level of personalized service offered can significantly impact your banking experience. While many Swiss banks offer multilingual support and various communication channels, the actual responsiveness and personalized attention might vary. Factors to consider include the availability of online banking platforms, the responsiveness of phone and email support, and the availability of dedicated relationship managers for high-net-worth clients.

Reading client reviews and testimonials can provide insights into the customer service experiences of other clients.

Weighted Decision-Making Matrix

To facilitate a structured decision-making process, a weighted decision-making matrix can be employed. This matrix allows you to assign weights to each factor based on its importance to your individual needs and then score each bank based on its performance in each area.

| Factor | Weight | Bank A Score (1-5) | Bank B Score (1-5) | Bank C Score (1-5) |

|---|---|---|---|---|

| Reputation & Stability | 30% | 4 | 5 | 3 |

| Service Offerings | 30% | 5 | 3 | 4 |

| Customer Service | 20% | 3 | 4 | 5 |

| Fees & Charges | 20% | 4 | 3 | 2 |

Note: The weights and scores in this example are illustrative. You should adjust these values based on your own priorities and research. The final score for each bank is calculated by multiplying the score by the weight and summing the results.

Opening a Swiss bank account presents a significant financial decision, demanding careful consideration of various factors. This guide has provided a comprehensive overview of the process, equipping you with the knowledge to confidently navigate the steps involved. Remember to thoroughly research your chosen bank, understand the tax implications specific to your circumstances, and ensure you meet all eligibility criteria.

With meticulous planning and preparation, you can successfully secure a Swiss bank account and benefit from the robust security and privacy it offers.